Proptech solutions leverage advanced technology to streamline property management, enhance real estate transactions, and provide data-driven insights for buyers, sellers, and investors. Real estate crowdfunding enables multiple investors to pool resources online, gaining access to property investments with lower capital requirements and diversified portfolios. Explore how these innovative approaches are transforming the real estate landscape and redefining investment opportunities.

Why it is important

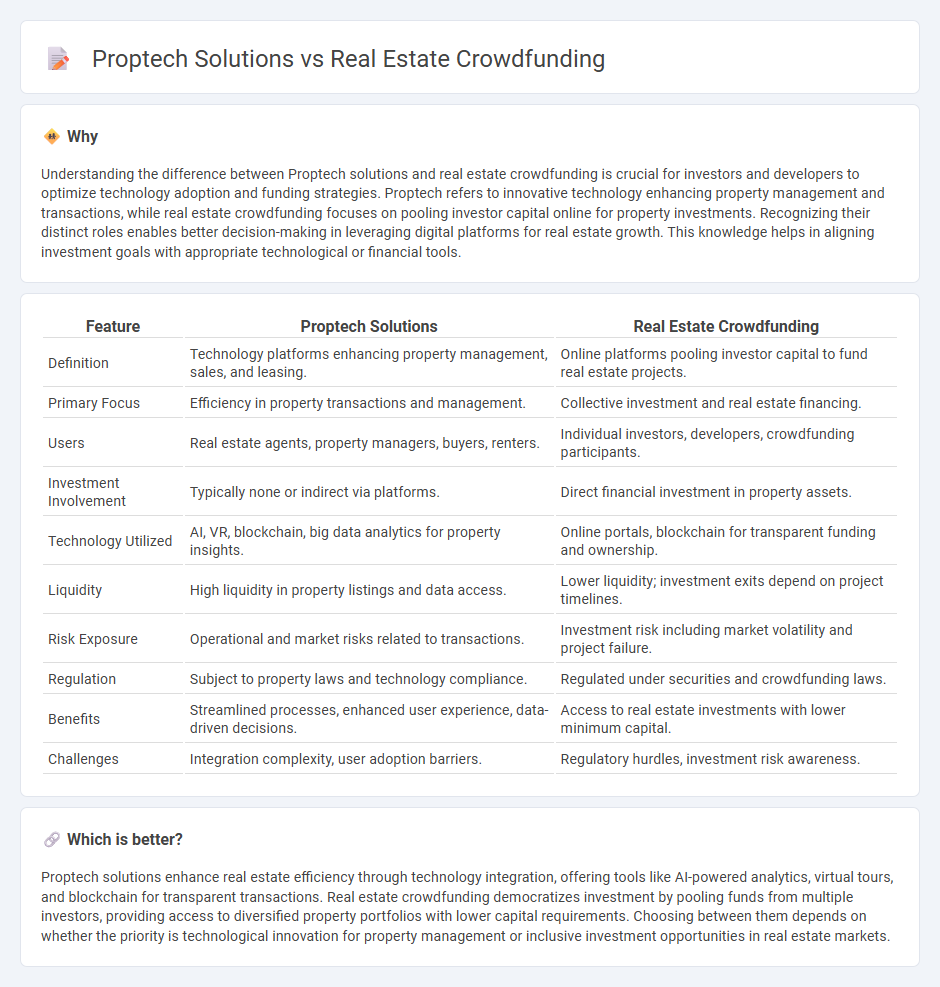

Understanding the difference between Proptech solutions and real estate crowdfunding is crucial for investors and developers to optimize technology adoption and funding strategies. Proptech refers to innovative technology enhancing property management and transactions, while real estate crowdfunding focuses on pooling investor capital online for property investments. Recognizing their distinct roles enables better decision-making in leveraging digital platforms for real estate growth. This knowledge helps in aligning investment goals with appropriate technological or financial tools.

Comparison Table

| Feature | Proptech Solutions | Real Estate Crowdfunding |

|---|---|---|

| Definition | Technology platforms enhancing property management, sales, and leasing. | Online platforms pooling investor capital to fund real estate projects. |

| Primary Focus | Efficiency in property transactions and management. | Collective investment and real estate financing. |

| Users | Real estate agents, property managers, buyers, renters. | Individual investors, developers, crowdfunding participants. |

| Investment Involvement | Typically none or indirect via platforms. | Direct financial investment in property assets. |

| Technology Utilized | AI, VR, blockchain, big data analytics for property insights. | Online portals, blockchain for transparent funding and ownership. |

| Liquidity | High liquidity in property listings and data access. | Lower liquidity; investment exits depend on project timelines. |

| Risk Exposure | Operational and market risks related to transactions. | Investment risk including market volatility and project failure. |

| Regulation | Subject to property laws and technology compliance. | Regulated under securities and crowdfunding laws. |

| Benefits | Streamlined processes, enhanced user experience, data-driven decisions. | Access to real estate investments with lower minimum capital. |

| Challenges | Integration complexity, user adoption barriers. | Regulatory hurdles, investment risk awareness. |

Which is better?

Proptech solutions enhance real estate efficiency through technology integration, offering tools like AI-powered analytics, virtual tours, and blockchain for transparent transactions. Real estate crowdfunding democratizes investment by pooling funds from multiple investors, providing access to diversified property portfolios with lower capital requirements. Choosing between them depends on whether the priority is technological innovation for property management or inclusive investment opportunities in real estate markets.

Connection

Proptech solutions leverage advanced technologies such as AI, blockchain, and big data analytics to streamline real estate transactions, enhance property management, and improve investment transparency. Real estate crowdfunding platforms utilize these Proptech innovations to facilitate fractional property investments, providing broader access to real estate markets and increasing liquidity. The integration of Proptech ensures efficient due diligence, secure smart contracts, and real-time market insights, making crowdfunding a more accessible and reliable investment method in real estate.

Key Terms

Investment Platform

Real estate crowdfunding platforms democratize property investment by allowing individuals to pool funds and access diverse portfolios with lower capital requirements. Proptech investment platforms leverage advanced technologies such as AI, blockchain, and big data analytics to enhance due diligence, streamline transactions, and improve transparency for investors. Explore how these innovative investment platforms are transforming real estate opportunities and optimizing returns.

Tokenization

Real estate crowdfunding leverages collective investment, enabling multiple investors to fund properties, while Proptech solutions integrate technology like blockchain to enhance asset management and transparency. Tokenization in Proptech transforms real estate assets into digital tokens, increasing liquidity, fractional ownership, and simplified transactions. Explore how tokenized real estate is revolutionizing investment opportunities and the future of property markets.

Digital Due Diligence

Digital due diligence in real estate crowdfunding leverages advanced Proptech solutions such as AI-driven analytics, blockchain verification, and automated risk assessment to enhance transparency and investor confidence. This technological integration streamlines property evaluation and accelerates decision-making, reducing traditional bottlenecks and increasing access to diversified investment portfolios. Explore how digital due diligence can transform your real estate investment strategy with cutting-edge Proptech innovations.

Source and External Links

Crowdfunding real estate: What to know - Rocket Mortgage - This article explains how real estate crowdfunding works, allowing investors to pool money for property investments through online platforms.

Crowdfunding - National Association of REALTORS(r) - This page discusses real estate crowdfunding as a method for pooling money to fund projects and earn passive income, often using platforms like Crowdstreet and Fundrise.

Arrived | Easily Invest in Real Estate - Arrived is a platform that allows investors to easily invest in rental properties starting from $100, offering passive income and property appreciation potential.

dowidth.com

dowidth.com