Escrow crowdfunding enables multiple investors to pool funds into real estate projects with secured transaction management, reducing individual risk and enhancing access to diverse properties. Turnkey property investing offers ready-to-rent homes that generate immediate cash flow and require minimal hands-on management, ideal for passive income strategies. Discover the differences and benefits of each approach to optimize your real estate investment portfolio.

Why it is important

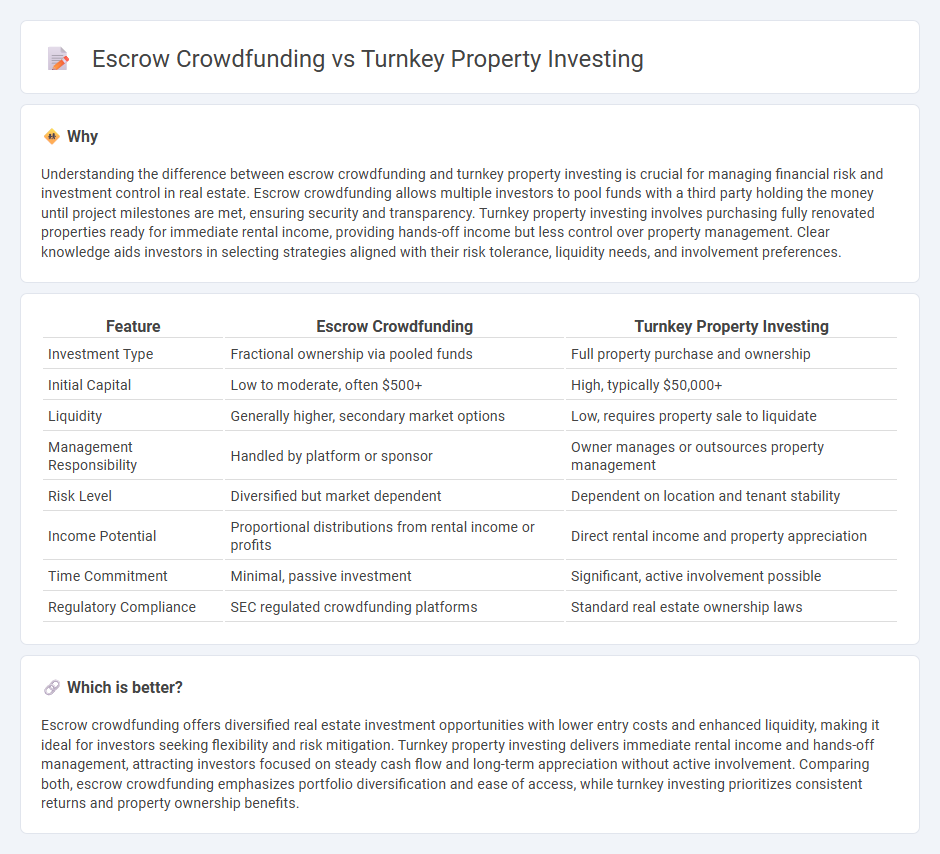

Understanding the difference between escrow crowdfunding and turnkey property investing is crucial for managing financial risk and investment control in real estate. Escrow crowdfunding allows multiple investors to pool funds with a third party holding the money until project milestones are met, ensuring security and transparency. Turnkey property investing involves purchasing fully renovated properties ready for immediate rental income, providing hands-off income but less control over property management. Clear knowledge aids investors in selecting strategies aligned with their risk tolerance, liquidity needs, and involvement preferences.

Comparison Table

| Feature | Escrow Crowdfunding | Turnkey Property Investing |

|---|---|---|

| Investment Type | Fractional ownership via pooled funds | Full property purchase and ownership |

| Initial Capital | Low to moderate, often $500+ | High, typically $50,000+ |

| Liquidity | Generally higher, secondary market options | Low, requires property sale to liquidate |

| Management Responsibility | Handled by platform or sponsor | Owner manages or outsources property management |

| Risk Level | Diversified but market dependent | Dependent on location and tenant stability |

| Income Potential | Proportional distributions from rental income or profits | Direct rental income and property appreciation |

| Time Commitment | Minimal, passive investment | Significant, active involvement possible |

| Regulatory Compliance | SEC regulated crowdfunding platforms | Standard real estate ownership laws |

Which is better?

Escrow crowdfunding offers diversified real estate investment opportunities with lower entry costs and enhanced liquidity, making it ideal for investors seeking flexibility and risk mitigation. Turnkey property investing delivers immediate rental income and hands-off management, attracting investors focused on steady cash flow and long-term appreciation without active involvement. Comparing both, escrow crowdfunding emphasizes portfolio diversification and ease of access, while turnkey investing prioritizes consistent returns and property ownership benefits.

Connection

Escrow crowdfunding streamlines the funding process for turnkey property investing by securely managing investor contributions until financial goals are met. Turnkey properties offer fully renovated homes ready for rental, attracting investors seeking passive income through real estate. Combining escrow crowdfunding with turnkey investments enhances transparency and mitigates risk in property acquisition and management.

Key Terms

**Turnkey Property Investing:**

Turnkey property investing offers immediate rental income with fully renovated, tenant-occupied properties, minimizing hands-on management and maximizing passive cash flow for investors. This strategy appeals to those seeking secure, hassle-free real estate investments with consistent returns and professional property management. Discover how turnkey property investing can streamline your real estate portfolio and generate steady income.

Property Management

Turnkey property investing offers seamless property management services including tenant screening, rent collection, and maintenance handled by experienced local teams. Escrow crowdfunding platforms primarily focus on capital pooling and transaction security, with limited direct property management involvement. Explore the detailed differences to determine which investment approach aligns with your property management preferences.

Cash Flow

Turnkey property investing offers immediate cash flow through fully renovated rental properties managed by professional teams, minimizing hands-on involvement. Escrow crowdfunding allows investors to pool funds for real estate projects, providing diversified income streams but with fluctuating cash flow depending on development phases. Explore detailed comparisons to determine which strategy boosts your passive income effectively.

Source and External Links

Investing in Turnkey Real Estate | White Coat Investor - This webpage discusses how turnkey real estate allows for a mostly hands-off investment experience, providing full control over the property while minimizing day-to-day management responsibilities.

Turnkey Real Estate: The Ultimate Guide for Investors - The Close - This guide explains the concept of turnkey properties, which are fully renovated and ready for immediate rental income, offering a convenient and passive investment option.

What is turnkey real estate (and is it right for you)? - Stessa - This article explains how turnkey properties are purchased, renovated, and managed by third-party companies, providing a hassle-free investment experience for buyers.

dowidth.com

dowidth.com