Proptech startups leverage technology to innovate property management, transactions, and valuation, dramatically reshaping the real estate landscape with AI-driven analytics and blockchain-based platforms. Real Estate Investment Trusts (REITs) offer investors a more traditional avenue to gain exposure to diversified real estate portfolios with liquidity and regulated structures, often delivering steady income through dividends. Explore how these contrasting approaches are transforming real estate investment and ownership models.

Why it is important

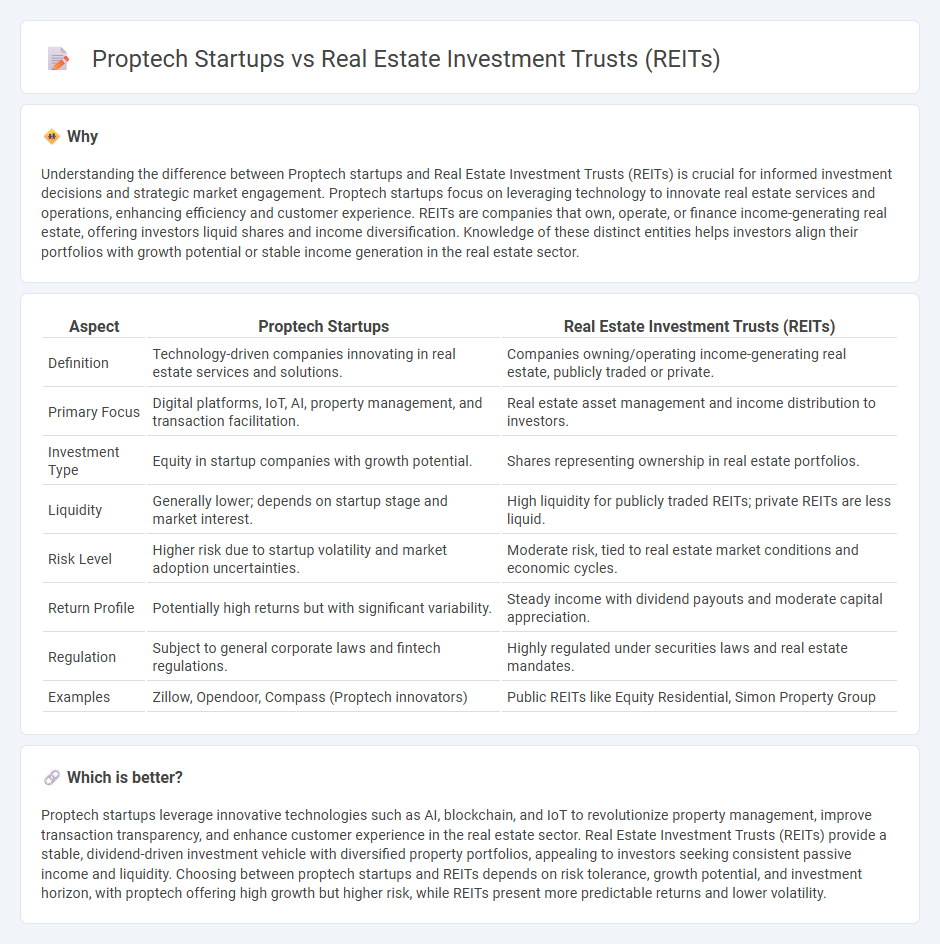

Understanding the difference between Proptech startups and Real Estate Investment Trusts (REITs) is crucial for informed investment decisions and strategic market engagement. Proptech startups focus on leveraging technology to innovate real estate services and operations, enhancing efficiency and customer experience. REITs are companies that own, operate, or finance income-generating real estate, offering investors liquid shares and income diversification. Knowledge of these distinct entities helps investors align their portfolios with growth potential or stable income generation in the real estate sector.

Comparison Table

| Aspect | Proptech Startups | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Definition | Technology-driven companies innovating in real estate services and solutions. | Companies owning/operating income-generating real estate, publicly traded or private. |

| Primary Focus | Digital platforms, IoT, AI, property management, and transaction facilitation. | Real estate asset management and income distribution to investors. |

| Investment Type | Equity in startup companies with growth potential. | Shares representing ownership in real estate portfolios. |

| Liquidity | Generally lower; depends on startup stage and market interest. | High liquidity for publicly traded REITs; private REITs are less liquid. |

| Risk Level | Higher risk due to startup volatility and market adoption uncertainties. | Moderate risk, tied to real estate market conditions and economic cycles. |

| Return Profile | Potentially high returns but with significant variability. | Steady income with dividend payouts and moderate capital appreciation. |

| Regulation | Subject to general corporate laws and fintech regulations. | Highly regulated under securities laws and real estate mandates. |

| Examples | Zillow, Opendoor, Compass (Proptech innovators) | Public REITs like Equity Residential, Simon Property Group |

Which is better?

Proptech startups leverage innovative technologies such as AI, blockchain, and IoT to revolutionize property management, improve transaction transparency, and enhance customer experience in the real estate sector. Real Estate Investment Trusts (REITs) provide a stable, dividend-driven investment vehicle with diversified property portfolios, appealing to investors seeking consistent passive income and liquidity. Choosing between proptech startups and REITs depends on risk tolerance, growth potential, and investment horizon, with proptech offering high growth but higher risk, while REITs present more predictable returns and lower volatility.

Connection

Proptech startups leverage technology to streamline property management, transactions, and market analysis, enabling Real Estate Investment Trusts (REITs) to enhance operational efficiency and transparency. By integrating advanced data analytics, artificial intelligence, and blockchain solutions, Proptech firms provide REITs with real-time insights and automated processes that improve asset management and investor reporting. This synergy accelerates digital transformation in the real estate sector, attracting more capital inflows to REITs through increased trust and performance metrics.

Key Terms

Asset Diversification

Real Estate Investment Trusts (REITs) offer investors broad asset diversification by pooling funds to invest in a wide array of property types, such as commercial, residential, and industrial real estate. Proptech startups, leveraging innovative technologies, provide more specialized investment opportunities, often targeting niche markets and emerging real estate trends. Explore how asset diversification varies between REITs and proptech startups to optimize your real estate investment portfolio.

Technology Integration

Real Estate Investment Trusts (REITs) are increasingly adopting advanced technologies such as AI-driven analytics and blockchain for asset management and transparent transactions, enhancing portfolio performance and investor confidence. Proptech startups focus on disrupting traditional real estate processes through innovations like virtual reality tours, IoT-enabled smart buildings, and automated property management systems, driving efficiency and customer engagement. Explore how these technology integrations are reshaping the real estate industry and investment strategies.

Capital Accessibility

Real Estate Investment Trusts (REITs) offer investors access to diversified property portfolios with high liquidity and regulated capital flows, making them a traditional choice for steady income and risk management. Proptech startups, leveraging technology-driven platforms, democratize real estate investment by enabling fractional ownership and lower entry barriers, thus expanding capital accessibility to a broader audience. Discover how these contrasting approaches are reshaping real estate capital access and investment strategies.

Source and External Links

Real estate investment trust - Wikipedia - A REIT is a company that owns and operates income-producing real estate, including offices, apartments, warehouses, and shopping centers, and is typically categorized into equity REITs and mortgage REITs with tax advantages and can be publicly traded or private.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale, income-producing real estate by owning or operating properties and may be publicly traded or non-traded, providing investors with the opportunity to share income without buying property themselves.

What's a REIT (Real Estate Investment Trust)? - Nareit - A REIT owns, operates, or finances income-producing real estate and offers investors steady income streams, diversification, and long-term capital appreciation, often trading on major stock exchanges.

dowidth.com

dowidth.com