Build-to-rent properties are purpose-built communities designed exclusively for long-term rental, offering amenities and professional management typically absent in single-family rentals, which are individual homes owned and leased by private landlords. These two investment models differ significantly in scale, tenant experience, and operational efficiencies, influencing their appeal to different types of renters and investors. Discover more about the advantages and considerations of build-to-rent versus single-family rental investments.

Why it is important

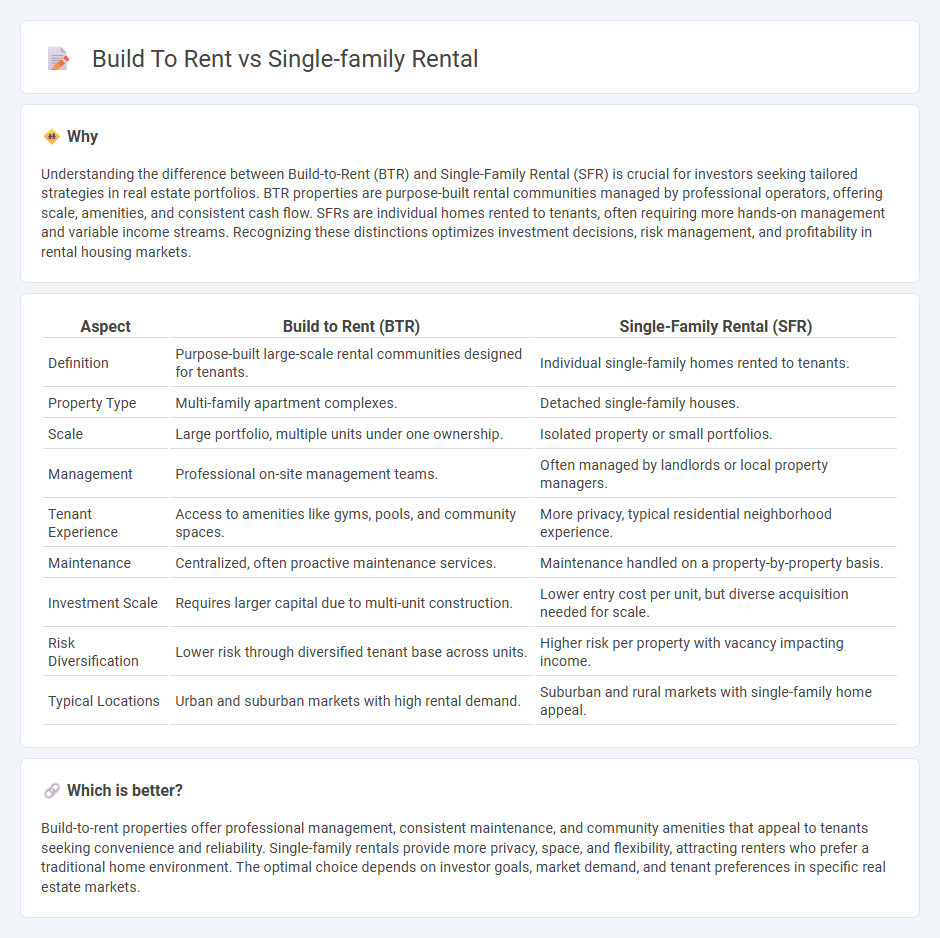

Understanding the difference between Build-to-Rent (BTR) and Single-Family Rental (SFR) is crucial for investors seeking tailored strategies in real estate portfolios. BTR properties are purpose-built rental communities managed by professional operators, offering scale, amenities, and consistent cash flow. SFRs are individual homes rented to tenants, often requiring more hands-on management and variable income streams. Recognizing these distinctions optimizes investment decisions, risk management, and profitability in rental housing markets.

Comparison Table

| Aspect | Build to Rent (BTR) | Single-Family Rental (SFR) |

|---|---|---|

| Definition | Purpose-built large-scale rental communities designed for tenants. | Individual single-family homes rented to tenants. |

| Property Type | Multi-family apartment complexes. | Detached single-family houses. |

| Scale | Large portfolio, multiple units under one ownership. | Isolated property or small portfolios. |

| Management | Professional on-site management teams. | Often managed by landlords or local property managers. |

| Tenant Experience | Access to amenities like gyms, pools, and community spaces. | More privacy, typical residential neighborhood experience. |

| Maintenance | Centralized, often proactive maintenance services. | Maintenance handled on a property-by-property basis. |

| Investment Scale | Requires larger capital due to multi-unit construction. | Lower entry cost per unit, but diverse acquisition needed for scale. |

| Risk Diversification | Lower risk through diversified tenant base across units. | Higher risk per property with vacancy impacting income. |

| Typical Locations | Urban and suburban markets with high rental demand. | Suburban and rural markets with single-family home appeal. |

Which is better?

Build-to-rent properties offer professional management, consistent maintenance, and community amenities that appeal to tenants seeking convenience and reliability. Single-family rentals provide more privacy, space, and flexibility, attracting renters who prefer a traditional home environment. The optimal choice depends on investor goals, market demand, and tenant preferences in specific real estate markets.

Connection

Build-to-rent developments focus on constructing residential properties specifically designed for long-term leasing, aligning closely with the single-family rental market that emphasizes detached homes rented to tenants. This synergy allows investors to meet growing demand for single-family rentals by creating purpose-built communities with amenities tailored to renters' preferences. Emphasizing scalability and professional management, build-to-rent projects enhance the appeal and value of single-family rental assets in the competitive real estate sector.

Key Terms

Ownership Structure

Single-family rental properties are typically owned by individual investors or small-scale landlords, allowing for direct property management and tenant relations, whereas build-to-rent developments are often owned by institutional investors or real estate firms, focusing on scalable portfolios and professional property management. Ownership structure significantly impacts operational efficiencies, financing options, and long-term investment strategies, with build-to-rent offering centralized control and economies of scale compared to the fragmented ownership of single-family rentals. Explore the nuances of ownership models and their implications on rental markets for deeper insights.

Property Management

Single-family rental (SFR) properties are typically managed individually, requiring tailored tenant screening, maintenance coordination, and rent collection for each home, which can increase operational complexity as the portfolio grows. Build-to-rent (BTR) communities are designed with centralized property management, offering streamlined processes, consistent maintenance services, and enhanced resident engagement through dedicated onsite teams and technology platforms. Discover detailed insights on property management efficiencies and best practices in single-family rental versus build-to-rent models.

Investment Strategy

Single-family rental properties offer investors steady cash flow and long-term appreciation by leasing individual homes, while build-to-rent developments focus on purpose-built communities designed for scalable rental income and operational efficiencies. Investment strategies for single-family rentals prioritize asset diversification and neighborhood selection, whereas build-to-rent emphasizes economies of scale and professional property management. Explore deeper insights into optimizing your real estate portfolio with both rental models.

Source and External Links

Single-family rental - The Rent. Blog - Single-family rentals are standalone residential properties designed to house a single family, commonly owned by investors to generate rental income and capital appreciation, forming a growing and significant asset class in the real estate market.

2025 Single-Family Rental Index - Multi-Housing News - Single-family rent prices continue to grow nationwide, with notable increases in major cities like New York and Chicago, reflecting ongoing demand and market dynamics through mid-2025.

Top Five Things You Need To Know About Single-Family Rentals ... - Single-family rentals are subject to fair housing laws regardless of being standalone homes, requiring landlords and managers to comply with occupancy and familial status regulations for long-term rentals.

dowidth.com

dowidth.com