Green leases focus on sustainability by aligning tenant and landlord responsibilities to reduce environmental impact through energy efficiency and resource conservation efforts. Percentage leases base rent on a fixed percentage of the tenant's gross sales, offering flexible payment tied directly to business performance. Discover how these innovative leasing models can optimize real estate investments and tenant relations.

Why it is important

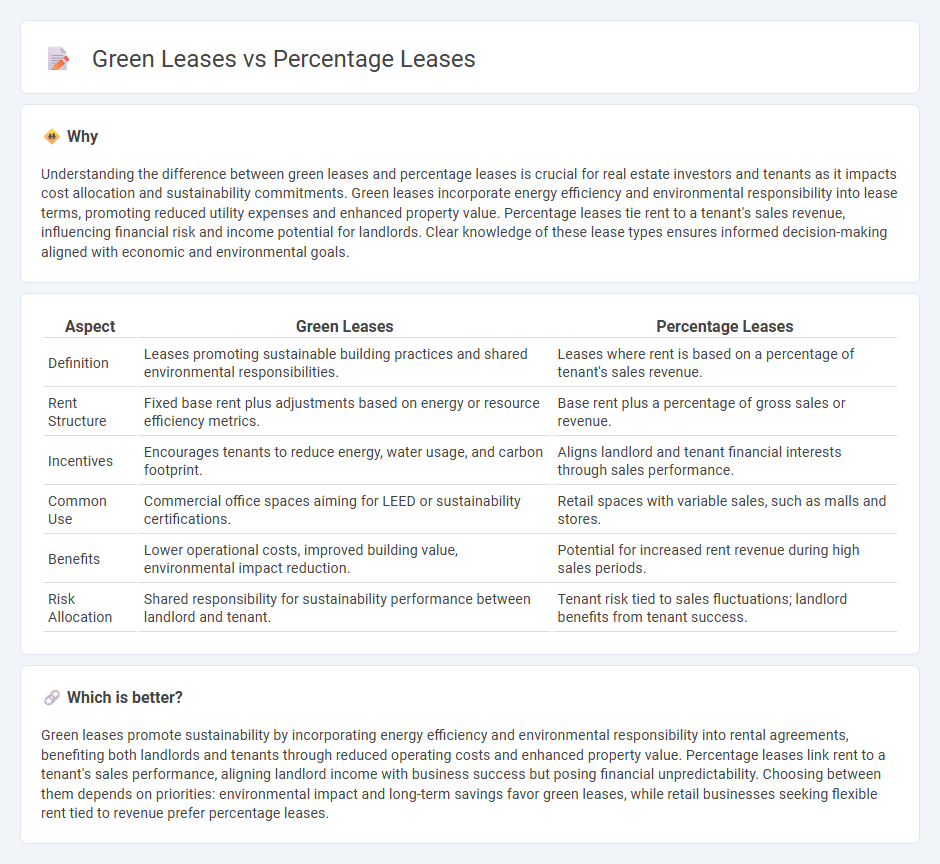

Understanding the difference between green leases and percentage leases is crucial for real estate investors and tenants as it impacts cost allocation and sustainability commitments. Green leases incorporate energy efficiency and environmental responsibility into lease terms, promoting reduced utility expenses and enhanced property value. Percentage leases tie rent to a tenant's sales revenue, influencing financial risk and income potential for landlords. Clear knowledge of these lease types ensures informed decision-making aligned with economic and environmental goals.

Comparison Table

| Aspect | Green Leases | Percentage Leases |

|---|---|---|

| Definition | Leases promoting sustainable building practices and shared environmental responsibilities. | Leases where rent is based on a percentage of tenant's sales revenue. |

| Rent Structure | Fixed base rent plus adjustments based on energy or resource efficiency metrics. | Base rent plus a percentage of gross sales or revenue. |

| Incentives | Encourages tenants to reduce energy, water usage, and carbon footprint. | Aligns landlord and tenant financial interests through sales performance. |

| Common Use | Commercial office spaces aiming for LEED or sustainability certifications. | Retail spaces with variable sales, such as malls and stores. |

| Benefits | Lower operational costs, improved building value, environmental impact reduction. | Potential for increased rent revenue during high sales periods. |

| Risk Allocation | Shared responsibility for sustainability performance between landlord and tenant. | Tenant risk tied to sales fluctuations; landlord benefits from tenant success. |

Which is better?

Green leases promote sustainability by incorporating energy efficiency and environmental responsibility into rental agreements, benefiting both landlords and tenants through reduced operating costs and enhanced property value. Percentage leases link rent to a tenant's sales performance, aligning landlord income with business success but posing financial unpredictability. Choosing between them depends on priorities: environmental impact and long-term savings favor green leases, while retail businesses seeking flexible rent tied to revenue prefer percentage leases.

Connection

Green leases and percentage leases intersect by encouraging sustainable property management through shared financial incentives based on tenant revenue and energy efficiency. Percentage leases link rental payments to tenant sales, promoting landlord-tenant collaboration on operational costs, including sustainability measures outlined in green leases. Both lease types foster aligned interests in reducing environmental impact and optimizing property performance, benefiting long-term asset value and tenant satisfaction.

Key Terms

Rent Calculation

Percentage leases calculate rent based on a fixed base amount plus a percentage of tenant sales, aligning landlord income with retail performance. Green leases incorporate environmental performance metrics, linking rent adjustments to energy efficiency, sustainability benchmarks, or reduced carbon footprints. Explore the advantages and implications of rent structures in percentage and green leases to optimize lease agreements.

Operating Expenses

Percentage leases charge tenants based on a portion of their gross sales, aligning landlord revenue with tenant success but often excluding operating expenses from the base rent. Green leases incorporate clauses that encourage tenants and landlords to share responsibility for sustainable practices, particularly by delineating how operating expenses related to energy efficiency and environmental impact are managed and allocated. Explore how integrating operating expense considerations in these lease types can benefit both parties financially and environmentally.

Sustainability Requirements

Percentage leases tie rent to tenant sales, encouraging retailers to optimize performance, while green leases emphasize sustainability by integrating energy efficiency, waste reduction, and eco-friendly practices into lease agreements. Green leases allocate responsibility for environmental compliance and incentivize investments in sustainable building technologies, making them crucial for achieving corporate social responsibility goals and reducing carbon footprints. Explore how these leasing models impact sustainability outcomes and financial incentives in commercial real estate.

Source and External Links

Percentage Lease | Formula + Calculator - Wall Street Prep - A percentage lease requires the tenant to pay a base rent plus a set percentage of gross sales exceeding a breakpoint, commonly used in retail leasing for shared upside between landlord and tenant.

What is a Percentage Lease? - Occupier - In a percentage lease, the tenant pays a lower fixed base rent plus an agreed percentage of gross sales, incentivizing landlords to benefit from tenant sales performance.

How Does a Percentage Lease Work? - LegalZoom - The lease formula calculates total rent as base rent plus a percentage of sales above a breakpoint, providing landlords variable income linked to tenant revenue.

dowidth.com

dowidth.com