Build-to-rent developments focus on providing high-quality rental homes owned and managed by institutional investors, offering tenants long-term leases and professional maintenance. Rent-to-own schemes allow tenants to apply rental payments toward eventual homeownership, bridging the gap between renting and buying. Explore the differences between these innovative real estate options to find the best fit for your housing goals.

Why it is important

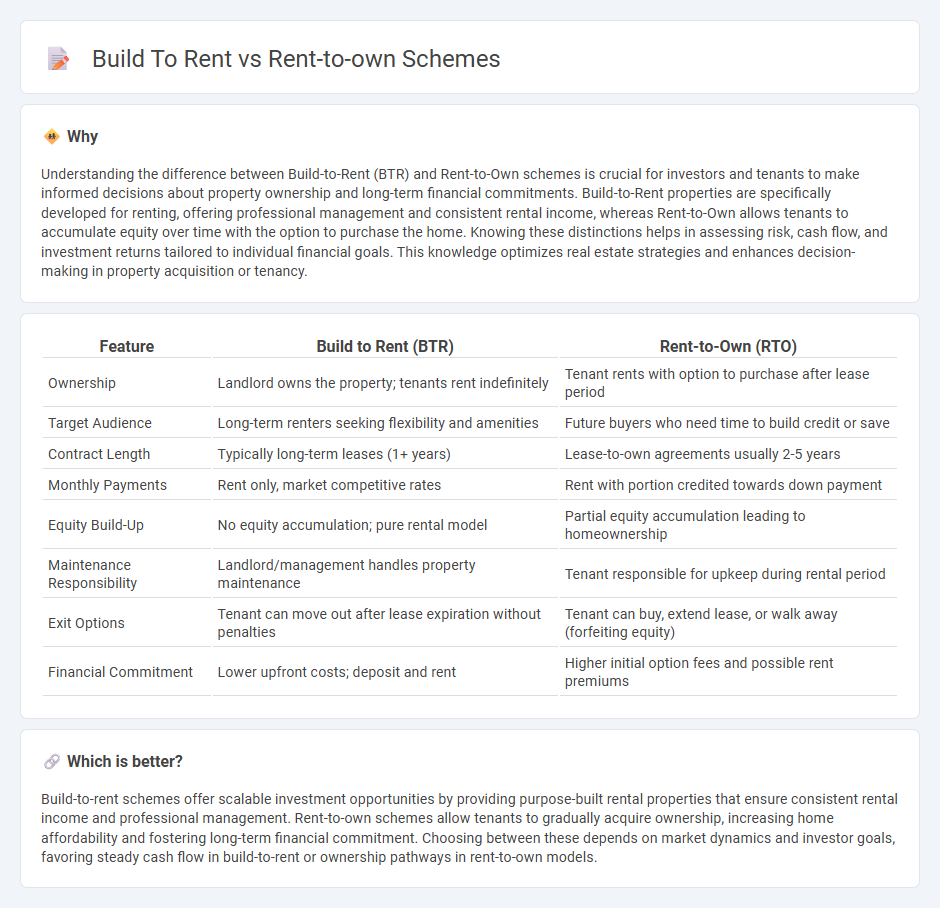

Understanding the difference between Build-to-Rent (BTR) and Rent-to-Own schemes is crucial for investors and tenants to make informed decisions about property ownership and long-term financial commitments. Build-to-Rent properties are specifically developed for renting, offering professional management and consistent rental income, whereas Rent-to-Own allows tenants to accumulate equity over time with the option to purchase the home. Knowing these distinctions helps in assessing risk, cash flow, and investment returns tailored to individual financial goals. This knowledge optimizes real estate strategies and enhances decision-making in property acquisition or tenancy.

Comparison Table

| Feature | Build to Rent (BTR) | Rent-to-Own (RTO) |

|---|---|---|

| Ownership | Landlord owns the property; tenants rent indefinitely | Tenant rents with option to purchase after lease period |

| Target Audience | Long-term renters seeking flexibility and amenities | Future buyers who need time to build credit or save |

| Contract Length | Typically long-term leases (1+ years) | Lease-to-own agreements usually 2-5 years |

| Monthly Payments | Rent only, market competitive rates | Rent with portion credited towards down payment |

| Equity Build-Up | No equity accumulation; pure rental model | Partial equity accumulation leading to homeownership |

| Maintenance Responsibility | Landlord/management handles property maintenance | Tenant responsible for upkeep during rental period |

| Exit Options | Tenant can move out after lease expiration without penalties | Tenant can buy, extend lease, or walk away (forfeiting equity) |

| Financial Commitment | Lower upfront costs; deposit and rent | Higher initial option fees and possible rent premiums |

Which is better?

Build-to-rent schemes offer scalable investment opportunities by providing purpose-built rental properties that ensure consistent rental income and professional management. Rent-to-own schemes allow tenants to gradually acquire ownership, increasing home affordability and fostering long-term financial commitment. Choosing between these depends on market dynamics and investor goals, favoring steady cash flow in build-to-rent or ownership pathways in rent-to-own models.

Connection

Build-to-rent developments generate rental properties designed for long-term tenancy, creating steady rental income streams for investors. Rent-to-own schemes provide tenants with the option to purchase the rented property after a set period, bridging the gap between renting and homeownership. Both models address housing affordability and accessibility by offering flexible pathways to property acquisition within the real estate market.

Key Terms

Lease Agreement

Rent-to-own schemes offer tenants the opportunity to apply a portion of their rent payments toward future property ownership, with lease agreements typically detailing specific purchase terms, payment structures, and buyout timelines. Build to rent properties, by contrast, focus solely on long-term rental arrangements under lease agreements emphasizing tenant rights, property management, and maintenance responsibilities without ownership transition. Explore detailed lease agreement comparisons to understand the legal and financial implications of each model.

Option to Purchase

Rent-to-own schemes provide tenants with the option to purchase the property after a lease term, allowing part of their rental payments to contribute towards the down payment. Build-to-rent developments primarily focus on long-term rental income for investors, with limited or no option to purchase for tenants, emphasizing rental stability over ownership transition. Explore the key differences and implications of the option to purchase in these housing models to make informed decisions.

Institutional Ownership

Institutional ownership in rent-to-own schemes typically involves long-term asset management with gradual tenant equity accumulation, whereas build-to-rent models emphasize large-scale investment in rental properties held by institutions for consistent income streams. Rent-to-own offers tenants a pathway to homeownership through monthly payments contributing to eventual purchase, contrasting with build-to-rent's focus on providing fully managed rental units without ownership opportunities. Explore the evolving dynamics of institutional ownership in residential real estate to understand which model best suits your investment or housing goals.

Source and External Links

Rent-to-Own Homes: How It Works - Experian - Rent-to-own arrangements let you rent a home for a set period (usually 1-3 years) while paying an upfront option fee and higher monthly rent (with part possibly going toward a down payment), after which you can either choose or be required to buy the home depending on your contract type

How Does Rent-To-Own Work? - Zillow - In a rent-to-own agreement, a portion of your monthly rent builds toward a future down payment on the house, with the purchase price and terms specified upfront, and at the end of the lease you have the option--or requirement--to buy the property

How Does Rent-to-Own Work? | PNC Insights - Rent-to-own contracts allow you to reserve a home at a fixed price while renting, with extra payments going toward a down payment, but if you don't buy, those funds are typically forfeited

dowidth.com

dowidth.com