Sale-leaseback transactions involve selling a property and simultaneously leasing it back from the buyer, allowing owners to free up capital while maintaining operational control. Conventional sales transfer ownership completely, with the seller relinquishing rights and possession upon closing. Explore the benefits and strategic uses of sale-leaseback arrangements versus traditional sales to make informed real estate decisions.

Why it is important

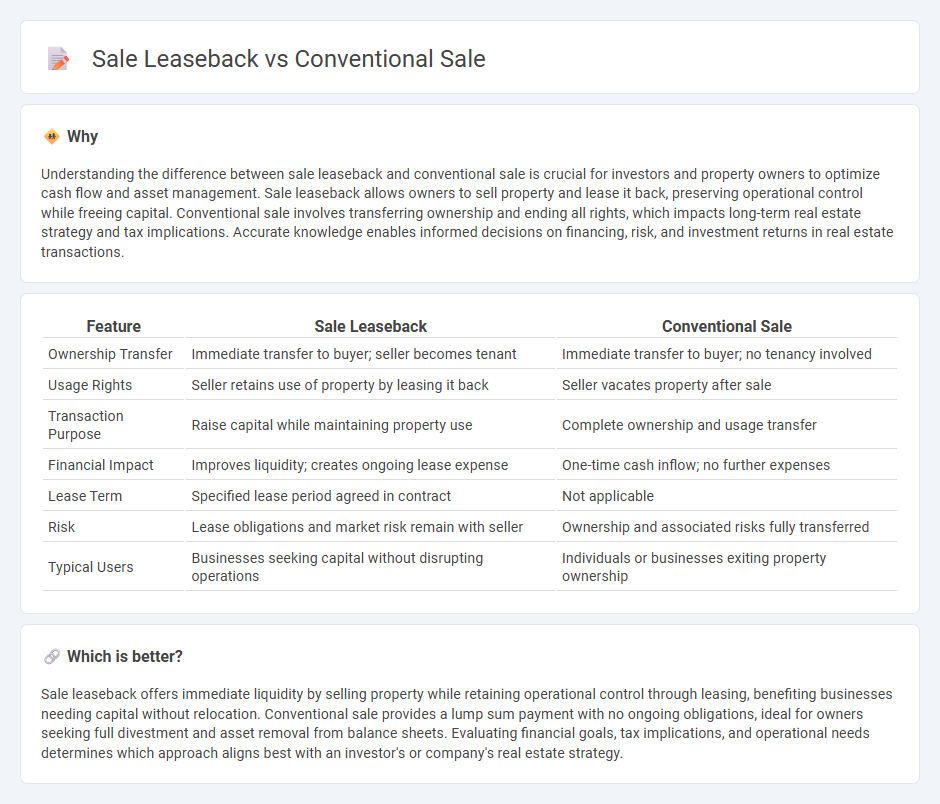

Understanding the difference between sale leaseback and conventional sale is crucial for investors and property owners to optimize cash flow and asset management. Sale leaseback allows owners to sell property and lease it back, preserving operational control while freeing capital. Conventional sale involves transferring ownership and ending all rights, which impacts long-term real estate strategy and tax implications. Accurate knowledge enables informed decisions on financing, risk, and investment returns in real estate transactions.

Comparison Table

| Feature | Sale Leaseback | Conventional Sale |

|---|---|---|

| Ownership Transfer | Immediate transfer to buyer; seller becomes tenant | Immediate transfer to buyer; no tenancy involved |

| Usage Rights | Seller retains use of property by leasing it back | Seller vacates property after sale |

| Transaction Purpose | Raise capital while maintaining property use | Complete ownership and usage transfer |

| Financial Impact | Improves liquidity; creates ongoing lease expense | One-time cash inflow; no further expenses |

| Lease Term | Specified lease period agreed in contract | Not applicable |

| Risk | Lease obligations and market risk remain with seller | Ownership and associated risks fully transferred |

| Typical Users | Businesses seeking capital without disrupting operations | Individuals or businesses exiting property ownership |

Which is better?

Sale leaseback offers immediate liquidity by selling property while retaining operational control through leasing, benefiting businesses needing capital without relocation. Conventional sale provides a lump sum payment with no ongoing obligations, ideal for owners seeking full divestment and asset removal from balance sheets. Evaluating financial goals, tax implications, and operational needs determines which approach aligns best with an investor's or company's real estate strategy.

Connection

Sale leaseback and conventional sale are connected through the transfer of property ownership, where sale leaseback involves selling an asset and leasing it back to retain operational control, while conventional sale entails transferring ownership without ongoing lease agreements. Both strategies impact cash flow, tax benefits, and balance sheet structure, influencing an investor's or company's financial and operational flexibility. Understanding these connections allows for optimized real estate portfolio management and tailored financial strategies.

Key Terms

Ownership Transfer

Conventional sales involve the immediate transfer of property ownership from seller to buyer, granting the buyer full control and rights over the asset. In contrast, sale-leaseback transactions transfer ownership to the buyer while the seller retains operational use through a lease agreement, maintaining possession without ownership. Explore how these distinct ownership structures impact financial strategy and asset management.

Occupancy Rights

Conventional sale transfers full ownership and occupancy rights to the buyer, removing the seller's control over the property. Sale leaseback allows the seller to retain occupancy rights by leasing the property back after selling it, ensuring continued use without ownership responsibilities. Explore the benefits and implications of occupancy rights in sale leaseback agreements to optimize your real estate strategy.

Financing Structure

Conventional sale involves transferring property ownership directly from the seller to the buyer, with payment typically made upfront or through a mortgage, reflecting a straightforward financing structure. In contrast, sale leaseback allows the original owner to sell the asset but retain operational use by leasing it back, creating a financing structure that converts equity into liquid capital while maintaining business continuity. Explore detailed comparisons to understand which financing structure aligns best with your financial strategy.

Source and External Links

Conventional vs. Subject To, the pros and cons. - A conventional sale in real estate is the traditional way of selling a house where the seller receives a cash payment after the buyer secures a mortgage or pays with their own funds, offering immediate liquidity, market-driven pricing control, and a quicker closing process.

What is a Conventional Sale? - A conventional sale occurs when the property is owned outright or the mortgage owed is less than the market value, usually resulting in a smoother transaction compared to foreclosures or short sales.

Conventional Sale: The Most Common Way to Buy a House - A conventional sale is the standard process of selling a home where the seller completes the sale through typical real estate channels, often involving realtors and traditional financing methods.

dowidth.com

dowidth.com