Co-living developments offer affordable, community-focused housing options designed for long-term residents seeking shared amenities and social interaction, contrasting with short-term rentals that cater to transient guests prioritizing flexibility and privacy. Real estate investors increasingly value co-living spaces due to higher tenant retention rates and stable occupancy compared to the fluctuating demand of short-term rental markets. Explore the evolving dynamics between co-living and short-term rentals to maximize property investment strategies.

Why it is important

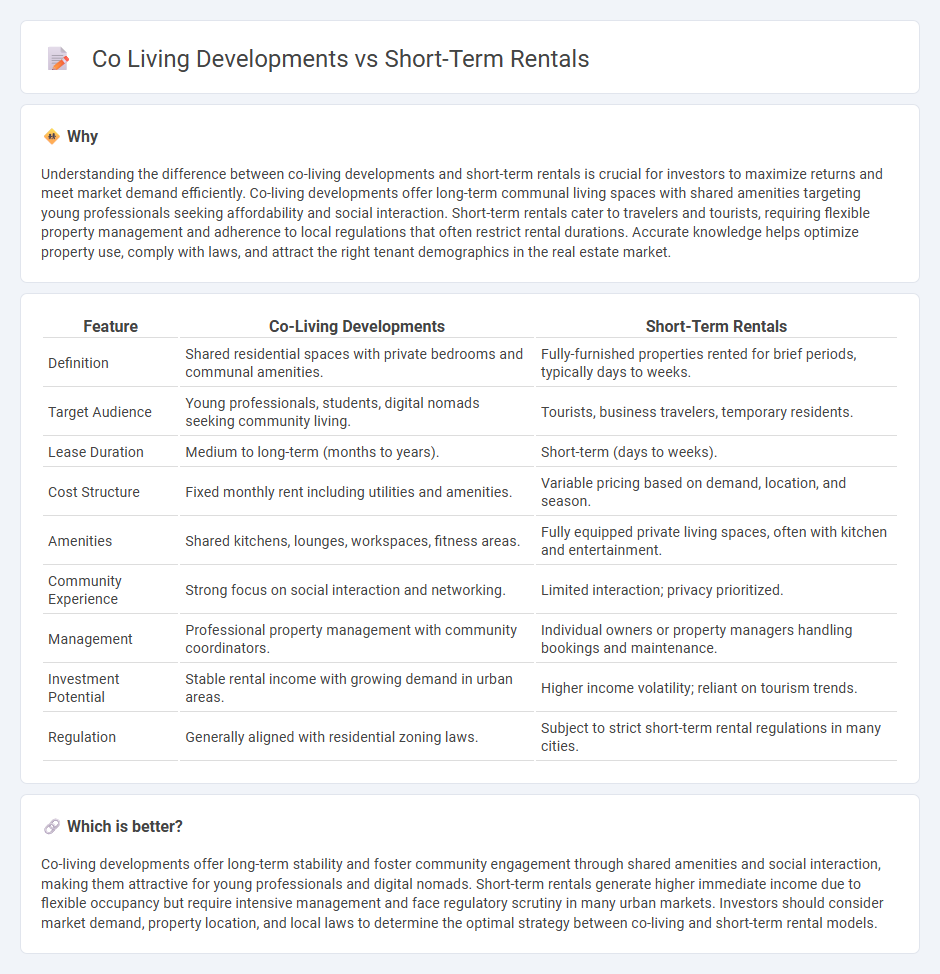

Understanding the difference between co-living developments and short-term rentals is crucial for investors to maximize returns and meet market demand efficiently. Co-living developments offer long-term communal living spaces with shared amenities targeting young professionals seeking affordability and social interaction. Short-term rentals cater to travelers and tourists, requiring flexible property management and adherence to local regulations that often restrict rental durations. Accurate knowledge helps optimize property use, comply with laws, and attract the right tenant demographics in the real estate market.

Comparison Table

| Feature | Co-Living Developments | Short-Term Rentals |

|---|---|---|

| Definition | Shared residential spaces with private bedrooms and communal amenities. | Fully-furnished properties rented for brief periods, typically days to weeks. |

| Target Audience | Young professionals, students, digital nomads seeking community living. | Tourists, business travelers, temporary residents. |

| Lease Duration | Medium to long-term (months to years). | Short-term (days to weeks). |

| Cost Structure | Fixed monthly rent including utilities and amenities. | Variable pricing based on demand, location, and season. |

| Amenities | Shared kitchens, lounges, workspaces, fitness areas. | Fully equipped private living spaces, often with kitchen and entertainment. |

| Community Experience | Strong focus on social interaction and networking. | Limited interaction; privacy prioritized. |

| Management | Professional property management with community coordinators. | Individual owners or property managers handling bookings and maintenance. |

| Investment Potential | Stable rental income with growing demand in urban areas. | Higher income volatility; reliant on tourism trends. |

| Regulation | Generally aligned with residential zoning laws. | Subject to strict short-term rental regulations in many cities. |

Which is better?

Co-living developments offer long-term stability and foster community engagement through shared amenities and social interaction, making them attractive for young professionals and digital nomads. Short-term rentals generate higher immediate income due to flexible occupancy but require intensive management and face regulatory scrutiny in many urban markets. Investors should consider market demand, property location, and local laws to determine the optimal strategy between co-living and short-term rental models.

Connection

Co-living developments and short-term rentals are interconnected through their shared focus on flexible, community-oriented housing solutions that cater to urban professionals and digital nomads. Both models optimize property utilization by offering furnished, affordable living spaces with amenities that encourage social interaction and convenience. The rise of co-living spaces enhances the short-term rental market by providing scalable, turnkey accommodations that meet the growing demand for adaptable urban living options.

Key Terms

Lease Structure

Short-term rentals offer flexible lease terms ranging from a few days to several months, catering primarily to travelers and transient occupants. Co-living developments typically feature longer lease agreements, often spanning six to twelve months, with shared communal spaces designed to foster a sense of community among residents. Explore how lease structures impact tenant experience and investment strategies in both housing models.

Occupancy Rate

Short-term rentals typically achieve occupancy rates between 60% and 80%, influenced by location, seasonality, and pricing strategies. Co-living developments often maintain higher occupancy rates, averaging around 85% to 95%, due to long-term lease commitments and community-oriented living arrangements. Explore detailed market analyses to understand how occupancy rates impact revenue in both housing models.

Tenant Demographics

Short-term rentals primarily attract tourists and business travelers aged 25-45 seeking flexible, furnished accommodations for brief stays, often favoring urban centers and popular vacation spots. Co-living developments target young professionals and digital nomads aged 22-35 who prioritize community living, affordability, and long-term leases within vibrant neighborhoods. Explore detailed insights on tenant demographics for short-term rentals and co-living to optimize your real estate strategy.

Source and External Links

What is Considered a Short-Term Rental? - GovOS - Provides an overview of short-term rentals, including types like entire homes, accessory dwellings, and rooms.

Short Term Rentals in NYC | Sublet My Apartment in NYC - Offers a marketplace for posting and finding furnished short-term rentals, sublets, and leasebreaks in New York City.

Short-Term & Temporary Housing - Extended Stay America - Provides temporary housing solutions for short-term needs, including business travel and relocation.

dowidth.com

dowidth.com