Opportunity zone investing leverages tax incentives to attract capital into designated economically distressed areas, offering benefits like deferred capital gains taxes and potential exclusion of gains on long-term investments. Crowdfunding in real estate enables a broad range of investors to pool funds online, accessing diversified projects with lower minimum investments and increased transparency. Explore the advantages and differences of these innovative real estate investment strategies to determine the best fit for your financial goals.

Why it is important

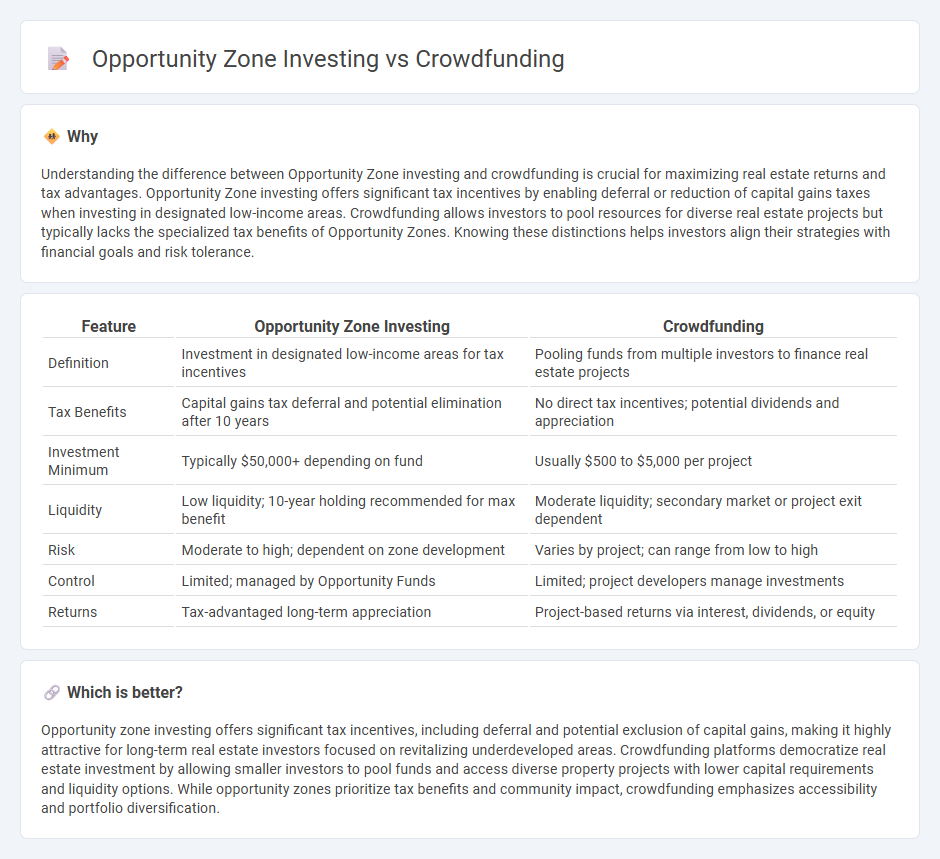

Understanding the difference between Opportunity Zone investing and crowdfunding is crucial for maximizing real estate returns and tax advantages. Opportunity Zone investing offers significant tax incentives by enabling deferral or reduction of capital gains taxes when investing in designated low-income areas. Crowdfunding allows investors to pool resources for diverse real estate projects but typically lacks the specialized tax benefits of Opportunity Zones. Knowing these distinctions helps investors align their strategies with financial goals and risk tolerance.

Comparison Table

| Feature | Opportunity Zone Investing | Crowdfunding |

|---|---|---|

| Definition | Investment in designated low-income areas for tax incentives | Pooling funds from multiple investors to finance real estate projects |

| Tax Benefits | Capital gains tax deferral and potential elimination after 10 years | No direct tax incentives; potential dividends and appreciation |

| Investment Minimum | Typically $50,000+ depending on fund | Usually $500 to $5,000 per project |

| Liquidity | Low liquidity; 10-year holding recommended for max benefit | Moderate liquidity; secondary market or project exit dependent |

| Risk | Moderate to high; dependent on zone development | Varies by project; can range from low to high |

| Control | Limited; managed by Opportunity Funds | Limited; project developers manage investments |

| Returns | Tax-advantaged long-term appreciation | Project-based returns via interest, dividends, or equity |

Which is better?

Opportunity zone investing offers significant tax incentives, including deferral and potential exclusion of capital gains, making it highly attractive for long-term real estate investors focused on revitalizing underdeveloped areas. Crowdfunding platforms democratize real estate investment by allowing smaller investors to pool funds and access diverse property projects with lower capital requirements and liquidity options. While opportunity zones prioritize tax benefits and community impact, crowdfunding emphasizes accessibility and portfolio diversification.

Connection

Opportunity zone investing leverages tax incentives to encourage investment in underdeveloped real estate areas, attracting investors seeking capital gains deferral and reduction. Crowdfunding platforms facilitate access to these opportunity zone projects by pooling funds from multiple investors, democratizing real estate investment opportunities that were traditionally limited to high-net-worth individuals. This synergy between opportunity zone incentives and crowdfunding accelerates development in targeted neighborhoods while offering diversified, lower-cost entry points for investors.

Key Terms

Pooled Capital

Pooled capital in crowdfunding allows investors to participate in diversified projects with lower individual financial commitment, while opportunity zone investing focuses pooled resources on tax-advantaged real estate developments within designated areas. Crowdfunding platforms streamline capital aggregation from numerous small investors, whereas opportunity zone funds concentrate large pools of capital to stimulate economic growth and provide tax incentives. Explore the nuances and benefits of each investment model to determine which aligns best with your financial goals.

Tax Incentives

Crowdfunding investments often provide limited tax incentives compared to opportunity zone investing, which offers significant tax benefits such as deferral of capital gains tax and potential exclusion of gains from investments held over ten years. Opportunity zones, designated by the IRS, specifically encourage long-term investments in economically distressed areas by allowing taxpayers to defer and possibly reduce taxes on prior capital gains. Explore detailed tax advantages and investment structures to determine the best strategy for your financial goals.

Project Eligibility

Project eligibility for crowdfunding typically requires alignment with platform-specific criteria such as innovation, scalability, or community impact, whereas opportunity zone investing mandates that projects be located within designated low-income census tracts to qualify for tax incentives. Crowdfunding projects often attract diverse investors through equity stakes or rewards, while opportunity zone investments primarily target long-term capital gains deferral and reduction benefits for eligible real estate or business developments. Explore detailed eligibility requirements and benefits to determine the best investment approach for your objectives.

Source and External Links

Crowdfunding - Crowdfunding is a practice of funding projects or ventures by raising money from a large number of people, typically via the internet.

Crowdfunding for Startups - This resource describes crowdfunding as a way for startups to fund projects through collective efforts from a large pool of individuals using online platforms.

GoFundMe - GoFundMe is a leading crowdfunding platform that allows users to start fundraisers easily and raise money for various causes, including personal emergencies and charities.

dowidth.com

dowidth.com