Short term rental arbitrage involves leasing properties to rent them out on platforms like Airbnb without owning the real estate, maximizing cash flow through strategic subletting. House hacking entails purchasing a multi-unit property, living in one unit, and renting out the others to cover mortgage costs and build equity. Explore the benefits and challenges of each strategy to determine which aligns with your real estate investment goals.

Why it is important

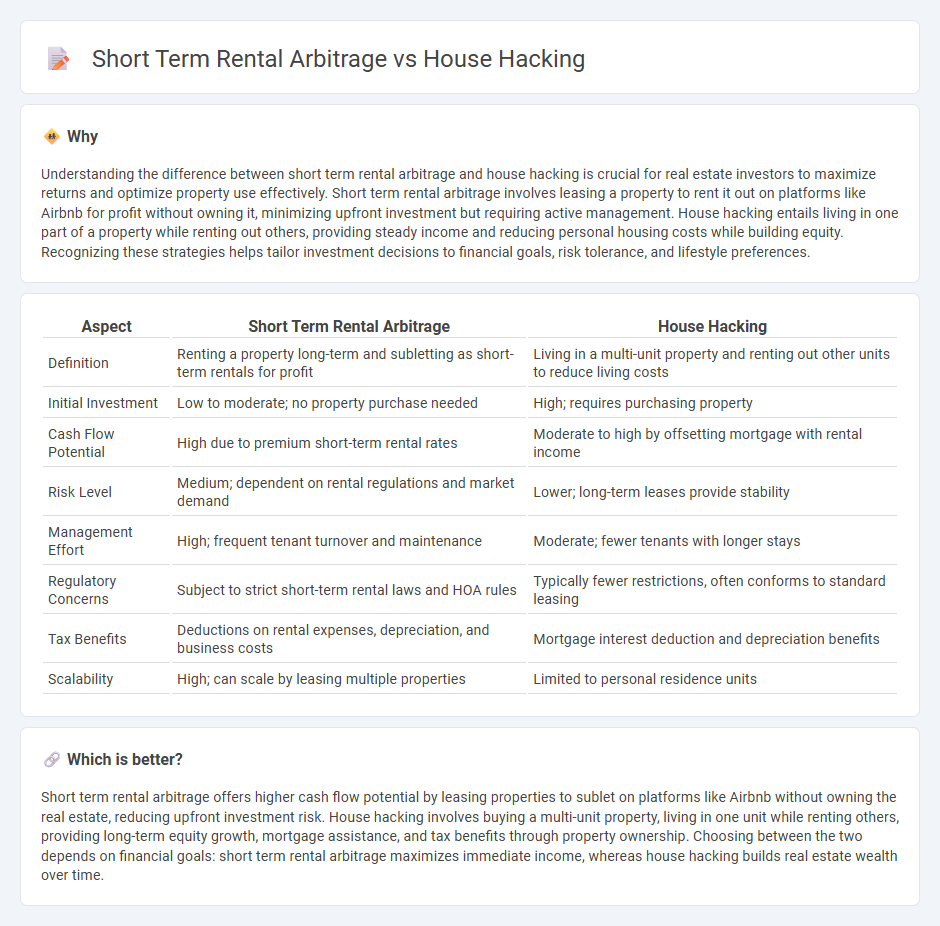

Understanding the difference between short term rental arbitrage and house hacking is crucial for real estate investors to maximize returns and optimize property use effectively. Short term rental arbitrage involves leasing a property to rent it out on platforms like Airbnb for profit without owning it, minimizing upfront investment but requiring active management. House hacking entails living in one part of a property while renting out others, providing steady income and reducing personal housing costs while building equity. Recognizing these strategies helps tailor investment decisions to financial goals, risk tolerance, and lifestyle preferences.

Comparison Table

| Aspect | Short Term Rental Arbitrage | House Hacking |

|---|---|---|

| Definition | Renting a property long-term and subletting as short-term rentals for profit | Living in a multi-unit property and renting out other units to reduce living costs |

| Initial Investment | Low to moderate; no property purchase needed | High; requires purchasing property |

| Cash Flow Potential | High due to premium short-term rental rates | Moderate to high by offsetting mortgage with rental income |

| Risk Level | Medium; dependent on rental regulations and market demand | Lower; long-term leases provide stability |

| Management Effort | High; frequent tenant turnover and maintenance | Moderate; fewer tenants with longer stays |

| Regulatory Concerns | Subject to strict short-term rental laws and HOA rules | Typically fewer restrictions, often conforms to standard leasing |

| Tax Benefits | Deductions on rental expenses, depreciation, and business costs | Mortgage interest deduction and depreciation benefits |

| Scalability | High; can scale by leasing multiple properties | Limited to personal residence units |

Which is better?

Short term rental arbitrage offers higher cash flow potential by leasing properties to sublet on platforms like Airbnb without owning the real estate, reducing upfront investment risk. House hacking involves buying a multi-unit property, living in one unit while renting others, providing long-term equity growth, mortgage assistance, and tax benefits through property ownership. Choosing between the two depends on financial goals: short term rental arbitrage maximizes immediate income, whereas house hacking builds real estate wealth over time.

Connection

Short term rental arbitrage and house hacking both maximize real estate investment returns by leveraging existing properties for income generation without significant upfront capital. House hacking involves living in a property while renting out part of it to cover mortgage costs, aligning with short term rental arbitrage's model of renting properties on a short-term basis to capitalize on higher rental rates. Both strategies optimize cash flow by strategically utilizing residential real estate to generate rental income streams.

Key Terms

Owner-occupancy

House hacking leverages owner-occupancy by allowing homeowners to live in one part of their property while renting out other sections, effectively reducing mortgage costs and building equity. In contrast, short-term rental arbitrage involves leasing a property long-term without owner residency and subletting it on platforms like Airbnb, focusing on profit rather than occupancy benefits. Explore the distinctions and advantages of each strategy to make informed investment decisions.

Lease agreements

Lease agreements in house hacking often involve long-term residential leases tailored for owner-occupants, enabling tenants to sublet portions of the property with landlord consent. Short-term rental arbitrage lease agreements require explicit permission for subleasing on platforms like Airbnb and typically include clauses addressing occupancy limits, property maintenance, and higher liability coverage. Explore detailed strategies for crafting lease agreements that maximize profitability while ensuring legal compliance in both models.

Cash flow

House hacking generates steady cash flow by reducing living expenses and building equity through property ownership, often resulting in long-term financial stability. Short-term rental arbitrage can maximize monthly income by leveraging high-demand markets without owning property, but it carries higher operational risks and variability in cash flow. Explore strategies for optimizing cash flow in real estate investments to determine the best fit for your financial goals.

Source and External Links

What is House Hacking? Definition and Strategies - House hacking is the practice of generating income from your home, typically by buying a multi-family property, living in one unit, and renting out the others to cover most or all of your mortgage, creating passive income to help millennials and Gen Z afford homeownership.

The Complete Guide To Successful House Hacking - Landlord Studio - House hacking involves living in a property and renting out parts of it (a spare bedroom or multi-unit home) to cover living expenses, enabling investors and young homeowners to build equity and reduce housing costs.

What is house hacking and is it something you should be doing? - Rocket Mortgage - Common house hacking strategies include buying a multifamily home where you live on site and rent other units, or renting out spare rooms through short-term rental platforms, helping reduce or eliminate living expenses while building real estate investment experience.

dowidth.com

dowidth.com