Smart contract leasing leverages blockchain technology to automate and enforce rental agreements, ensuring transparency, security, and reduced fraud risks. Rent-to-own agreements provide tenants the option to purchase the property after a rental period, combining leasing with a path to homeownership. Explore the advantages and challenges of both approaches to find the best fit for your real estate investment strategy.

Why it is important

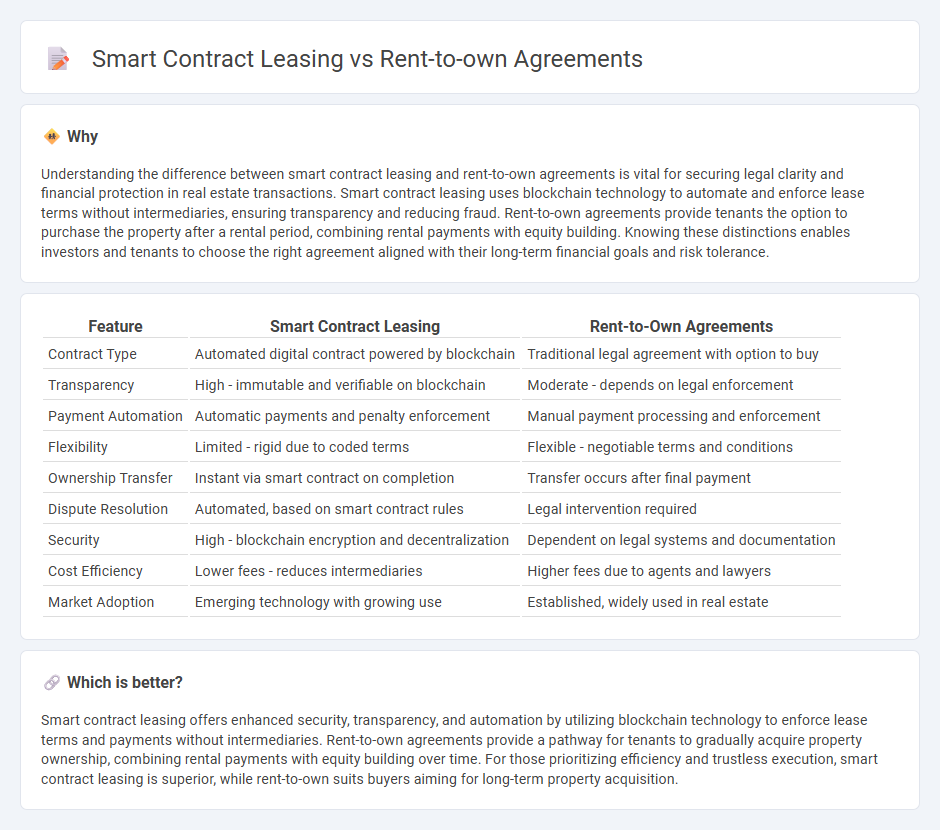

Understanding the difference between smart contract leasing and rent-to-own agreements is vital for securing legal clarity and financial protection in real estate transactions. Smart contract leasing uses blockchain technology to automate and enforce lease terms without intermediaries, ensuring transparency and reducing fraud. Rent-to-own agreements provide tenants the option to purchase the property after a rental period, combining rental payments with equity building. Knowing these distinctions enables investors and tenants to choose the right agreement aligned with their long-term financial goals and risk tolerance.

Comparison Table

| Feature | Smart Contract Leasing | Rent-to-Own Agreements |

|---|---|---|

| Contract Type | Automated digital contract powered by blockchain | Traditional legal agreement with option to buy |

| Transparency | High - immutable and verifiable on blockchain | Moderate - depends on legal enforcement |

| Payment Automation | Automatic payments and penalty enforcement | Manual payment processing and enforcement |

| Flexibility | Limited - rigid due to coded terms | Flexible - negotiable terms and conditions |

| Ownership Transfer | Instant via smart contract on completion | Transfer occurs after final payment |

| Dispute Resolution | Automated, based on smart contract rules | Legal intervention required |

| Security | High - blockchain encryption and decentralization | Dependent on legal systems and documentation |

| Cost Efficiency | Lower fees - reduces intermediaries | Higher fees due to agents and lawyers |

| Market Adoption | Emerging technology with growing use | Established, widely used in real estate |

Which is better?

Smart contract leasing offers enhanced security, transparency, and automation by utilizing blockchain technology to enforce lease terms and payments without intermediaries. Rent-to-own agreements provide a pathway for tenants to gradually acquire property ownership, combining rental payments with equity building over time. For those prioritizing efficiency and trustless execution, smart contract leasing is superior, while rent-to-own suits buyers aiming for long-term property acquisition.

Connection

Smart contract leasing automates and secures rent-to-own agreements by encoding terms such as payment schedules, ownership transfer conditions, and maintenance responsibilities on blockchain networks, ensuring transparency and reducing disputes. Rent-to-own agreements benefit from smart contracts as they facilitate real-time tracking of payments and trigger automatic property title transfers once contractual obligations are fulfilled. This integration enhances trust between parties, streamlines property leasing processes, and leverages decentralized technology for efficient real estate transactions.

Key Terms

Option to Purchase

Rent-to-own agreements grant tenants the Option to Purchase by applying rental payments toward the property's purchase price, offering a gradual path to ownership without immediate financing. Smart contract leasing automates the Option to Purchase through blockchain technology, ensuring transparent, secure, and self-executing terms that reduce counterparty risk. Explore the detailed benefits and mechanics of both approaches to optimize your property acquisition strategy.

Decentralized Ledger

Rent-to-own agreements provide traditional, legally binding contracts where ownership transfers after payment completion, often involving intermediaries and centralized records. Smart contract leasing on Decentralized Ledger Technology (DLT) automates lease terms execution, enhances transparency, and eliminates middlemen by utilizing blockchain's tamper-proof, distributed ledger. Explore how Decentralized Ledger transforms asset leasing by combining security, efficiency, and trustless interactions.

Automated Execution

Rent-to-own agreements require manual oversight and traditional legal processes for execution and enforcement, often leading to delays and increased costs. Smart contract leasing automates the entire transaction, using blockchain technology to ensure immediate and transparent execution of terms without intermediaries. Explore how automated execution in smart contracts revolutionizes property leasing efficiency and security.

Source and External Links

The Basics of Rent-To-Own Agreements - Rent-to-own agreements combine a rental lease with an option to purchase, often including higher rent payments with a portion credited toward the home's down payment, with tenants typically responsible for repairs during the lease.

What is Renting to Own? - Rent-to-own involves paying an option fee and/or rent credits towards purchase, with the tenant needing to fulfill conditions such as mortgage approval before finalizing the home purchase, and possibly using a Land Contract if financing is unavailable.

How Does Rent-to-Own Work? - Rent-to-own agreements have lease and purchase option parts, including lease-option contracts (optional purchase) or lease-purchase contracts (mandatory), and require careful legal review due to varied terms and risks.

dowidth.com

dowidth.com