Single-family rental portfolios offer diversified, stable cash flow driven by high demand for residential living and lower tenant turnover compared to office building portfolios, which face fluctuating occupancy rates influenced by economic cycles and evolving work trends. These residential assets typically provide resilience against market volatility, while office buildings require active management to adapt to changing commercial real estate dynamics. Explore our detailed analysis to understand which portfolio aligns best with your investment goals.

Why it is important

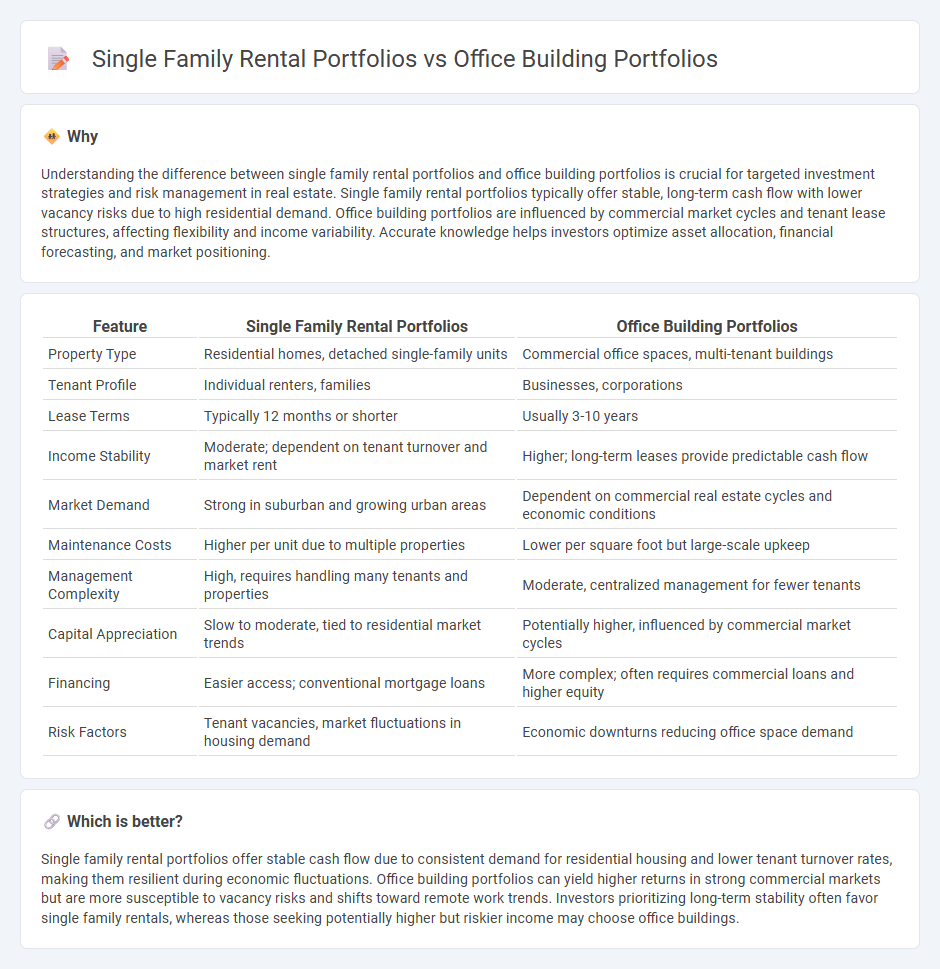

Understanding the difference between single family rental portfolios and office building portfolios is crucial for targeted investment strategies and risk management in real estate. Single family rental portfolios typically offer stable, long-term cash flow with lower vacancy risks due to high residential demand. Office building portfolios are influenced by commercial market cycles and tenant lease structures, affecting flexibility and income variability. Accurate knowledge helps investors optimize asset allocation, financial forecasting, and market positioning.

Comparison Table

| Feature | Single Family Rental Portfolios | Office Building Portfolios |

|---|---|---|

| Property Type | Residential homes, detached single-family units | Commercial office spaces, multi-tenant buildings |

| Tenant Profile | Individual renters, families | Businesses, corporations |

| Lease Terms | Typically 12 months or shorter | Usually 3-10 years |

| Income Stability | Moderate; dependent on tenant turnover and market rent | Higher; long-term leases provide predictable cash flow |

| Market Demand | Strong in suburban and growing urban areas | Dependent on commercial real estate cycles and economic conditions |

| Maintenance Costs | Higher per unit due to multiple properties | Lower per square foot but large-scale upkeep |

| Management Complexity | High, requires handling many tenants and properties | Moderate, centralized management for fewer tenants |

| Capital Appreciation | Slow to moderate, tied to residential market trends | Potentially higher, influenced by commercial market cycles |

| Financing | Easier access; conventional mortgage loans | More complex; often requires commercial loans and higher equity |

| Risk Factors | Tenant vacancies, market fluctuations in housing demand | Economic downturns reducing office space demand |

Which is better?

Single family rental portfolios offer stable cash flow due to consistent demand for residential housing and lower tenant turnover rates, making them resilient during economic fluctuations. Office building portfolios can yield higher returns in strong commercial markets but are more susceptible to vacancy risks and shifts toward remote work trends. Investors prioritizing long-term stability often favor single family rentals, whereas those seeking potentially higher but riskier income may choose office buildings.

Connection

Single family rental portfolios and office building portfolios intersect through diversified real estate investment strategies focused on stable cash flow and asset appreciation. Both asset types benefit from location-driven demand, economic cycles, and tenant retention efforts that influence occupancy rates and revenue streams. Investors leverage portfolio synergies by balancing residential rental stability with commercial office space growth potential to optimize overall risk and return.

Key Terms

Tenant Mix

Office building portfolios typically feature a diverse tenant mix including professional services, technology firms, and financial institutions, enhancing income stability through varied lease terms. Single-family rental portfolios generally consist of residential tenants, with demand influenced by local housing markets and demographic trends, offering steady cash flow but less diversification. Explore how optimizing tenant mix can impact portfolio performance and risk management.

Lease Structure

Office building portfolios typically feature long-term, triple net leases where tenants bear property expenses, enhancing predictable cash flow and reducing landlord management responsibilities. Single family rental portfolios often involve shorter-term leases with landlords covering maintenance, requiring more active management but allowing flexibility in rent adjustments. Explore detailed lease structures and financial impacts to optimize your real estate investment strategy.

Asset Liquidity

Office building portfolios often exhibit lower asset liquidity compared to single family rental portfolios due to longer lease terms and higher transaction complexities. Single family rental portfolios benefit from easier marketability and faster turnover driven by widespread residential demand and standardized property characteristics. Explore the comparative liquidity dynamics between these asset classes to optimize your real estate investment strategy.

Source and External Links

How to Build a Strong Commercial Real Estate Portfolio - Office building portfolios consist of properties designed for business activities, ranging from small suburban offices to multi-story downtown skyscrapers, prized for long-term leases and high-quality tenants, often consolidated for efficient property management.

The Future of Corporate Real Estate Portfolios - Corporate office building portfolios are evolving due to shifts like hybrid work models and employee-centric strategies, favoring flexible, sustainable, and collaboration-focused spaces over traditional offices.

Things to Consider When Building a Commercial Real Estate Portfolio - Diversification is essential in office building portfolios, recommending investment across various property types, geographies, sub-sectors, sponsors, and strategies to mitigate risks and enhance long-term resilience.

dowidth.com

dowidth.com