Fractional ownership platforms enable investors to buy shares in specific properties, offering transparency and liquidity through digital management and blockchain technology. Real estate investment clubs focus on collective decision-making and pooled resources, often emphasizing local market expertise and hands-on involvement. Explore the advantages and differences between these investment models to find the best fit for your real estate goals.

Why it is important

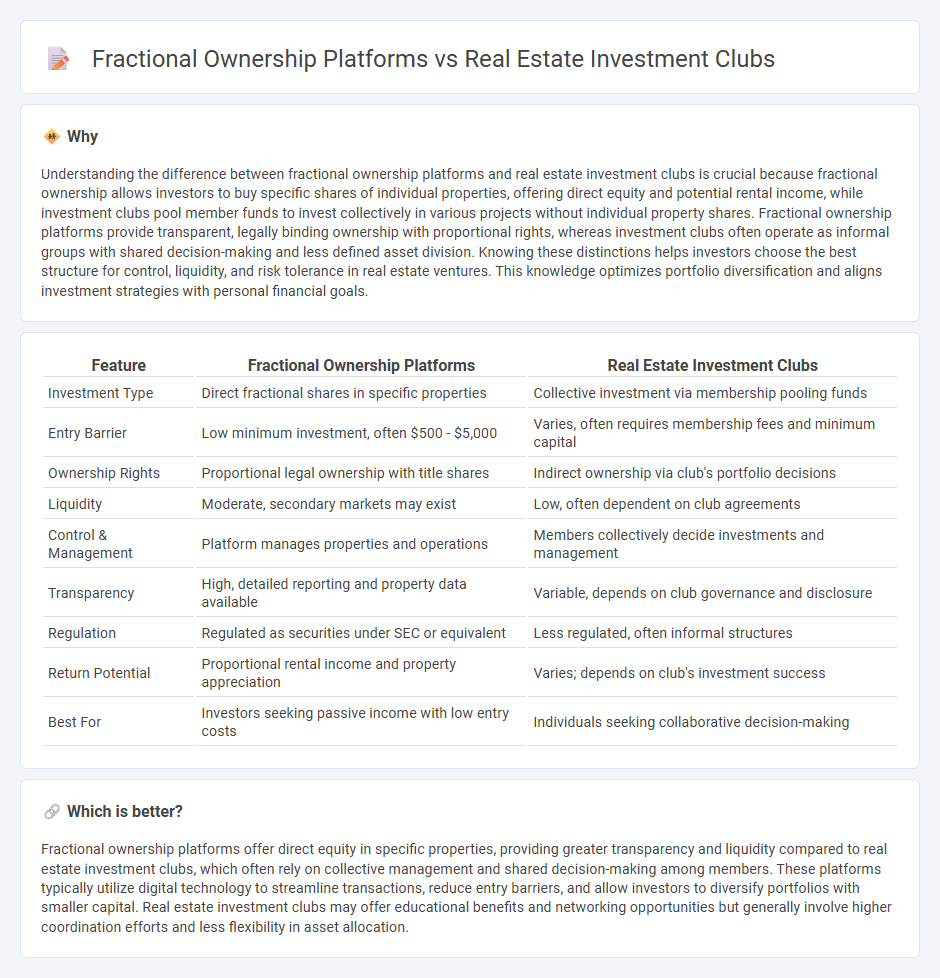

Understanding the difference between fractional ownership platforms and real estate investment clubs is crucial because fractional ownership allows investors to buy specific shares of individual properties, offering direct equity and potential rental income, while investment clubs pool member funds to invest collectively in various projects without individual property shares. Fractional ownership platforms provide transparent, legally binding ownership with proportional rights, whereas investment clubs often operate as informal groups with shared decision-making and less defined asset division. Knowing these distinctions helps investors choose the best structure for control, liquidity, and risk tolerance in real estate ventures. This knowledge optimizes portfolio diversification and aligns investment strategies with personal financial goals.

Comparison Table

| Feature | Fractional Ownership Platforms | Real Estate Investment Clubs |

|---|---|---|

| Investment Type | Direct fractional shares in specific properties | Collective investment via membership pooling funds |

| Entry Barrier | Low minimum investment, often $500 - $5,000 | Varies, often requires membership fees and minimum capital |

| Ownership Rights | Proportional legal ownership with title shares | Indirect ownership via club's portfolio decisions |

| Liquidity | Moderate, secondary markets may exist | Low, often dependent on club agreements |

| Control & Management | Platform manages properties and operations | Members collectively decide investments and management |

| Transparency | High, detailed reporting and property data available | Variable, depends on club governance and disclosure |

| Regulation | Regulated as securities under SEC or equivalent | Less regulated, often informal structures |

| Return Potential | Proportional rental income and property appreciation | Varies; depends on club's investment success |

| Best For | Investors seeking passive income with low entry costs | Individuals seeking collaborative decision-making |

Which is better?

Fractional ownership platforms offer direct equity in specific properties, providing greater transparency and liquidity compared to real estate investment clubs, which often rely on collective management and shared decision-making among members. These platforms typically utilize digital technology to streamline transactions, reduce entry barriers, and allow investors to diversify portfolios with smaller capital. Real estate investment clubs may offer educational benefits and networking opportunities but generally involve higher coordination efforts and less flexibility in asset allocation.

Connection

Fractional ownership platforms and real estate investment clubs both democratize property investment by enabling multiple investors to pool capital and share ownership in real estate assets. These models increase market accessibility and liquidity by lowering entry barriers and fostering collaborative investment strategies, often utilizing digital platforms for transaction transparency and management. The synergy between fractional ownership and investment clubs enhances portfolio diversification and passive income opportunities for individual and group investors alike.

Key Terms

Collective Investment

Real estate investment clubs offer a community-driven approach where members pool resources to invest collectively, often fostering close collaboration and shared decision-making. Fractional ownership platforms provide streamlined access to diversified properties with lower entry costs and professional management, appealing to investors seeking hassle-free portfolio growth. Explore the distinct advantages of each model to determine which collective investment strategy aligns best with your financial goals.

Liquidity

Real estate investment clubs often require longer holding periods due to shared ownership structures, resulting in lower liquidity for investors compared to fractional ownership platforms. Fractional ownership platforms provide enhanced liquidity by allowing investors to buy and sell shares more freely on secondary markets. Explore how liquidity impacts your investment strategy between these two real estate options.

Ownership Structure

Real estate investment clubs typically involve collective ownership where members pool funds to buy properties, often requiring active participation in decision-making and management. Fractional ownership platforms offer individual investors a share of a property, with ownership rights proportionate to their investment, usually managed by a professional entity for streamlined control. Explore the nuances of these ownership structures to determine the best fit for your real estate investment strategy.

Source and External Links

Co-Investing Club: Group Real Estate Investments - SparkRental - Members pool funds to invest as little as $5,000 in vetted, passive real estate deals--including private partnerships, syndications, and funds--without requiring accredited investor status, aiming for 14%+ returns and diversifying across U.S. markets and property types.

Should You Join a Real Estate Investment Club? - Mashvisor - Real estate investment clubs bring together investors of all experience levels to share knowledge, network, and either invest independently or pool resources for group deals, often involving membership fees and structured guidelines.

OKC REIA - Oklahoma City - OKCREIA is Oklahoma City's premier local investor association, offering education, networking, and support through monthly meetings and workshops led by active local professionals, helping members navigate the OKC real estate market.

dowidth.com

dowidth.com