House hacking involves purchasing a property and living in one unit while renting out the others to cover mortgage costs, creating passive income and reducing housing expenses. Live-in flipping entails buying a home at a lower price, renovating it to increase value, and selling it for a profit after living there for a short period. Explore the advantages and strategies of house hacking and live-in flipping to determine the best real estate investment approach for your financial goals.

Why it is important

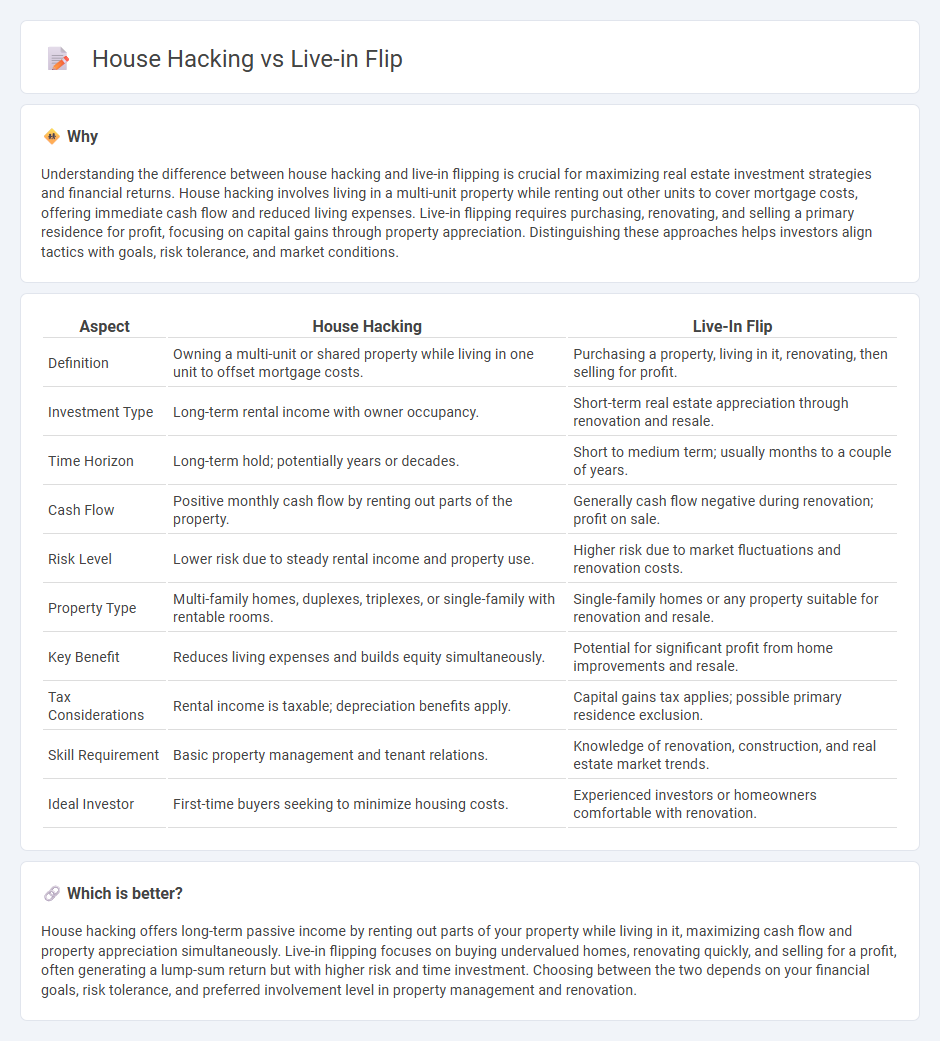

Understanding the difference between house hacking and live-in flipping is crucial for maximizing real estate investment strategies and financial returns. House hacking involves living in a multi-unit property while renting out other units to cover mortgage costs, offering immediate cash flow and reduced living expenses. Live-in flipping requires purchasing, renovating, and selling a primary residence for profit, focusing on capital gains through property appreciation. Distinguishing these approaches helps investors align tactics with goals, risk tolerance, and market conditions.

