Single family rentals offer tenants greater privacy and space, often attracting long-term residents seeking a home-like environment, while multifamily rentals provide investors with diversified income streams and operational efficiencies due to shared building amenities. Market trends indicate growing demand for multifamily properties in urban areas, whereas single family rentals remain popular in suburban and rural regions. Explore detailed insights to determine which rental investment aligns best with your financial goals.

Why it is important

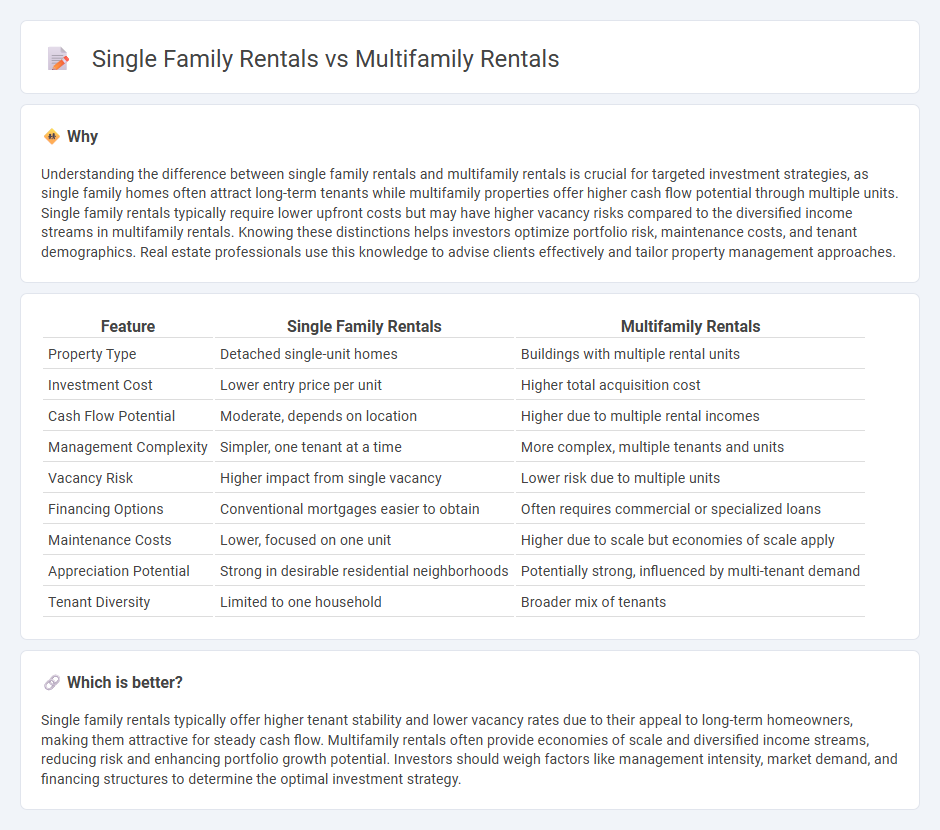

Understanding the difference between single family rentals and multifamily rentals is crucial for targeted investment strategies, as single family homes often attract long-term tenants while multifamily properties offer higher cash flow potential through multiple units. Single family rentals typically require lower upfront costs but may have higher vacancy risks compared to the diversified income streams in multifamily rentals. Knowing these distinctions helps investors optimize portfolio risk, maintenance costs, and tenant demographics. Real estate professionals use this knowledge to advise clients effectively and tailor property management approaches.

Comparison Table

| Feature | Single Family Rentals | Multifamily Rentals |

|---|---|---|

| Property Type | Detached single-unit homes | Buildings with multiple rental units |

| Investment Cost | Lower entry price per unit | Higher total acquisition cost |

| Cash Flow Potential | Moderate, depends on location | Higher due to multiple rental incomes |

| Management Complexity | Simpler, one tenant at a time | More complex, multiple tenants and units |

| Vacancy Risk | Higher impact from single vacancy | Lower risk due to multiple units |

| Financing Options | Conventional mortgages easier to obtain | Often requires commercial or specialized loans |

| Maintenance Costs | Lower, focused on one unit | Higher due to scale but economies of scale apply |

| Appreciation Potential | Strong in desirable residential neighborhoods | Potentially strong, influenced by multi-tenant demand |

| Tenant Diversity | Limited to one household | Broader mix of tenants |

Which is better?

Single family rentals typically offer higher tenant stability and lower vacancy rates due to their appeal to long-term homeowners, making them attractive for steady cash flow. Multifamily rentals often provide economies of scale and diversified income streams, reducing risk and enhancing portfolio growth potential. Investors should weigh factors like management intensity, market demand, and financing structures to determine the optimal investment strategy.

Connection

Single family rentals and multifamily rentals are interconnected within the real estate market as complementary housing options catering to diverse tenant needs and investment strategies. Investors often diversify portfolios by including both property types to balance risk and maximize rental income across different demographic segments. Market trends affecting rental demand, such as population growth and urbanization, simultaneously influence occupancy rates and property values in both single family and multifamily rental sectors.

Key Terms

Occupancy Rate

Multifamily rentals typically maintain higher occupancy rates compared to single-family rentals due to diversified tenant risk and stronger demand in urban areas. Single-family rentals often experience longer vacancy periods influenced by market fluctuations and tenant turnover. Explore detailed occupancy data and market trends to make informed investment decisions.

Economies of Scale

Multifamily rentals offer significant economies of scale by allowing property managers to reduce per-unit costs through centralized maintenance, management, and marketing efforts, whereas single family rentals typically incur higher expenses per unit due to individualized upkeep and dispersed locations. Bulk purchasing of materials and streamlined administrative processes further enhance profitability in multifamily properties. Discover how leveraging economies of scale can maximize your rental investment returns.

Property Management

Multifamily rentals often require more complex property management due to higher tenant turnover rates and increased maintenance demands compared to single-family rentals, which typically have more stable tenancy and simpler upkeep. Effective property management in multifamily units involves coordinated vendor relationships, streamlined rent collection systems, and rigorous tenant screening processes to maintain occupancy and profitability. Explore comprehensive property management solutions to optimize your rental portfolio's performance.

Source and External Links

Multi-Family Property Management Dallas For Apartments & Condo - Provides a full suite of services for multifamily rentals in the Dallas-Fort Worth area, including tenant screening and rent collection.

Listings and Available Properties - Dallas - The Multifamily Group - Offers a variety of multifamily properties for sale, including apartments and townhomes in cities like Plano, Richardson, and San Antonio.

Multifamily Housing Programs - USDA Rural Development - Assists rural property owners with loans, guarantees, and grants for developing and rehabilitating multifamily properties, especially for low-income, elderly, and disabled individuals.

dowidth.com

dowidth.com