Sale leaseback allows property owners to sell an asset and lease it back immediately, freeing up capital while retaining operational control. Tenant in common (TIC) involves shared ownership of a property among multiple investors, each holding an individual interest with rights to transfer or sell their portion independently. Explore these strategies to determine which aligns best with your real estate investment goals.

Why it is important

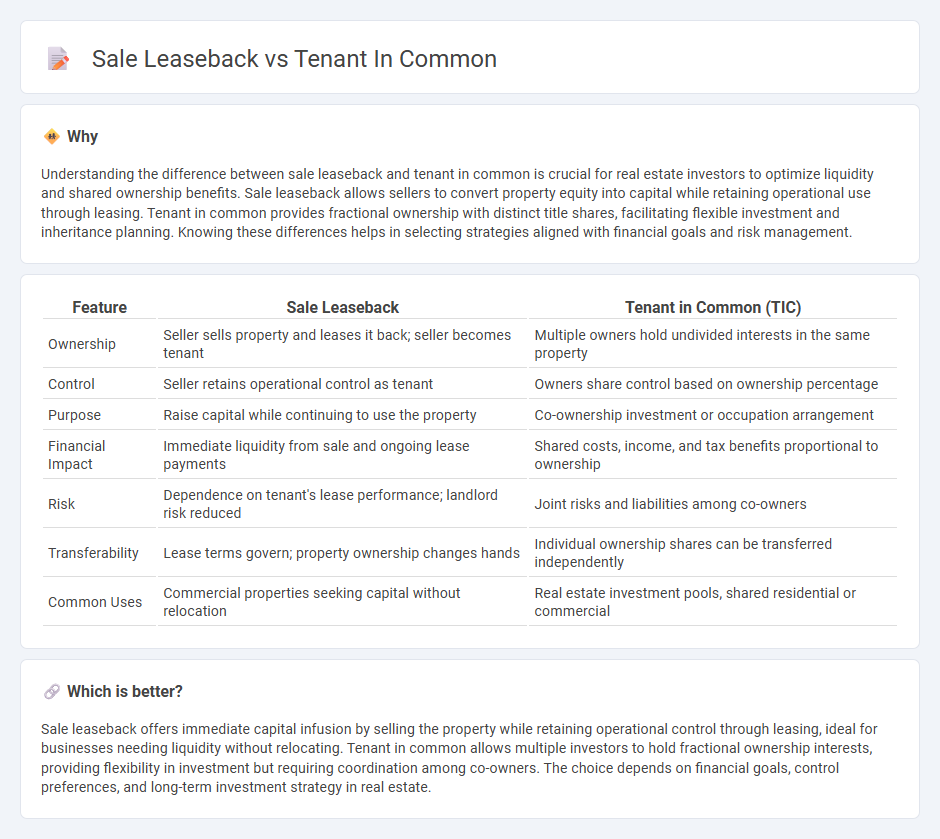

Understanding the difference between sale leaseback and tenant in common is crucial for real estate investors to optimize liquidity and shared ownership benefits. Sale leaseback allows sellers to convert property equity into capital while retaining operational use through leasing. Tenant in common provides fractional ownership with distinct title shares, facilitating flexible investment and inheritance planning. Knowing these differences helps in selecting strategies aligned with financial goals and risk management.

Comparison Table

| Feature | Sale Leaseback | Tenant in Common (TIC) |

|---|---|---|

| Ownership | Seller sells property and leases it back; seller becomes tenant | Multiple owners hold undivided interests in the same property |

| Control | Seller retains operational control as tenant | Owners share control based on ownership percentage |

| Purpose | Raise capital while continuing to use the property | Co-ownership investment or occupation arrangement |

| Financial Impact | Immediate liquidity from sale and ongoing lease payments | Shared costs, income, and tax benefits proportional to ownership |

| Risk | Dependence on tenant's lease performance; landlord risk reduced | Joint risks and liabilities among co-owners |

| Transferability | Lease terms govern; property ownership changes hands | Individual ownership shares can be transferred independently |

| Common Uses | Commercial properties seeking capital without relocation | Real estate investment pools, shared residential or commercial |

Which is better?

Sale leaseback offers immediate capital infusion by selling the property while retaining operational control through leasing, ideal for businesses needing liquidity without relocating. Tenant in common allows multiple investors to hold fractional ownership interests, providing flexibility in investment but requiring coordination among co-owners. The choice depends on financial goals, control preferences, and long-term investment strategy in real estate.

Connection

Sale leaseback transactions and tenants in common arrangements intersect by allowing multiple investors to collectively own real estate while benefiting from steady income streams. In a sale leaseback, the original owner sells the property and leases it back, often forming tenants in common with other investors to share ownership interests. This combination provides liquidity to sellers and fractional ownership opportunities, optimizing portfolio diversification and cash flow management.

Key Terms

Ownership Structure

A tenant in common (TIC) involves multiple owners holding undivided fractional interests in a property, each with separate title and the ability to transfer their share independently. In contrast, a sale-leaseback transaction transfers full ownership to the buyer, while the seller retains the right to lease and use the property, separating ownership from occupancy. Explore detailed comparisons of ownership structures to optimize your real estate strategy.

Capital Release

Tenant in common arrangements enable multiple investors to hold fractional ownership interests in a property, allowing each to access equity independently for capital release without selling the entire asset. Sale leaseback transactions involve selling an asset to a buyer and simultaneously leasing it back, thereby unlocking capital tied up in the property while maintaining operational use. Explore how these strategies can optimize your capital release options in real estate investments.

Possession Rights

Tenants in common hold individual ownership interests with distinct possession rights, allowing each co-owner to occupy and use the entire property irrespective of their ownership percentage. Sale-leaseback involves the property owner selling the asset and simultaneously leasing it back, maintaining possession solely through leasehold rights rather than ownership. Explore further to understand how possession rights impact investment strategies in these arrangements.

Source and External Links

Joint Tenancy vs. Tenancy in Common - Klun Law Firm - Tenants in common each own an undivided interest in real estate, with equal rights to use the property regardless of unequal ownership shares, and when one tenant dies, their share passes to their heirs rather than to the other owners.

Tenancy in common (TIC): What is it and how does it work - Tenancy in common allows two or more people, regardless of their relationship, to share property ownership with no right of survivorship, meaning each owner can sell, transfer, or bequeath their share independently.

Joint Tenancy vs. Tenants in Common: What's the Difference? - Under tenancy in common, owners may have unequal shares and can freely sell or transfer their interest; if an owner dies without a will, their share goes through probate instead of automatically passing to the other owners.

dowidth.com

dowidth.com