Sale leaseback transactions enable property owners to sell an asset and simultaneously lease it back, providing immediate capital while maintaining operational control. Triple net leases require tenants to cover property taxes, insurance, and maintenance, minimizing the landlord's financial responsibilities. Explore the differences between sale leaseback and triple net lease to determine the optimal strategy for your real estate investment.

Why it is important

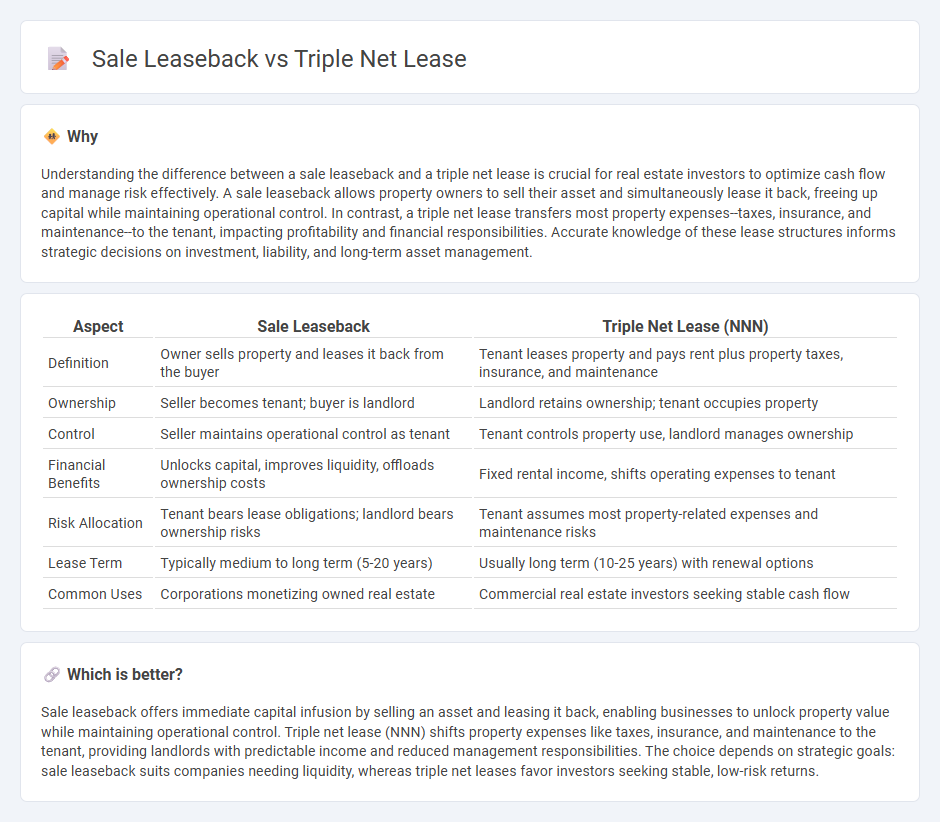

Understanding the difference between a sale leaseback and a triple net lease is crucial for real estate investors to optimize cash flow and manage risk effectively. A sale leaseback allows property owners to sell their asset and simultaneously lease it back, freeing up capital while maintaining operational control. In contrast, a triple net lease transfers most property expenses--taxes, insurance, and maintenance--to the tenant, impacting profitability and financial responsibilities. Accurate knowledge of these lease structures informs strategic decisions on investment, liability, and long-term asset management.

Comparison Table

| Aspect | Sale Leaseback | Triple Net Lease (NNN) |

|---|---|---|

| Definition | Owner sells property and leases it back from the buyer | Tenant leases property and pays rent plus property taxes, insurance, and maintenance |

| Ownership | Seller becomes tenant; buyer is landlord | Landlord retains ownership; tenant occupies property |

| Control | Seller maintains operational control as tenant | Tenant controls property use, landlord manages ownership |

| Financial Benefits | Unlocks capital, improves liquidity, offloads ownership costs | Fixed rental income, shifts operating expenses to tenant |

| Risk Allocation | Tenant bears lease obligations; landlord bears ownership risks | Tenant assumes most property-related expenses and maintenance risks |

| Lease Term | Typically medium to long term (5-20 years) | Usually long term (10-25 years) with renewal options |

| Common Uses | Corporations monetizing owned real estate | Commercial real estate investors seeking stable cash flow |

Which is better?

Sale leaseback offers immediate capital infusion by selling an asset and leasing it back, enabling businesses to unlock property value while maintaining operational control. Triple net lease (NNN) shifts property expenses like taxes, insurance, and maintenance to the tenant, providing landlords with predictable income and reduced management responsibilities. The choice depends on strategic goals: sale leaseback suits companies needing liquidity, whereas triple net leases favor investors seeking stable, low-risk returns.

Connection

Sale leaseback and triple net lease are connected through their common use in commercial real estate transactions where property ownership and occupancy are separated to optimize financial and operational efficiency. In a sale leaseback, the original owner sells the property and immediately leases it back under terms often structured as a triple net lease, requiring the tenant to pay property taxes, insurance, and maintenance costs. This arrangement benefits both parties by providing sellers with capital liquidity and landlords with long-term, stable, and low-management tenants.

Key Terms

Operating Expenses

Triple net leases require tenants to cover operating expenses including property taxes, insurance, and maintenance, transferring significant financial responsibility from the landlord. Sale leaseback transactions involve a property owner selling the asset and leasing it back, often with operating expenses negotiated within the lease terms, which can vary widely depending on the agreement. Explore detailed comparisons to understand how each impacts property cash flow and risk allocation.

Ownership Transfer

A triple net lease requires the tenant to cover property taxes, insurance, and maintenance, while ownership remains with the landlord, preserving capital investment. In contrast, a sale leaseback transfers property ownership to the buyer while the seller continues as the tenant, enabling liquidity without losing operational control. Explore the benefits and considerations of ownership transfer in both agreements to make informed real estate decisions.

Long-term Lease

A triple net lease (NNN) requires tenants to cover property taxes, insurance, and maintenance, offering landlords predictable long-term income and reduced management responsibilities. In contrast, sale-leaseback transactions allow property owners to sell assets while immediately leasing them back, providing capital infusion while maintaining operational control under long-term lease agreements. Explore detailed comparisons of long-term financial impacts and strategic benefits between triple net leases and sale-leasebacks to optimize your commercial real estate investments.

Source and External Links

What Is A Triple Net Lease (NNN) | Definition & Examples - A triple net lease is a commercial real estate agreement where the tenant pays rent and covers all operating expenses, including taxes, insurance, and maintenance.

Triple Net Lease - A triple net lease involves the tenant paying rent, utilities, and three types of property expenses: insurance, maintenance, and taxes.

Benefits and Drawbacks of a Triple Net Lease (NNN) - A triple net lease is a common structure where tenants cover property taxes, insurance, and operating expenses in addition to rent, offering benefits like negotiation for lower rents and more control over the property.

dowidth.com

dowidth.com