Comparison Table

| Aspect | House Hacking | Live-In Flip |

|---|---|---|

| Definition | Owning a multi-unit or shared property while living in one unit to offset mortgage costs. | Purchasing a property, living in it, renovating, then selling for profit. |

| Investment Type | Long-term rental income with owner occupancy. | Short-term real estate appreciation through renovation and resale. |

| Time Horizon | Long-term hold; potentially years or decades. | Short to medium term; usually months to a couple of years. |

| Cash Flow | Positive monthly cash flow by renting out parts of the property. | Generally cash flow negative during renovation; profit on sale. |

| Risk Level | Lower risk due to steady rental income and property use. | Higher risk due to market fluctuations and renovation costs. |

| Property Type | Multi-family homes, duplexes, triplexes, or single-family with rentable rooms. | Single-family homes or any property suitable for renovation and resale. |

| Key Benefit | Reduces living expenses and builds equity simultaneously. | Potential for significant profit from home improvements and resale. |

| Tax Considerations | Rental income is taxable; depreciation benefits apply. | Capital gains tax applies; possible primary residence exclusion. |

| Skill Requirement | Basic property management and tenant relations. | Knowledge of renovation, construction, and real estate market trends. |

| Ideal Investor | First-time buyers seeking to minimize housing costs. | Experienced investors or homeowners comfortable with renovation. |

Which is better?

House hacking offers long-term passive income by renting out parts of your property while living in it, maximizing cash flow and property appreciation simultaneously. Live-in flipping focuses on buying undervalued homes, renovating quickly, and selling for a profit, often generating a lump-sum return but with higher risk and time investment. Choosing between the two depends on your financial goals, risk tolerance, and preferred involvement level in property management and renovation.

Connection

House hacking and live-in flips both maximize real estate investment returns by leveraging primary residence ownership. House hacking involves renting out portions of a property to offset mortgage costs, while live-in flips focus on renovating a home to increase its market value before selling. Together, these strategies optimize cash flow and equity growth within the residential real estate market.

Key Terms

Primary Residence

Live-in flipping involves purchasing a primary residence, renovating it to increase market value, and selling it for profit, often within a short timeframe. House hacking leverages a primary residence by renting out portions of the property, such as spare rooms or separate units, to offset mortgage costs while maintaining residence. Explore how these strategies maximize equity growth and cash flow in your primary home.

Rental Income

Live-in flips involve purchasing a property to renovate and resell at a higher price, with rental income typically coming from short-term tenants during the renovation phase. House hacking focuses on buying a multi-unit property or a home with extra rooms, where the owner lives in one unit and rents out the others to generate steady rental income. Discover the advantages and financial strategies behind each approach to maximize your rental revenue effectively.

Capital Gains

Live-in flips involve purchasing a property, renovating it, and selling it quickly to capitalize on market appreciation, often benefiting from lower capital gains taxes if held under the primary residence exclusion for at least two years. House hacking typically entails buying a multi-unit property, living in one unit while renting out others, generating ongoing rental income and potential tax deductions, but with different implications for capital gains based on the property's use and duration of ownership. Explore detailed strategies to maximize capital gains benefits and optimize your real estate investments.

Source and External Links

Should You Try a Live-in Flip? - This webpage explains the process of a live-in flip, including finding the right property, securing financing, planning renovations, living in the home during renovations, and selling at the right time.

Live-In House Flipping 101 - This article provides a deep dive into the live-in flip strategy, covering its definition, pros, cons, and examples, highlighting the benefits of this approach, especially regarding tax advantages.

How to Do a Live-in Home Flip and Avoid Capital Gains - This article discusses how to utilize the live-in flip strategy to avoid capital gains taxes by waiting at least two years before selling a renovated primary residence.

dowidth.com

dowidth.com