Single family rentals offer privacy and space, attracting long-term tenants seeking a home-like environment, while multifamily rentals provide higher income potential through multiple units and diversified tenant risk. Investors often weigh factors like maintenance costs, vacancy rates, and market demand when choosing between these property types. Explore deeper insights to determine which rental property aligns best with your investment strategy.

Why it is important

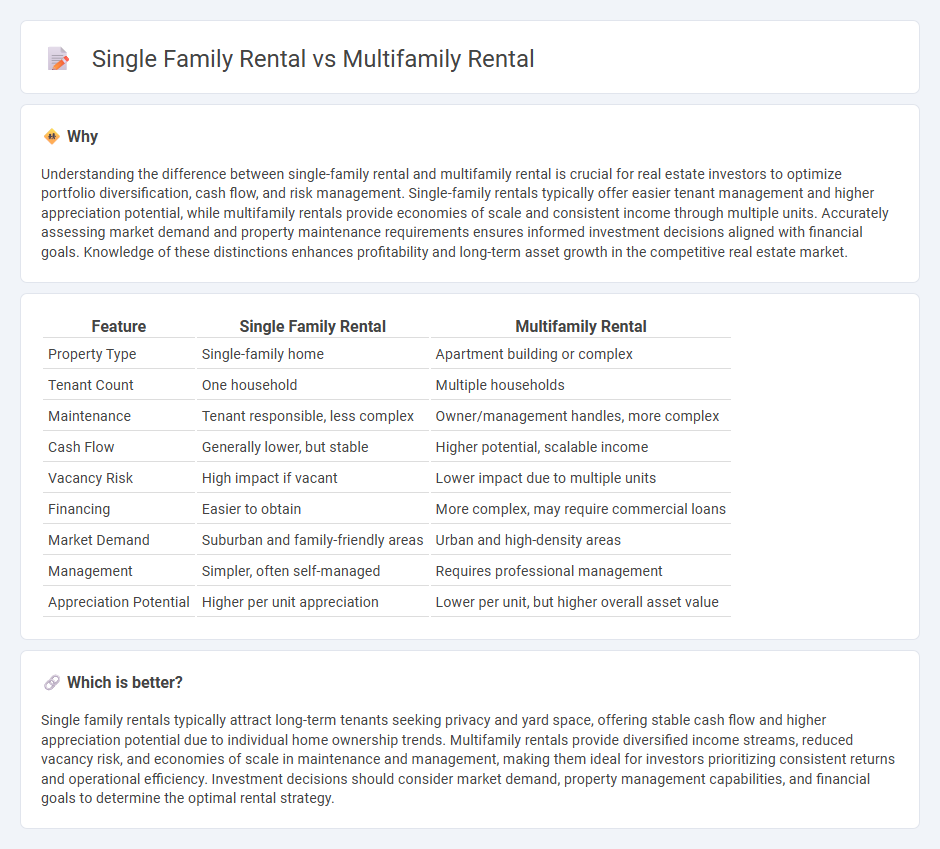

Understanding the difference between single-family rental and multifamily rental is crucial for real estate investors to optimize portfolio diversification, cash flow, and risk management. Single-family rentals typically offer easier tenant management and higher appreciation potential, while multifamily rentals provide economies of scale and consistent income through multiple units. Accurately assessing market demand and property maintenance requirements ensures informed investment decisions aligned with financial goals. Knowledge of these distinctions enhances profitability and long-term asset growth in the competitive real estate market.

Comparison Table

| Feature | Single Family Rental | Multifamily Rental |

|---|---|---|

| Property Type | Single-family home | Apartment building or complex |

| Tenant Count | One household | Multiple households |

| Maintenance | Tenant responsible, less complex | Owner/management handles, more complex |

| Cash Flow | Generally lower, but stable | Higher potential, scalable income |

| Vacancy Risk | High impact if vacant | Lower impact due to multiple units |

| Financing | Easier to obtain | More complex, may require commercial loans |

| Market Demand | Suburban and family-friendly areas | Urban and high-density areas |

| Management | Simpler, often self-managed | Requires professional management |

| Appreciation Potential | Higher per unit appreciation | Lower per unit, but higher overall asset value |

Which is better?

Single family rentals typically attract long-term tenants seeking privacy and yard space, offering stable cash flow and higher appreciation potential due to individual home ownership trends. Multifamily rentals provide diversified income streams, reduced vacancy risk, and economies of scale in maintenance and management, making them ideal for investors prioritizing consistent returns and operational efficiency. Investment decisions should consider market demand, property management capabilities, and financial goals to determine the optimal rental strategy.

Connection

Single family rentals and multifamily rentals are interconnected segments of the real estate market, both catering to residential tenants but varying in scale and investment strategies. Single family rentals typically appeal to investors seeking lower-density properties with potential for appreciation and tenant stability, while multifamily rentals offer higher cash flow through multiple units and economies of scale. Market trends, rental demand, and financing conditions impact both sectors, influencing portfolio diversification and capital allocation decisions.

Key Terms

Unit Density

Multifamily rentals offer higher unit density by accommodating multiple households within a single building, which maximizes land use efficiency and can lead to increased rental income per square foot. Single-family rentals provide standalone homes with lower unit density, offering more privacy but requiring more land area per unit, often resulting in lower overall rental yield compared to multifamily properties. Explore how unit density impacts investment returns and maintenance costs for both rental types to make informed decisions.

Property Management

Multifamily rentals typically offer streamlined property management through centralized maintenance, shared amenities, and a single leasing office, which can reduce operating costs compared to single-family rentals that require individual attention for each property. Single-family rentals often demand personalized tenant relations and more dispersed maintenance efforts, increasing the complexity and time commitment for property managers. Explore detailed property management strategies to optimize efficiency and maximize returns in both multifamily and single-family rental markets.

Tenant Demographics

Multifamily rentals predominantly attract younger professionals and lower to middle-income households seeking affordability and convenience, while single-family rentals typically draw families desiring more space and neighborhood stability. Tenant demographics in multifamily properties often include singles or couples without children, whereas single-family rentals cater to households with children and higher income levels. Explore the nuances of tenant profiles to optimize your rental investment strategy.

Source and External Links

Multifamily Economic and Market Commentary - This report discusses trends in multifamily rental units, including completions and rent growth across different classes of properties.

Tampa Multifamily Property Management: The Listing Tampa - Offers comprehensive multifamily property management services in the Tampa area, enhancing investment returns through efficient management.

Office of Multifamily Housing - Provides mortgage insurance and administers programs for the construction, rehabilitation, and purchase of multifamily rental housing properties.

dowidth.com

dowidth.com