Agritourism properties offer immersive rural experiences that generate income through farm-related activities, appealing to entrepreneurs seeking diversified revenue streams. Timberland investments focus on long-term asset appreciation and sustainable timber production, attracting investors interested in ecological value and financial returns. Explore the distinct advantages and potential of these real estate opportunities to determine the best fit for your portfolio.

Why it is important

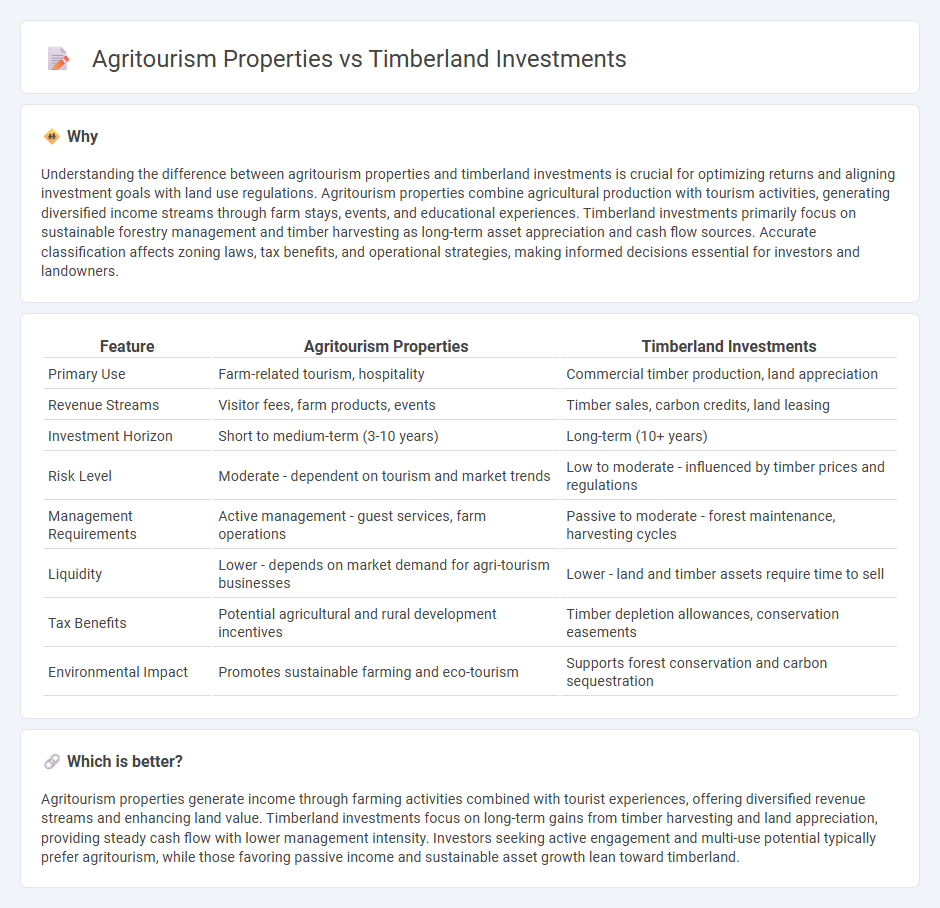

Understanding the difference between agritourism properties and timberland investments is crucial for optimizing returns and aligning investment goals with land use regulations. Agritourism properties combine agricultural production with tourism activities, generating diversified income streams through farm stays, events, and educational experiences. Timberland investments primarily focus on sustainable forestry management and timber harvesting as long-term asset appreciation and cash flow sources. Accurate classification affects zoning laws, tax benefits, and operational strategies, making informed decisions essential for investors and landowners.

Comparison Table

| Feature | Agritourism Properties | Timberland Investments |

|---|---|---|

| Primary Use | Farm-related tourism, hospitality | Commercial timber production, land appreciation |

| Revenue Streams | Visitor fees, farm products, events | Timber sales, carbon credits, land leasing |

| Investment Horizon | Short to medium-term (3-10 years) | Long-term (10+ years) |

| Risk Level | Moderate - dependent on tourism and market trends | Low to moderate - influenced by timber prices and regulations |

| Management Requirements | Active management - guest services, farm operations | Passive to moderate - forest maintenance, harvesting cycles |

| Liquidity | Lower - depends on market demand for agri-tourism businesses | Lower - land and timber assets require time to sell |

| Tax Benefits | Potential agricultural and rural development incentives | Timber depletion allowances, conservation easements |

| Environmental Impact | Promotes sustainable farming and eco-tourism | Supports forest conservation and carbon sequestration |

Which is better?

Agritourism properties generate income through farming activities combined with tourist experiences, offering diversified revenue streams and enhancing land value. Timberland investments focus on long-term gains from timber harvesting and land appreciation, providing steady cash flow with lower management intensity. Investors seeking active engagement and multi-use potential typically prefer agritourism, while those favoring passive income and sustainable asset growth lean toward timberland.

Connection

Agritourism properties and Timberland investments intersect through sustainable land management practices that enhance both agricultural productivity and forest conservation. Timberland investments provide long-term asset growth and income diversification by integrating timber harvesting with agritourism activities such as farm stays, educational tours, and recreational experiences. This synergy maximizes land value while promoting environmental stewardship and attracting eco-conscious visitors, thereby increasing overall profitability in real estate portfolios.

Key Terms

Land Use

Timberland investments offer sustainable returns through long-term forest growth and carbon sequestration benefits, while agritourism properties generate income by combining agricultural activities with tourism experiences on diversified land use. Land use in timberland primarily emphasizes conservation and timber production, whereas agritourism involves mixed-use land supporting crops, livestock, and visitor amenities. Explore more about optimizing land use strategies for maximizing investment in sustainable property portfolios.

Revenue Streams

Timberland investments generate revenue primarily through sustainable timber harvesting, carbon credits, and land appreciation, leveraging long-term growth in wood product demand and environmental services. Agritourism properties diversify income by combining agricultural production with tourism activities such as farm stays, educational tours, and local product sales, enhancing cash flow stability and seasonal appeal. Explore more to understand which investment aligns best with your financial goals and risk tolerance.

Conservation Easements

Timberland investments offer sustainable timber production and long-term asset appreciation while enabling conservation easements that protect biodiversity and forest health. Agritourism properties benefit from conservation easements by preserving farmland and enhancing visitor experiences through maintained scenic and natural landscapes. Explore how conservation easements can strategically align with your investment goals in timberland and agritourism properties for effective environmental and financial returns.

Source and External Links

Timberland | Institutional - Manulife Investment Management - Offers fully integrated, global, and sustainable timberland investment solutions, providing strong financial results and portfolio diversification.

Timberland - Overview, How to Diversify, Benefits of Investing - Provides an overview of timberland investments as an alternative investment form, including diversification benefits and predictable biological growth.

Timberland | J.P. Morgan Asset Management - Offers investment opportunities in core timberland, providing benefits such as inflation risk management and diversified income streams through sustainable forestry practices.

dowidth.com

dowidth.com