Dynamic pricing in real estate adjusts property values frequently based on real-time market demand, interest rates, and economic trends, allowing sellers to maximize revenue by responding to buyer behavior. Sealed-bid pricing involves confidential offers where buyers submit their highest bid without knowledge of competitors' prices, often used in competitive markets to ensure a fair and strategic sale. Explore how these pricing models impact property sales and investment strategies in today's evolving real estate landscape.

Why it is important

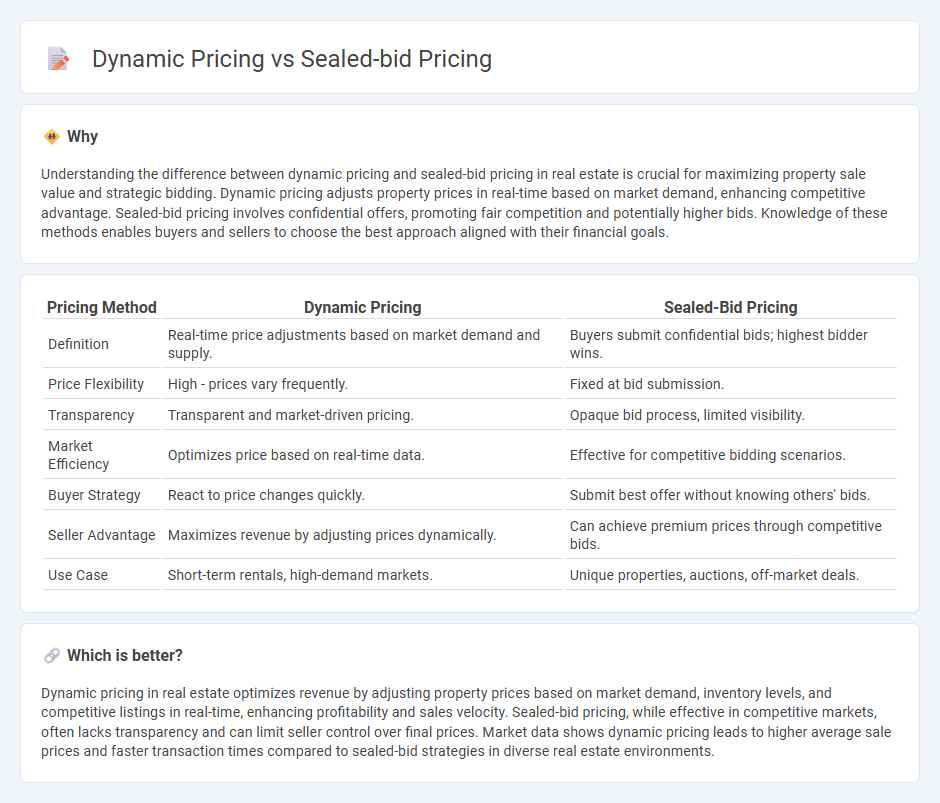

Understanding the difference between dynamic pricing and sealed-bid pricing in real estate is crucial for maximizing property sale value and strategic bidding. Dynamic pricing adjusts property prices in real-time based on market demand, enhancing competitive advantage. Sealed-bid pricing involves confidential offers, promoting fair competition and potentially higher bids. Knowledge of these methods enables buyers and sellers to choose the best approach aligned with their financial goals.

Comparison Table

| Pricing Method | Dynamic Pricing | Sealed-Bid Pricing |

|---|---|---|

| Definition | Real-time price adjustments based on market demand and supply. | Buyers submit confidential bids; highest bidder wins. |

| Price Flexibility | High - prices vary frequently. | Fixed at bid submission. |

| Transparency | Transparent and market-driven pricing. | Opaque bid process, limited visibility. |

| Market Efficiency | Optimizes price based on real-time data. | Effective for competitive bidding scenarios. |

| Buyer Strategy | React to price changes quickly. | Submit best offer without knowing others' bids. |

| Seller Advantage | Maximizes revenue by adjusting prices dynamically. | Can achieve premium prices through competitive bids. |

| Use Case | Short-term rentals, high-demand markets. | Unique properties, auctions, off-market deals. |

Which is better?

Dynamic pricing in real estate optimizes revenue by adjusting property prices based on market demand, inventory levels, and competitive listings in real-time, enhancing profitability and sales velocity. Sealed-bid pricing, while effective in competitive markets, often lacks transparency and can limit seller control over final prices. Market data shows dynamic pricing leads to higher average sale prices and faster transaction times compared to sealed-bid strategies in diverse real estate environments.

Connection

Dynamic pricing and sealed-bid pricing both optimize real estate transaction values by adjusting prices based on market demand and competitive offers. Dynamic pricing leverages real-time data analytics to update property prices, while sealed-bid pricing involves confidential bids that reveal true buyer valuations. Integrating these strategies enhances pricing accuracy and maximizes seller revenue in fluctuating real estate markets.

Key Terms

Bid Submission

Sealed-bid pricing requires bidders to submit confidential bids without knowing competitors' offers, ensuring fairness and preventing collusion during the bid submission process. Dynamic pricing involves real-time adjustments guided by supply, demand, and competitor strategies, often revealing pricing trends during submission rounds. Explore the intricacies of bid submission strategies to optimize your competitive edge.

Price Adjustment

Sealed-bid pricing involves fixed offers submitted without knowledge of competitors' bids, limiting real-time price adjustments and often leading to final prices based on initial valuations. Dynamic pricing allows continuous price adjustments utilizing algorithms driven by demand, competitor actions, and market trends to maximize revenue. Discover more about how these pricing strategies impact market competitiveness and customer behavior.

Market Transparency

Sealed-bid pricing limits market transparency by concealing competitors' bids until submission, which can reduce price discovery and market efficiency. Dynamic pricing enhances transparency by continuously adjusting prices based on real-time demand, competitor actions, and market conditions, promoting more informed purchasing decisions. Explore further to understand how these pricing strategies impact competitive behavior and consumer trust.

Source and External Links

15.3 Pricing Strategies - Principles of Marketing - Sealed-bid pricing involves submitting bids in sealed envelopes or electronically, and the most desirable bid is chosen after review.

Sealed Bidding: Strategic Applications in Procurement - Sealed bidding allows buyers to receive the best price without negotiation by ensuring fairness and leveling the playing field.

What is a sealed bid? - A sealed bid is a procurement method where suppliers submit confidential bids until a predetermined deadline, promoting fairness and preventing collusion.

dowidth.com

dowidth.com