Fractional ownership platforms offer investors the opportunity to purchase shares in real estate properties, providing access to diverse assets with lower capital requirements compared to direct property ownership. These platforms streamline property management, reduce individual risks, and enable liquidity through secondary markets or share transfers. Explore how fractional ownership can diversify your real estate portfolio while minimizing entry barriers.

Why it is important

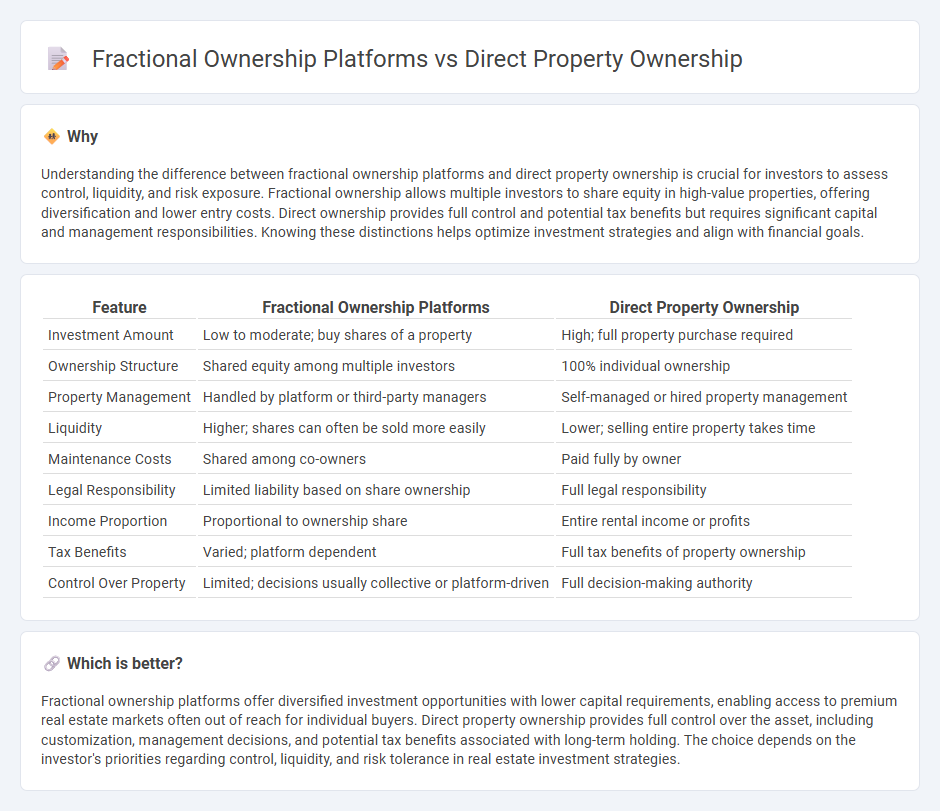

Understanding the difference between fractional ownership platforms and direct property ownership is crucial for investors to assess control, liquidity, and risk exposure. Fractional ownership allows multiple investors to share equity in high-value properties, offering diversification and lower entry costs. Direct ownership provides full control and potential tax benefits but requires significant capital and management responsibilities. Knowing these distinctions helps optimize investment strategies and align with financial goals.

Comparison Table

| Feature | Fractional Ownership Platforms | Direct Property Ownership |

|---|---|---|

| Investment Amount | Low to moderate; buy shares of a property | High; full property purchase required |

| Ownership Structure | Shared equity among multiple investors | 100% individual ownership |

| Property Management | Handled by platform or third-party managers | Self-managed or hired property management |

| Liquidity | Higher; shares can often be sold more easily | Lower; selling entire property takes time |

| Maintenance Costs | Shared among co-owners | Paid fully by owner |

| Legal Responsibility | Limited liability based on share ownership | Full legal responsibility |

| Income Proportion | Proportional to ownership share | Entire rental income or profits |

| Tax Benefits | Varied; platform dependent | Full tax benefits of property ownership |

| Control Over Property | Limited; decisions usually collective or platform-driven | Full decision-making authority |

Which is better?

Fractional ownership platforms offer diversified investment opportunities with lower capital requirements, enabling access to premium real estate markets often out of reach for individual buyers. Direct property ownership provides full control over the asset, including customization, management decisions, and potential tax benefits associated with long-term holding. The choice depends on the investor's priorities regarding control, liquidity, and risk tolerance in real estate investment strategies.

Connection

Fractional ownership platforms and direct property ownership are interconnected through their shared basis in real estate investment, allowing multiple investors to collectively hold tangible property assets. These platforms enable fractional stakeholders to gain direct property ownership benefits such as equity appreciation and rental income without the need for sole full property purchase. This hybrid ownership model enhances market liquidity and accessibility while preserving the value and rights associated with traditional direct property ownership.

Key Terms

Title Deed

Direct property ownership ensures exclusive rights through a clear title deed, granting full control over the asset and simplifying legal transactions. Fractional ownership platforms divide title deeds among multiple investors, facilitating shared equity but often involving more complex legal frameworks and limited individual control. Discover the advantages and challenges of each approach to make an informed investment decision.

Tokenization

Tokenization transforms direct property ownership by converting real estate assets into digital tokens, enabling fractional ownership that increases liquidity and accessibility for investors. Platforms leveraging blockchain technology facilitate seamless trading of these tokens, lowering entry barriers and expanding market participation. Discover how tokenization reshapes real estate investment opportunities and unlocks new potential.

Liquidity

Direct property ownership often involves limited liquidity as selling a property can take weeks or months, impacting investor flexibility. Fractional ownership platforms enhance liquidity by allowing investors to buy and sell shares of properties more rapidly through digital marketplaces. Explore how these platforms transform real estate investing by offering increased liquidity options.

Source and External Links

The Different Types of Property Ownership - Direct property ownership means buying a physical real estate asset like a house or commercial building, granting full control over it, the ability to generate rental income, and potential capital gains, but also involves responsibilities like maintenance and dealing with tenants, with risks concentrated in one asset and limited liquidity.

Property Ownership: Shares vs. Direct Purchase - Which is Better? - In direct property ownership by a company, the legal title is transferred directly to the buyer, with purchase price based on property value plus stamp duty, making it different from acquiring shares in a property-holding company where ownership is indirect.

Real Estate Syndication vs. Direct Ownership - Direct ownership involves purchasing and managing a property independently, with full responsibility for all aspects of ownership including maintenance and tenant management, contrasting with passive investment models like syndication.

dowidth.com

dowidth.com