Smart contracts streamline real estate transactions by automating processes and reducing the need for intermediaries like title companies, which traditionally handle property title verification and escrow services. Utilizing blockchain technology, smart contracts enhance transparency and security while cutting costs and closing times. Discover how these innovations are transforming property ownership and transaction efficiency.

Why it is important

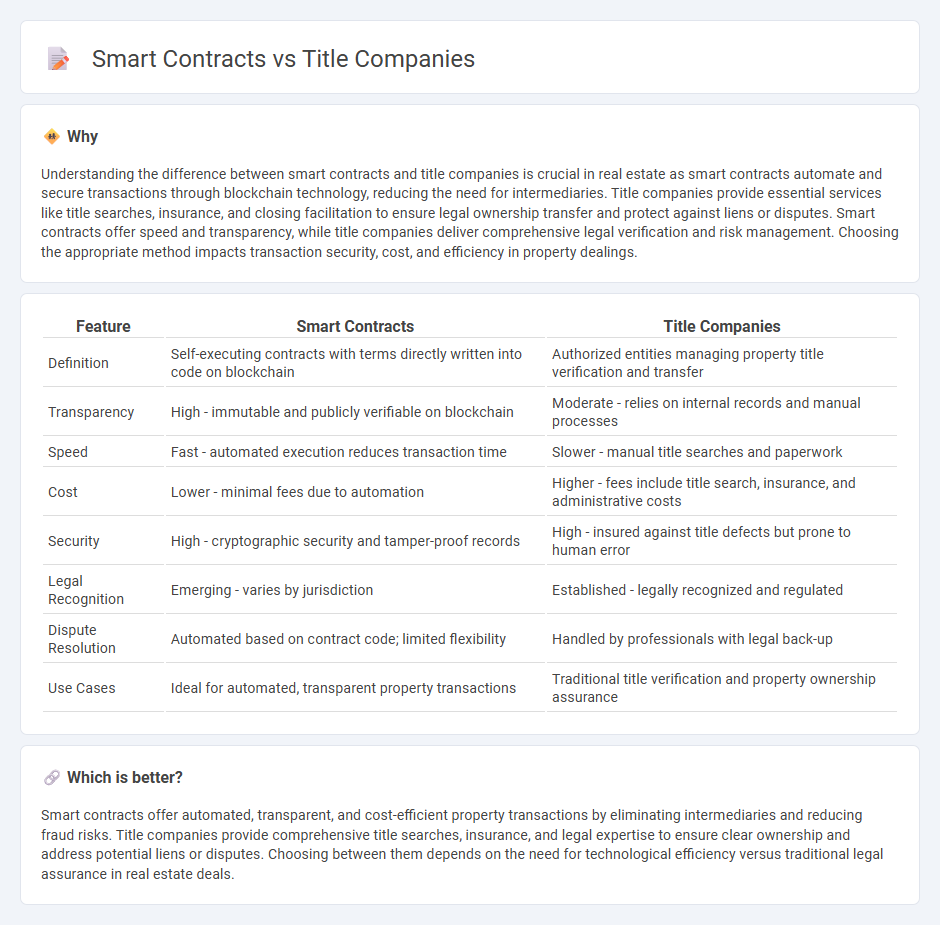

Understanding the difference between smart contracts and title companies is crucial in real estate as smart contracts automate and secure transactions through blockchain technology, reducing the need for intermediaries. Title companies provide essential services like title searches, insurance, and closing facilitation to ensure legal ownership transfer and protect against liens or disputes. Smart contracts offer speed and transparency, while title companies deliver comprehensive legal verification and risk management. Choosing the appropriate method impacts transaction security, cost, and efficiency in property dealings.

Comparison Table

| Feature | Smart Contracts | Title Companies |

|---|---|---|

| Definition | Self-executing contracts with terms directly written into code on blockchain | Authorized entities managing property title verification and transfer |

| Transparency | High - immutable and publicly verifiable on blockchain | Moderate - relies on internal records and manual processes |

| Speed | Fast - automated execution reduces transaction time | Slower - manual title searches and paperwork |

| Cost | Lower - minimal fees due to automation | Higher - fees include title search, insurance, and administrative costs |

| Security | High - cryptographic security and tamper-proof records | High - insured against title defects but prone to human error |

| Legal Recognition | Emerging - varies by jurisdiction | Established - legally recognized and regulated |

| Dispute Resolution | Automated based on contract code; limited flexibility | Handled by professionals with legal back-up |

| Use Cases | Ideal for automated, transparent property transactions | Traditional title verification and property ownership assurance |

Which is better?

Smart contracts offer automated, transparent, and cost-efficient property transactions by eliminating intermediaries and reducing fraud risks. Title companies provide comprehensive title searches, insurance, and legal expertise to ensure clear ownership and address potential liens or disputes. Choosing between them depends on the need for technological efficiency versus traditional legal assurance in real estate deals.

Connection

Smart contracts streamline real estate transactions by automating title transfers and reducing fraud risks, enhancing the efficiency and security of title companies. Title companies leverage blockchain technology to verify property ownership and securely manage record-keeping processes. This integration minimizes manual errors, lowers transaction costs, and accelerates closing times in the real estate market.

Key Terms

Escrow

Title companies provide escrow services ensuring secure property transactions by holding funds and documents until contract conditions are met. Smart contracts automate escrow through blockchain technology, offering faster, transparent, and tamper-proof execution without intermediaries. Explore how smart contracts are revolutionizing escrow processes beyond traditional title company roles.

Blockchain

Title companies ensure secure property transactions by verifying ownership and managing escrow, relying on centralized databases and human oversight. Smart contracts on blockchain automate these processes through transparent, tamper-proof code, reducing costs and eliminating intermediaries. Explore how blockchain-powered smart contracts are revolutionizing real estate transactions with unmatched efficiency and security.

Title insurance

Title companies provide essential services in verifying property ownership and issuing title insurance to protect against legal defects, while smart contracts automate transaction processes on blockchain platforms with transparency and efficiency. Title insurance remains critical in mitigating risks from undisclosed liens, fraud, or errors that smart contracts alone cannot fully address due to the need for comprehensive title searches and legal validation. Explore how integrating smart contracts with traditional title insurance could transform real estate transactions and enhance security.

Source and External Links

What Is a Title Company and Why You Need One - Credible - A title company ensures that a property's title is clear and properly documented, verifying ownership and providing title insurance to protect against undisclosed liens or errors, which smooths the transfer of ownership from seller to buyer in real estate transactions.

What Does a Title Company Do? - Zillow - Title companies verify the legitimacy of a property title, conduct title searches, issue title insurance, manage escrow accounts, and often facilitate the closing process to ensure ownership is properly transferred and protected.

title company | Wex | US Law | LII / Legal Information Institute - A title company conducts title searches to detect ownership or boundary issues and provides title insurance that protects buyers against potential errors found after the purchase, typically charging a one-time fee included in closing costs.

dowidth.com

dowidth.com