Micro flipping offers a quick-turn strategy by purchasing properties with minimal holding time and rapid resale, optimizing cash flow and reducing market exposure. Subject-to transactions allow buyers to acquire properties by taking over existing mortgage payments, providing leverage without immediate financing costs. Discover more about how each method can fit your real estate investment goals.

Why it is important

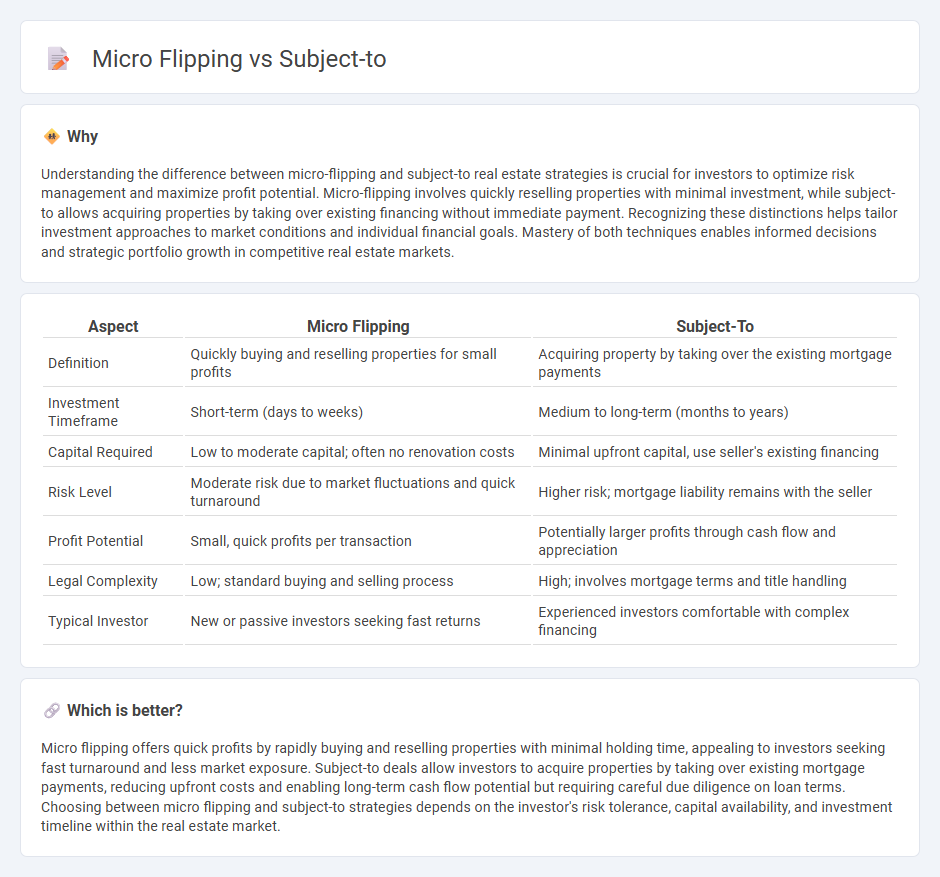

Understanding the difference between micro-flipping and subject-to real estate strategies is crucial for investors to optimize risk management and maximize profit potential. Micro-flipping involves quickly reselling properties with minimal investment, while subject-to allows acquiring properties by taking over existing financing without immediate payment. Recognizing these distinctions helps tailor investment approaches to market conditions and individual financial goals. Mastery of both techniques enables informed decisions and strategic portfolio growth in competitive real estate markets.

Comparison Table

| Aspect | Micro Flipping | Subject-To |

|---|---|---|

| Definition | Quickly buying and reselling properties for small profits | Acquiring property by taking over the existing mortgage payments |

| Investment Timeframe | Short-term (days to weeks) | Medium to long-term (months to years) |

| Capital Required | Low to moderate capital; often no renovation costs | Minimal upfront capital, use seller's existing financing |

| Risk Level | Moderate risk due to market fluctuations and quick turnaround | Higher risk; mortgage liability remains with the seller |

| Profit Potential | Small, quick profits per transaction | Potentially larger profits through cash flow and appreciation |

| Legal Complexity | Low; standard buying and selling process | High; involves mortgage terms and title handling |

| Typical Investor | New or passive investors seeking fast returns | Experienced investors comfortable with complex financing |

Which is better?

Micro flipping offers quick profits by rapidly buying and reselling properties with minimal holding time, appealing to investors seeking fast turnaround and less market exposure. Subject-to deals allow investors to acquire properties by taking over existing mortgage payments, reducing upfront costs and enabling long-term cash flow potential but requiring careful due diligence on loan terms. Choosing between micro flipping and subject-to strategies depends on the investor's risk tolerance, capital availability, and investment timeline within the real estate market.

Connection

Micro flipping involves quickly buying and selling properties to capitalize on short-term market trends, often requiring minimal upfront investment. Subject-to financing allows investors to acquire property by taking over the existing mortgage payments without formally assuming the loan, reducing the initial capital needed. Combining micro flipping with subject-to strategies enables investors to efficiently control properties, improve them, and sell rapidly while minimizing cash outlay and financial risk.

Key Terms

Existing mortgage

Subject-to investing involves acquiring a property while keeping the existing mortgage in place, allowing investors to control real estate without qualifying for new loans. Micro flipping centers on quickly reselling recently purchased properties for a profit, typically requiring full ownership and often new financing. Explore detailed comparisons to determine which strategy best suits your investment goals.

Assignment contract

Subject-to and micro flipping strategies often utilize assignment contracts to transfer property rights efficiently without traditional financing methods. Assignment contracts facilitate micro flipping by allowing investors to sell their purchase rights to another buyer quickly, whereas subject-to deals typically involve taking over the existing mortgage under the original loan terms. Explore how leveraging assignment contracts can maximize profits in both subject-to and micro flipping real estate transactions.

Quick resale

Subject-to investing involves acquiring property by taking over the seller's existing mortgage, enabling quick transactions without traditional financing delays. Micro flipping focuses on rapidly reselling properties, often without renovation, leveraging market demand for fast turnovers. Explore effective strategies to maximize gains in quick real estate resale markets.

Source and External Links

What Does 'Subject to' Mean? | Britannica Dictionary - "Subject to" has three main meanings: affected by something, likely to suffer from something, or dependent on a condition or approval to happen or be true.

Legalese - Subject To - What does it mean? - Fieldings Porter - In contracts, "subject to" signals that one clause is conditional on or subordinate to another, establishing priority or exceptions between clauses.

subject someone/something to something - Cambridge Dictionary - The phrase means to make someone or something experience an unpleasant or worrying thing, often used in the form "subject someone to something".

dowidth.com

dowidth.com