Automated valuation models (AVMs) utilize algorithms and extensive property data to generate fast, accurate home value estimates, enabling efficient real estate market analysis. Broker Price Opinions (BPOs) rely on local real estate experts who assess comparable sales, neighborhood trends, and property conditions for a more personalized valuation. Explore the key differences and benefits of AVMs and BPOs to enhance your property valuation strategy.

Why it is important

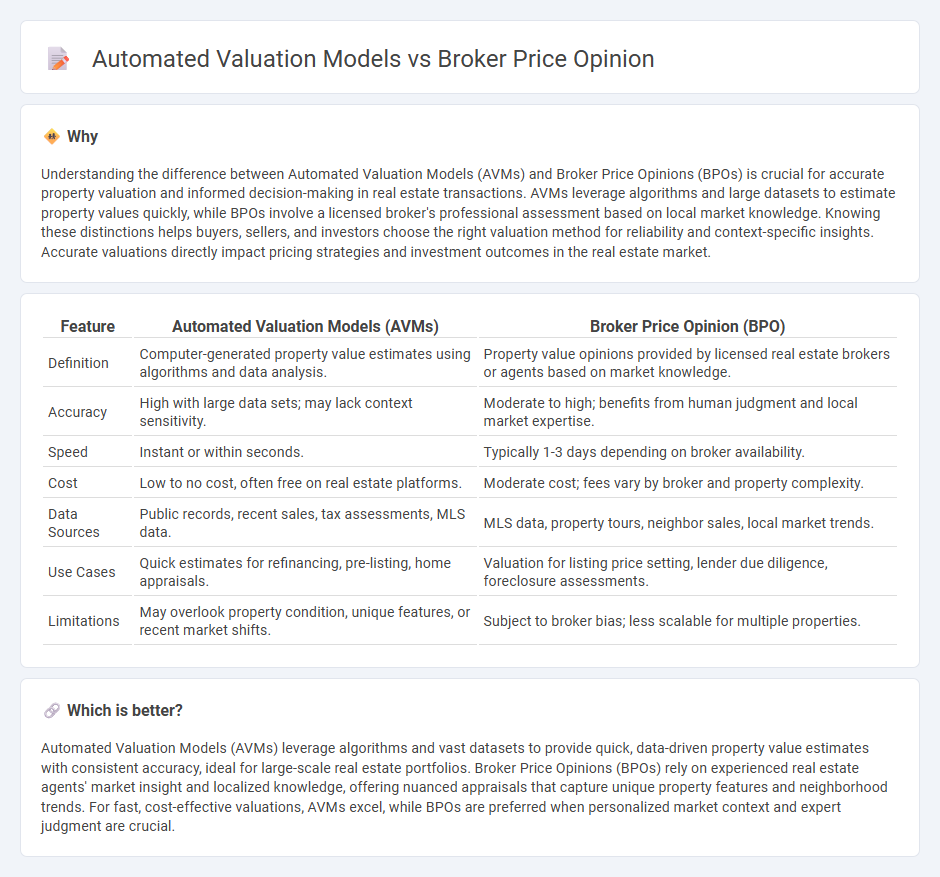

Understanding the difference between Automated Valuation Models (AVMs) and Broker Price Opinions (BPOs) is crucial for accurate property valuation and informed decision-making in real estate transactions. AVMs leverage algorithms and large datasets to estimate property values quickly, while BPOs involve a licensed broker's professional assessment based on local market knowledge. Knowing these distinctions helps buyers, sellers, and investors choose the right valuation method for reliability and context-specific insights. Accurate valuations directly impact pricing strategies and investment outcomes in the real estate market.

Comparison Table

| Feature | Automated Valuation Models (AVMs) | Broker Price Opinion (BPO) |

|---|---|---|

| Definition | Computer-generated property value estimates using algorithms and data analysis. | Property value opinions provided by licensed real estate brokers or agents based on market knowledge. |

| Accuracy | High with large data sets; may lack context sensitivity. | Moderate to high; benefits from human judgment and local market expertise. |

| Speed | Instant or within seconds. | Typically 1-3 days depending on broker availability. |

| Cost | Low to no cost, often free on real estate platforms. | Moderate cost; fees vary by broker and property complexity. |

| Data Sources | Public records, recent sales, tax assessments, MLS data. | MLS data, property tours, neighbor sales, local market trends. |

| Use Cases | Quick estimates for refinancing, pre-listing, home appraisals. | Valuation for listing price setting, lender due diligence, foreclosure assessments. |

| Limitations | May overlook property condition, unique features, or recent market shifts. | Subject to broker bias; less scalable for multiple properties. |

Which is better?

Automated Valuation Models (AVMs) leverage algorithms and vast datasets to provide quick, data-driven property value estimates with consistent accuracy, ideal for large-scale real estate portfolios. Broker Price Opinions (BPOs) rely on experienced real estate agents' market insight and localized knowledge, offering nuanced appraisals that capture unique property features and neighborhood trends. For fast, cost-effective valuations, AVMs excel, while BPOs are preferred when personalized market context and expert judgment are crucial.

Connection

Automated Valuation Models (AVMs) and Broker Price Opinions (BPOs) both provide property value estimates but differ in methodology; AVMs use algorithms and large datasets, while BPOs rely on brokers' market expertise and on-site evaluations. AVMs efficiently generate quick, data-driven valuations, making them ideal for initial price assessments, whereas BPOs offer nuanced, context-rich insights critical for transactions requiring professional judgment. Integrating AVMs with BPOs enhances accuracy and reliability in real estate pricing by combining technological precision with human expertise.

Key Terms

Comparative Market Analysis (CMA)

Broker Price Opinion (BPO) offers a detailed property valuation generated by real estate professionals, incorporating market trends and unique property features, while Automated Valuation Models (AVMs) use algorithms and large databases to provide rapid, data-driven estimates. Both tools are integral to Comparative Market Analysis (CMA), with BPOs providing nuanced insights often missing in AVM outputs and AVMs delivering consistent, scalable valuations. Explore how combining BPOs and AVMs can enhance the accuracy of your property CMA for smarter investment decisions.

Algorithm-driven Valuation

Broker Price Opinions (BPOs) rely on real estate agents' market expertise combined with comparative market analysis, whereas Automated Valuation Models (AVMs) use algorithm-driven data integration from property records, recent sales, and market trends to estimate values. AVMs offer scalability and speed with varying accuracy depending on data quality and property type, making them essential tools for lenders and investors seeking quick valuations. Explore how algorithm-driven valuation models continue to evolve in accuracy and application across real estate markets.

Subjective Adjustments

Broker Price Opinions (BPOs) incorporate subjective adjustments based on local market insights and property-specific conditions, offering a nuanced perspective unavailable in Automated Valuation Models (AVMs). AVMs rely on algorithms analyzing historical data and comparable sales but lack the flexibility to account for unique property features or current market sentiment. Explore the contrasts between BPOs and AVMs to better understand how subjective adjustments influence property valuation accuracy.

Source and External Links

A guide to broker price opinion (BPO) - This guide explains how broker price opinions work, including the types such as internal and external BPOs, and factors that influence property valuation.

Broker's price opinion - A BPO is an informal appraisal performed by a licensed real estate agent or broker, often used by financial institutions to estimate property value.

Broker Price Opinion (BPO): A Full Guide - This guide discusses the role of BPOs in estimating property value, their benefits, and limitations, particularly in buying or selling a home.

dowidth.com

dowidth.com