Value-add investments in real estate focus on properties that require improvements or renovations to increase their market value and rental income, offering higher potential returns with moderate risk. Turnkey investments involve fully renovated, income-producing properties that provide immediate cash flow and lower risk, appealing to investors seeking convenience and stability. Explore the differences further to determine which strategy aligns with your investment goals.

Why it is important

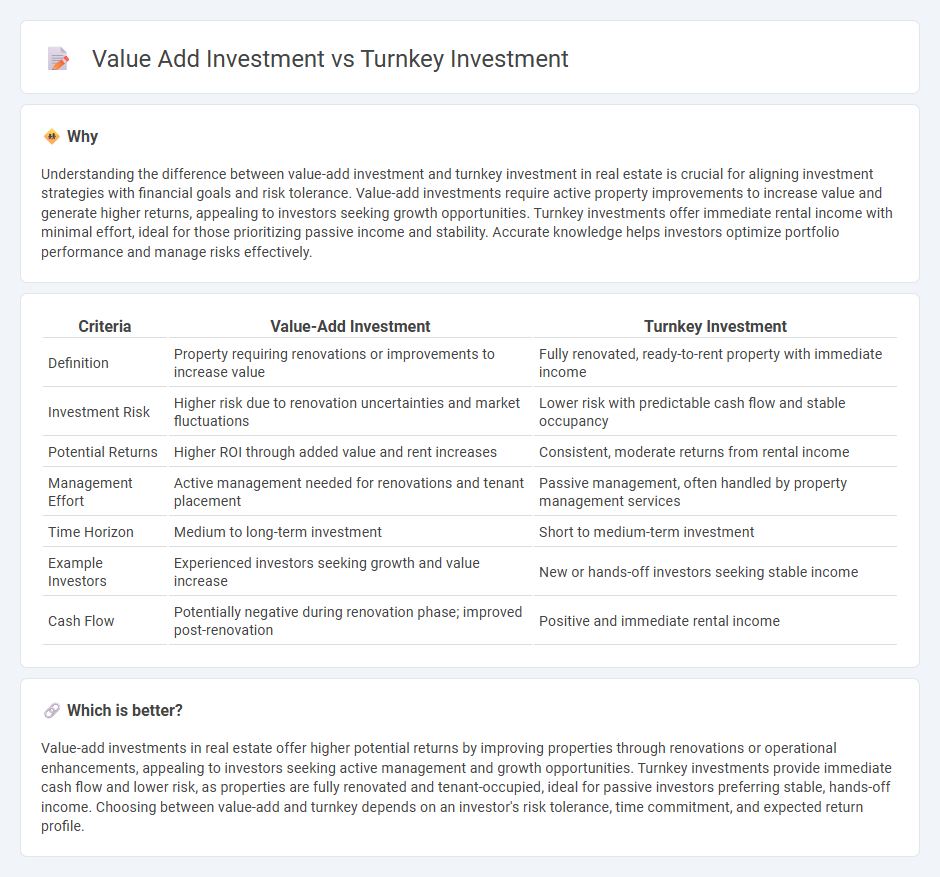

Understanding the difference between value-add investment and turnkey investment in real estate is crucial for aligning investment strategies with financial goals and risk tolerance. Value-add investments require active property improvements to increase value and generate higher returns, appealing to investors seeking growth opportunities. Turnkey investments offer immediate rental income with minimal effort, ideal for those prioritizing passive income and stability. Accurate knowledge helps investors optimize portfolio performance and manage risks effectively.

Comparison Table

| Criteria | Value-Add Investment | Turnkey Investment |

|---|---|---|

| Definition | Property requiring renovations or improvements to increase value | Fully renovated, ready-to-rent property with immediate income |

| Investment Risk | Higher risk due to renovation uncertainties and market fluctuations | Lower risk with predictable cash flow and stable occupancy |

| Potential Returns | Higher ROI through added value and rent increases | Consistent, moderate returns from rental income |

| Management Effort | Active management needed for renovations and tenant placement | Passive management, often handled by property management services |

| Time Horizon | Medium to long-term investment | Short to medium-term investment |

| Example Investors | Experienced investors seeking growth and value increase | New or hands-off investors seeking stable income |

| Cash Flow | Potentially negative during renovation phase; improved post-renovation | Positive and immediate rental income |

Which is better?

Value-add investments in real estate offer higher potential returns by improving properties through renovations or operational enhancements, appealing to investors seeking active management and growth opportunities. Turnkey investments provide immediate cash flow and lower risk, as properties are fully renovated and tenant-occupied, ideal for passive investors preferring stable, hands-off income. Choosing between value-add and turnkey depends on an investor's risk tolerance, time commitment, and expected return profile.

Connection

Value-add investment in real estate involves purchasing properties with the potential for renovation or improvements to increase their market value and rental income. Turnkey investment refers to properties that are fully renovated and ready for immediate rental income generation with minimal management effort. Both strategies are connected through their focus on maximizing rental returns, with value-add investors creating opportunities for future turnkey products that appeal to investors seeking passive income.

Key Terms

Renovation

Turnkey investments involve fully renovated properties ready for immediate rental or resale, minimizing risk and management effort for investors. Value-add investments require strategic renovations or upgrades to increase property value and rental income, offering higher potential returns with increased involvement. Explore deeper insights on renovation strategies and investment outcomes to make informed decisions.

Cash Flow

Turnkey investments provide immediate cash flow through fully renovated properties with stable tenants, minimizing management efforts and risk. Value-add investments involve purchasing underperforming assets, renovating or repositioning them to increase rents and occupancy, which can lead to higher future cash flow but require active management and carry greater risk. Explore detailed comparisons to determine which investment strategy best aligns with your financial goals and risk tolerance.

Appreciation Potential

Turnkey investments offer stable cash flow with minimal management, appealing to investors seeking immediate income and lower risk, while value-add investments prioritize appreciation potential through property improvements and operational enhancements, resulting in higher returns over time. Appreciation potential in value-add projects stems from strategic renovations, market repositioning, and increased rental income, making them ideal for investors aiming for substantial equity growth. Explore deeper insights on maximizing appreciation potential between turnkey and value-add investment strategies.

Source and External Links

Turnkey Real Estate: The Ultimate Guide for Investors - The Close - A turnkey real estate investment is a fully renovated, tenant-ready property that allows investors to generate passive income immediately with minimal management effort, as the property is typically managed by a third-party company.

Investing in Turnkey Real Estate | White Coat Investor - Turnkey properties let investors enjoy full ownership and control, providing a mostly hands-off experience because the turnkey provider handles the property's renovation, tenant placement, and ongoing management.

What is turnkey real estate (and is it right for you)? - Stessa - Turnkey investment properties are usually sold at a premium after being purchased and renovated by companies who also handle ongoing property management, targeting buyers seeking predictable rental income without the hassle of property rehab or daily management.

dowidth.com

dowidth.com