Smart contracts streamline real estate transactions by automating agreements and reducing the need for intermediaries like mortgage brokers. These blockchain-based contracts ensure transparency, security, and faster processing times compared to traditional mortgage services. Discover how integrating smart contracts can transform your home buying experience.

Why it is important

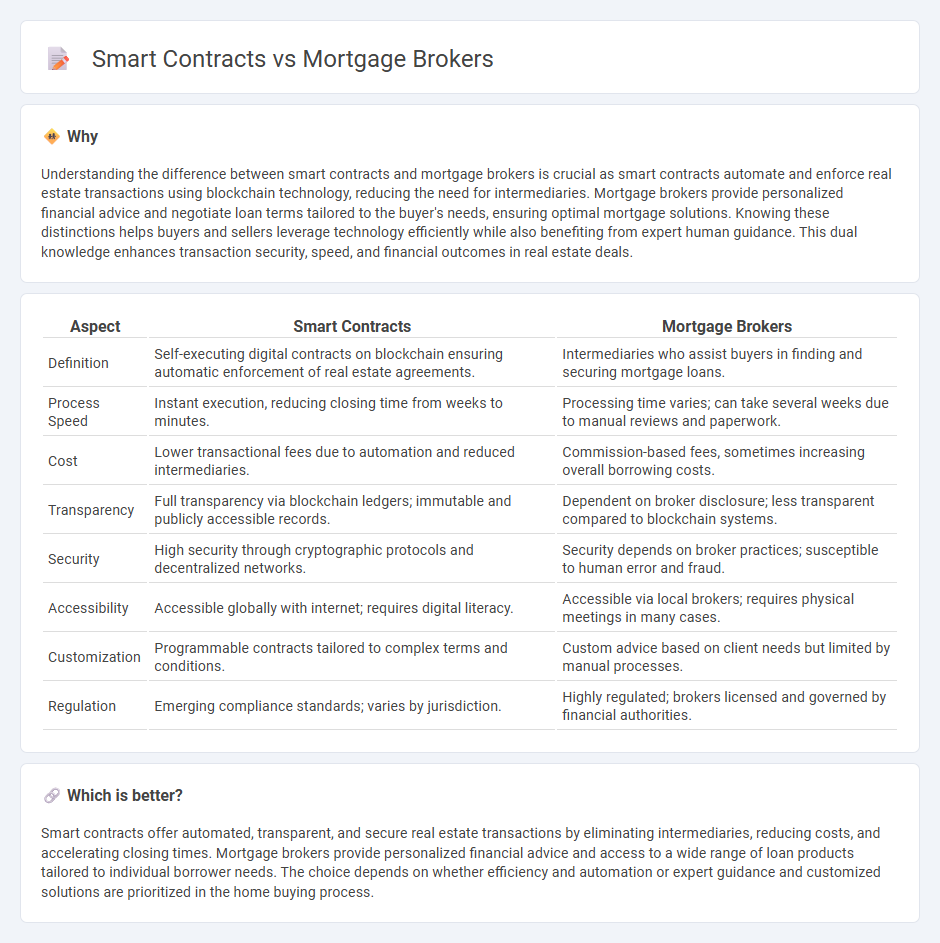

Understanding the difference between smart contracts and mortgage brokers is crucial as smart contracts automate and enforce real estate transactions using blockchain technology, reducing the need for intermediaries. Mortgage brokers provide personalized financial advice and negotiate loan terms tailored to the buyer's needs, ensuring optimal mortgage solutions. Knowing these distinctions helps buyers and sellers leverage technology efficiently while also benefiting from expert human guidance. This dual knowledge enhances transaction security, speed, and financial outcomes in real estate deals.

Comparison Table

| Aspect | Smart Contracts | Mortgage Brokers |

|---|---|---|

| Definition | Self-executing digital contracts on blockchain ensuring automatic enforcement of real estate agreements. | Intermediaries who assist buyers in finding and securing mortgage loans. |

| Process Speed | Instant execution, reducing closing time from weeks to minutes. | Processing time varies; can take several weeks due to manual reviews and paperwork. |

| Cost | Lower transactional fees due to automation and reduced intermediaries. | Commission-based fees, sometimes increasing overall borrowing costs. |

| Transparency | Full transparency via blockchain ledgers; immutable and publicly accessible records. | Dependent on broker disclosure; less transparent compared to blockchain systems. |

| Security | High security through cryptographic protocols and decentralized networks. | Security depends on broker practices; susceptible to human error and fraud. |

| Accessibility | Accessible globally with internet; requires digital literacy. | Accessible via local brokers; requires physical meetings in many cases. |

| Customization | Programmable contracts tailored to complex terms and conditions. | Custom advice based on client needs but limited by manual processes. |

| Regulation | Emerging compliance standards; varies by jurisdiction. | Highly regulated; brokers licensed and governed by financial authorities. |

Which is better?

Smart contracts offer automated, transparent, and secure real estate transactions by eliminating intermediaries, reducing costs, and accelerating closing times. Mortgage brokers provide personalized financial advice and access to a wide range of loan products tailored to individual borrower needs. The choice depends on whether efficiency and automation or expert guidance and customized solutions are prioritized in the home buying process.

Connection

Smart contracts streamline real estate transactions by automating mortgage approvals and fund disbursements, reducing reliance on traditional mortgage brokers for paperwork and verification. Mortgage brokers benefit from smart contracts through enhanced transparency and faster processing times, improving client satisfaction and operational efficiency. Integrated blockchain technology ensures secure, immutable records, fostering trust between borrowers, brokers, and lenders.

Key Terms

Intermediary

Mortgage brokers act as traditional intermediaries by connecting borrowers with lenders, streamlining loan applications, and providing personalized advice throughout the mortgage process. Smart contracts automate intermediary functions, executing loan agreements transparently and efficiently on blockchain networks without human involvement. Explore how these technological shifts reshape the future of mortgage lending.

Automation

Mortgage brokers streamline loan processing by leveraging personal expertise and traditional verification methods, while smart contracts automate these processes through blockchain technology, reducing human error and accelerating transaction speed. Smart contracts execute loan agreements instantly when predefined conditions are met, enabling near real-time approvals and disbursements without manual intervention. Discover how automation through smart contracts is revolutionizing mortgage lending efficiency and transparency.

Trustless

Mortgage brokers facilitate loan agreements by acting as trusted intermediaries who verify borrower credentials and negotiate terms with lenders. Smart contracts operate on blockchain technology to execute mortgage agreements automatically and trustlessly, eliminating the need for third-party validation. Explore the advantages of trustless smart contracts over traditional mortgage brokers to understand the future of secure lending.

Source and External Links

Dallas Mortgage Broker - Tatom Lending - Dallas mortgage brokers have access to many lenders, offering personalized options and better rates compared to banks which only offer their own rates, and they possess deeper expertise in managing various loan factors to suit borrowers' needs.

Stonebriar Mortgage: Mortgage Broker | Dallas, Austin, San Antonio, Houston TX & Beyond - Stonebriar Mortgage specializes in matching customers with flexible mortgage options across Texas through an extensive lender network, helping those with low credit, self-employment, or low down payments.

The Tuttle Group: Top Dallas Mortgage Lender - The Tuttle Group assists with unique loan situations and aims to align home loans with long-term financial goals, offering support for credit management and providing comprehensive mortgage options for various borrower types.

dowidth.com

dowidth.com