Lease-to-own agreements allow tenants to gradually acquire property ownership by applying rent payments toward the purchase price, offering flexibility for buyers with limited upfront capital. Wraparound mortgages consolidate existing loans into a new, larger mortgage held by the seller, enabling buyers to bypass traditional lenders and negotiate terms directly. Explore the advantages and challenges of both lease-to-own models and wraparound mortgages to determine the best fit for your real estate goals.

Why it is important

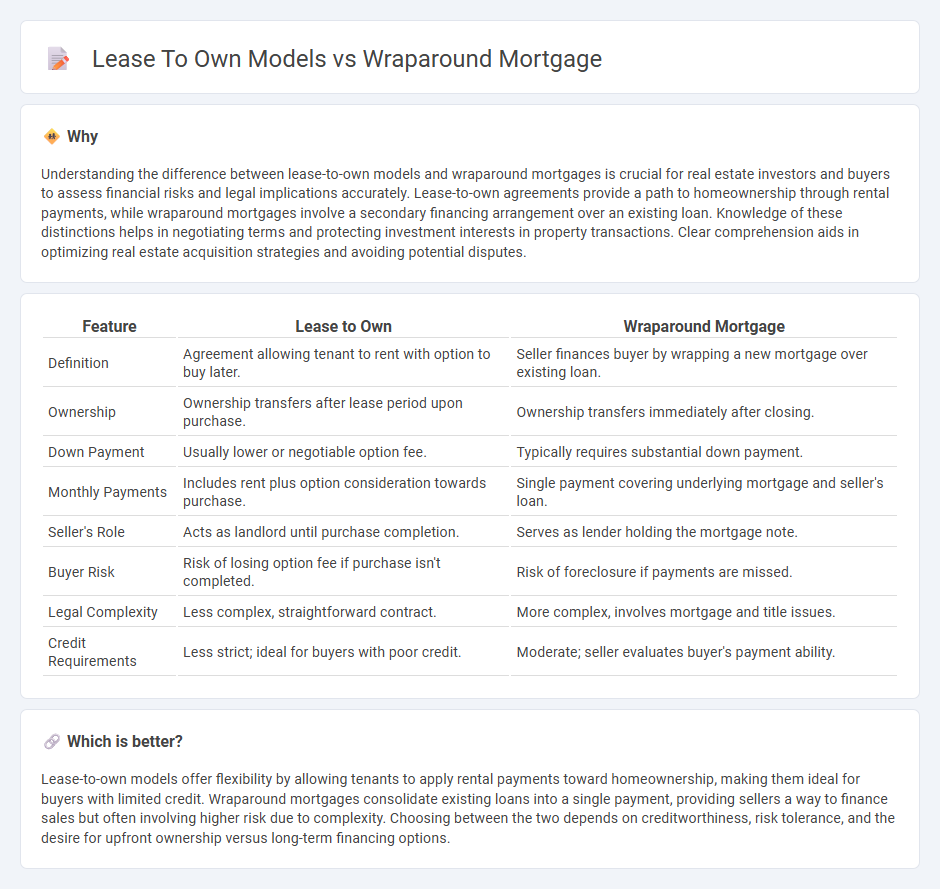

Understanding the difference between lease-to-own models and wraparound mortgages is crucial for real estate investors and buyers to assess financial risks and legal implications accurately. Lease-to-own agreements provide a path to homeownership through rental payments, while wraparound mortgages involve a secondary financing arrangement over an existing loan. Knowledge of these distinctions helps in negotiating terms and protecting investment interests in property transactions. Clear comprehension aids in optimizing real estate acquisition strategies and avoiding potential disputes.

Comparison Table

| Feature | Lease to Own | Wraparound Mortgage |

|---|---|---|

| Definition | Agreement allowing tenant to rent with option to buy later. | Seller finances buyer by wrapping a new mortgage over existing loan. |

| Ownership | Ownership transfers after lease period upon purchase. | Ownership transfers immediately after closing. |

| Down Payment | Usually lower or negotiable option fee. | Typically requires substantial down payment. |

| Monthly Payments | Includes rent plus option consideration towards purchase. | Single payment covering underlying mortgage and seller's loan. |

| Seller's Role | Acts as landlord until purchase completion. | Serves as lender holding the mortgage note. |

| Buyer Risk | Risk of losing option fee if purchase isn't completed. | Risk of foreclosure if payments are missed. |

| Legal Complexity | Less complex, straightforward contract. | More complex, involves mortgage and title issues. |

| Credit Requirements | Less strict; ideal for buyers with poor credit. | Moderate; seller evaluates buyer's payment ability. |

Which is better?

Lease-to-own models offer flexibility by allowing tenants to apply rental payments toward homeownership, making them ideal for buyers with limited credit. Wraparound mortgages consolidate existing loans into a single payment, providing sellers a way to finance sales but often involving higher risk due to complexity. Choosing between the two depends on creditworthiness, risk tolerance, and the desire for upfront ownership versus long-term financing options.

Connection

Lease to own models and wraparound mortgages are connected through their structure, allowing buyers to acquire property with flexible financing options outside traditional loans. In a lease to own agreement, tenants pay rent with a portion applied toward equity, while a wraparound mortgage enables the seller to retain the original loan and create a new mortgage that "wraps around" it, facilitating owner financing. Both methods provide alternative pathways to homeownership, especially in markets with stringent lending requirements or for buyers with limited credit access.

Key Terms

Owner Financing

Wraparound mortgages consolidate existing loans into a single, new loan held by the seller, allowing buyers to make payments directly to the seller while owner financing the property. Lease-to-own models involve rental agreements with an option or obligation to purchase, providing tenants a pathway to ownership with portions of rent potentially credited toward the purchase price. Explore the benefits and drawbacks of owner financing through wraparound mortgages and lease-to-own structures to determine the optimal path to property ownership.

Equity

Wraparound mortgages allow buyers to build equity immediately by making payments on the seller's existing loan plus an additional amount, effectively combining debts into one. Lease-to-own models typically delay equity accumulation until the purchase option is exercised, with rent payments contributing partially or minimally to the eventual down payment. Explore the benefits and equity growth opportunities of each approach to determine which suits your financial goals.

Purchase Option

Wraparound mortgages incorporate a purchase option by allowing buyers to make payments on a new, larger loan that includes the seller's existing mortgage, simplifying the path to ownership without traditional bank financing. Lease-to-own models embed a purchase option in the lease agreement, enabling tenants to buy the property after a set period, with part of the rent often credited toward the purchase price. Explore further to understand how each approach impacts ownership flexibility and financial obligations.

Source and External Links

What Is A Wraparound Mortgage? | Bankrate - A wraparound mortgage is a form of seller financing where the seller keeps their original mortgage and creates a new loan for the buyer, who makes payments to the seller; the seller then pays the original lender, often profiting from the interest rate difference.

Exploring the pros and cons of wraparound mortgages | Point Blog - This mortgage "wraps around" the seller's existing loan, allowing buyers easier qualification and lower closing costs, with the seller benefiting from immediate down payments and monthly profit from the difference in mortgage payments.

Ins and Outs of Wraparound mortgages in Texas Real Estate - Wraparound mortgages involve risks like seller default and due-on-sale clauses but can be structured with escrow and legal safeguards to protect both buyer and seller while enabling flexible financing outside traditional loans.

dowidth.com

dowidth.com