Tokenized real estate offers fractional ownership through blockchain technology, enabling increased liquidity and accessibility compared to traditional real estate limited partnerships, which typically require higher capital and involve less flexible ownership stakes. Investors in tokenized real estate benefit from faster transactions and reduced administrative burdens, while limited partnerships often provide established management expertise and potential tax advantages. Explore the evolving landscape of real estate investment methods to discover which option aligns with your financial goals.

Why it is important

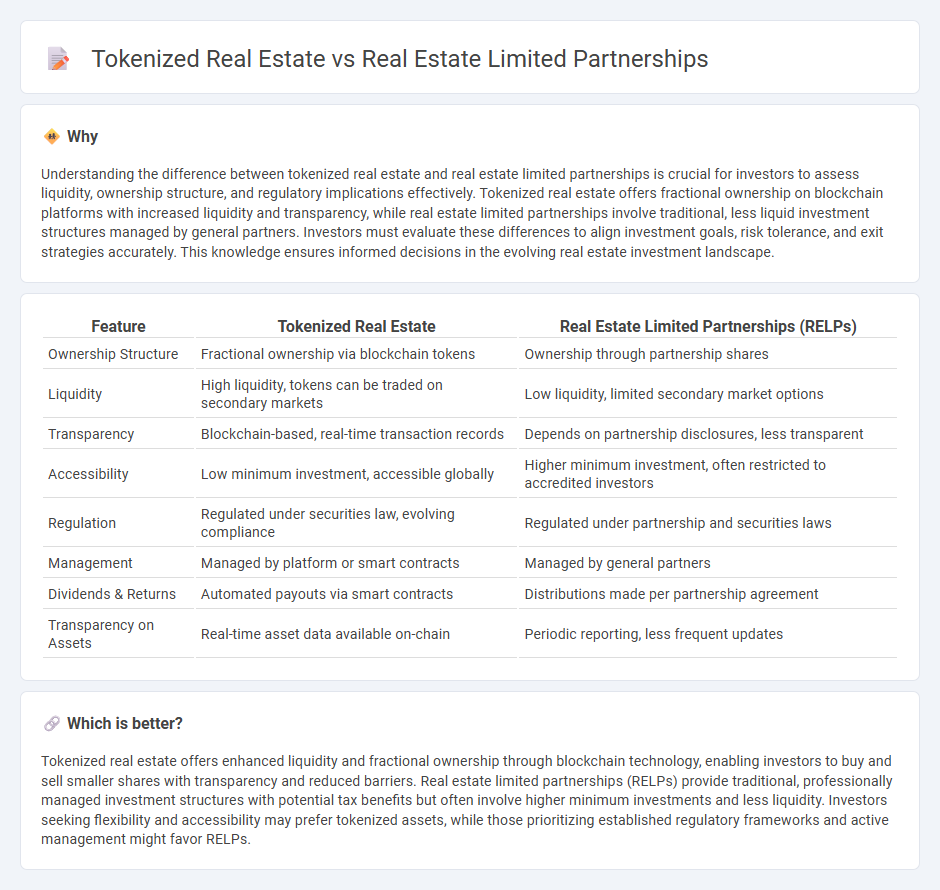

Understanding the difference between tokenized real estate and real estate limited partnerships is crucial for investors to assess liquidity, ownership structure, and regulatory implications effectively. Tokenized real estate offers fractional ownership on blockchain platforms with increased liquidity and transparency, while real estate limited partnerships involve traditional, less liquid investment structures managed by general partners. Investors must evaluate these differences to align investment goals, risk tolerance, and exit strategies accurately. This knowledge ensures informed decisions in the evolving real estate investment landscape.

Comparison Table

| Feature | Tokenized Real Estate | Real Estate Limited Partnerships (RELPs) |

|---|---|---|

| Ownership Structure | Fractional ownership via blockchain tokens | Ownership through partnership shares |

| Liquidity | High liquidity, tokens can be traded on secondary markets | Low liquidity, limited secondary market options |

| Transparency | Blockchain-based, real-time transaction records | Depends on partnership disclosures, less transparent |

| Accessibility | Low minimum investment, accessible globally | Higher minimum investment, often restricted to accredited investors |

| Regulation | Regulated under securities law, evolving compliance | Regulated under partnership and securities laws |

| Management | Managed by platform or smart contracts | Managed by general partners |

| Dividends & Returns | Automated payouts via smart contracts | Distributions made per partnership agreement |

| Transparency on Assets | Real-time asset data available on-chain | Periodic reporting, less frequent updates |

Which is better?

Tokenized real estate offers enhanced liquidity and fractional ownership through blockchain technology, enabling investors to buy and sell smaller shares with transparency and reduced barriers. Real estate limited partnerships (RELPs) provide traditional, professionally managed investment structures with potential tax benefits but often involve higher minimum investments and less liquidity. Investors seeking flexibility and accessibility may prefer tokenized assets, while those prioritizing established regulatory frameworks and active management might favor RELPs.

Connection

Tokenized real estate and real estate limited partnerships (RELPs) both offer innovative investment structures by enabling fractional ownership of property assets, increasing liquidity and accessibility for investors. Tokenized real estate digitizes shares in property through blockchain technology, allowing seamless trading of fractional interests similar to shares in RELPs, which pool investor capital for collective real estate ventures. Both methods provide a way to diversify portfolios and reduce barriers to real estate investment by lowering minimum investment thresholds and improving transparency through digital records or formal partnership agreements.

Key Terms

Ownership Structure

Real estate limited partnerships (RELPs) involve a traditional ownership structure with general partners managing the property and limited partners as passive investors, often requiring significant capital and formal agreements. Tokenized real estate leverages blockchain technology to fractionalize ownership into digital tokens, enabling broader investor participation, increased liquidity, and streamlined transactions. Explore how these ownership models redefine investment accessibility and control in the evolving real estate market.

Liquidity

Traditional real estate limited partnerships offer investors ownership stakes with relatively low liquidity due to lengthy holding periods and limited secondary markets. Tokenized real estate leverages blockchain technology to enable fractional ownership, significantly enhancing liquidity by allowing tokens to be traded on digital exchanges with greater speed and accessibility. Explore the benefits and challenges of each to determine which investment aligns best with your financial goals.

Regulatory Compliance

Real estate limited partnerships (RELPs) operate under established securities laws with stringent regulatory compliance, requiring extensive disclosure and investor protections as mandated by the SEC. Tokenized real estate leverages blockchain technology to enable fractional ownership through digital tokens, presenting novel regulatory challenges related to securities classification and anti-money laundering laws. Explore deeper insights into how evolving regulations impact these investment vehicles and their compliance frameworks.

Source and External Links

What Is a Real Estate Limited Partnership (RELP)? - A RELP allows passive investors (limited partners) to put up capital for real estate projects managed by a general partner, with profits and losses shared according to investment share.

How real estate partnerships work: The pros and cons - In a RELP, general partners handle management and assume unlimited liability, while limited partners provide capital, avoid management duties, and face only limited risk up to their investment amount.

LP vs. GP in Commercial Real Estate Investing - Limited partners are passive investors, often ranging from institutions to individuals, with liability capped at their investment, while general partners execute the business plan and manage all aspects of the real estate deal.

dowidth.com

dowidth.com