Blockchain title transfer uses decentralized ledger technology to securely and transparently record property ownership, reducing fraud and eliminating lengthy verification processes. Title insurance provides financial protection against defects or disputes in property titles, offering a safety net after transaction completion. Explore the advantages and risks of each method to decide which best suits your real estate needs.

Why it is important

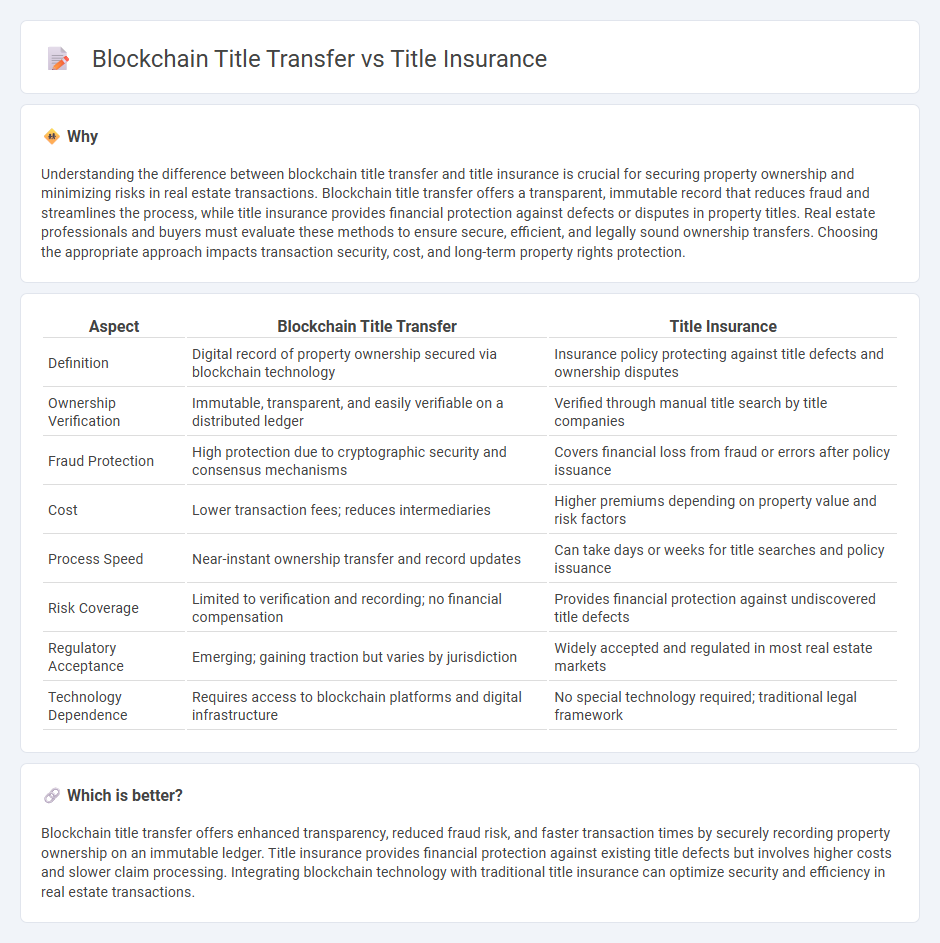

Understanding the difference between blockchain title transfer and title insurance is crucial for securing property ownership and minimizing risks in real estate transactions. Blockchain title transfer offers a transparent, immutable record that reduces fraud and streamlines the process, while title insurance provides financial protection against defects or disputes in property titles. Real estate professionals and buyers must evaluate these methods to ensure secure, efficient, and legally sound ownership transfers. Choosing the appropriate approach impacts transaction security, cost, and long-term property rights protection.

Comparison Table

| Aspect | Blockchain Title Transfer | Title Insurance |

|---|---|---|

| Definition | Digital record of property ownership secured via blockchain technology | Insurance policy protecting against title defects and ownership disputes |

| Ownership Verification | Immutable, transparent, and easily verifiable on a distributed ledger | Verified through manual title search by title companies |

| Fraud Protection | High protection due to cryptographic security and consensus mechanisms | Covers financial loss from fraud or errors after policy issuance |

| Cost | Lower transaction fees; reduces intermediaries | Higher premiums depending on property value and risk factors |

| Process Speed | Near-instant ownership transfer and record updates | Can take days or weeks for title searches and policy issuance |

| Risk Coverage | Limited to verification and recording; no financial compensation | Provides financial protection against undiscovered title defects |

| Regulatory Acceptance | Emerging; gaining traction but varies by jurisdiction | Widely accepted and regulated in most real estate markets |

| Technology Dependence | Requires access to blockchain platforms and digital infrastructure | No special technology required; traditional legal framework |

Which is better?

Blockchain title transfer offers enhanced transparency, reduced fraud risk, and faster transaction times by securely recording property ownership on an immutable ledger. Title insurance provides financial protection against existing title defects but involves higher costs and slower claim processing. Integrating blockchain technology with traditional title insurance can optimize security and efficiency in real estate transactions.

Connection

Blockchain title transfer enhances real estate transactions by providing a secure, transparent, and tamper-proof ledger for recording property ownership changes. Title insurance mitigates risks associated with defects or disputes in property titles, ensuring financial protection for buyers and lenders. Integrating blockchain technology with title insurance streamlines verification processes, reduces fraud, and accelerates the transfer of property titles.

Key Terms

Ownership Verification

Title insurance provides a financial guarantee protecting property owners and lenders against losses from title defects, fraud, or disputes, relying on extensive title searches and historical records to verify ownership. Blockchain title transfer technology enhances ownership verification by creating a decentralized, immutable ledger that records property transactions transparently and securely, significantly reducing the risk of fraud and errors. Explore how blockchain innovations can complement or disrupt traditional title insurance systems for improved property ownership verification.

Fraud Prevention

Title insurance provides a financial safety net against property ownership disputes, relying on thorough title searches and insurance policies to mitigate fraud risks. Blockchain title transfer enhances fraud prevention by using decentralized, tamper-proof ledgers that ensure transparent and immutable property records, drastically reducing the chances of title fraud. Explore the evolving landscape of property ownership security and how these technologies compare in fraud prevention.

Transparency

Title insurance historically ensures protection against defects in property titles by providing thorough title searches and compensating for losses from title disputes. Blockchain title transfer introduces transparency through immutable, decentralized ledgers that provide real-time access and verification of ownership history, reducing fraud risks and settlement times. Discover how integrating blockchain technology could revolutionize property transactions and enhance transparency in title management.

Source and External Links

Title-Insurance - California Department of Insurance - Title insurance is a one-time premium policy protecting property owners and lenders from losses due to defects in title like liens or encumbrances that were unknown when the policy was issued and guarantees loan priority, differing from homeowners insurance which covers risks like fire or theft with recurring premiums.

Title Insurance: Coverage, Cost and Whether You Need It - NerdWallet - Title insurance protects homeowners and lenders against losses from unresolved title defects such as hidden liens or ownership disputes, covering issues missed during the title search with separate policies available for lenders and owners.

What is Title Insurance? - Old Republic Title - Title insurance is a financial protection against title defects that may emerge after purchase, offering coverage for risks like fraud, missing heirs, unpaid taxes, and document errors with a one-time premium paid at closing.

dowidth.com

dowidth.com