Smart lease agreements utilize blockchain technology to ensure transparent, secure, and automated rental contract management, reducing disputes and enhancing trust between landlords and tenants. Master lease agreements aggregate multiple rental units under a single contract, simplifying portfolio management and providing landlords with consistent cash flow and operational control. Explore how these innovative leasing strategies can transform property management and investment efficiency.

Why it is important

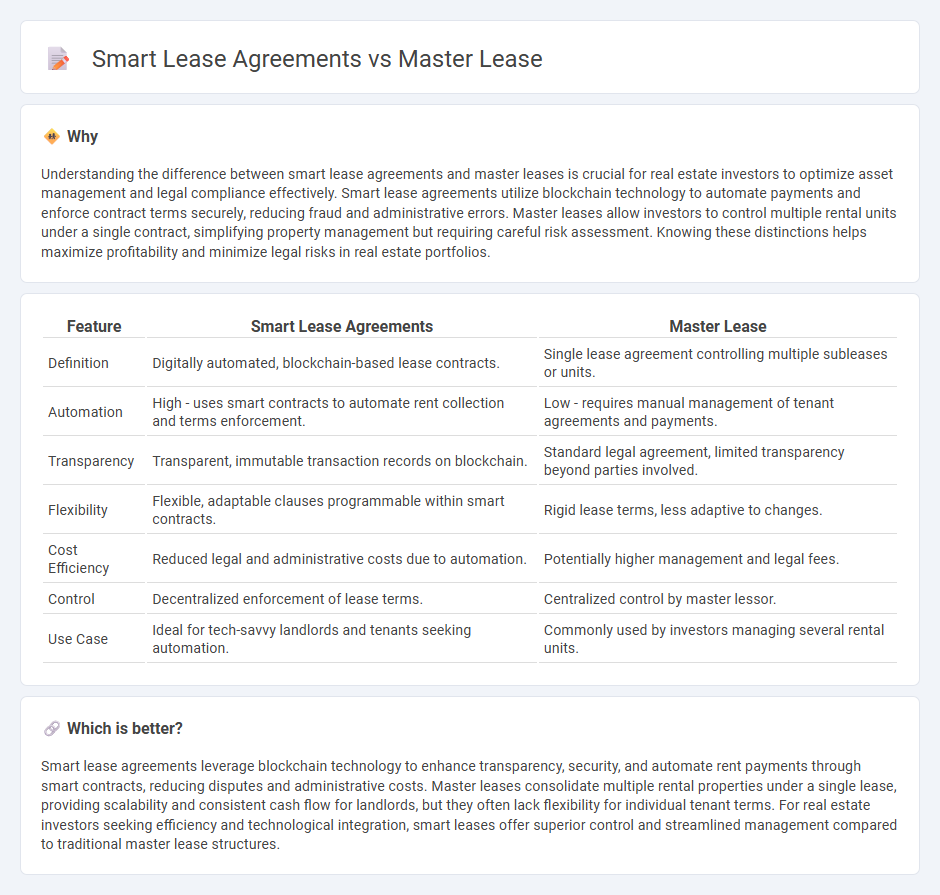

Understanding the difference between smart lease agreements and master leases is crucial for real estate investors to optimize asset management and legal compliance effectively. Smart lease agreements utilize blockchain technology to automate payments and enforce contract terms securely, reducing fraud and administrative errors. Master leases allow investors to control multiple rental units under a single contract, simplifying property management but requiring careful risk assessment. Knowing these distinctions helps maximize profitability and minimize legal risks in real estate portfolios.

Comparison Table

| Feature | Smart Lease Agreements | Master Lease |

|---|---|---|

| Definition | Digitally automated, blockchain-based lease contracts. | Single lease agreement controlling multiple subleases or units. |

| Automation | High - uses smart contracts to automate rent collection and terms enforcement. | Low - requires manual management of tenant agreements and payments. |

| Transparency | Transparent, immutable transaction records on blockchain. | Standard legal agreement, limited transparency beyond parties involved. |

| Flexibility | Flexible, adaptable clauses programmable within smart contracts. | Rigid lease terms, less adaptive to changes. |

| Cost Efficiency | Reduced legal and administrative costs due to automation. | Potentially higher management and legal fees. |

| Control | Decentralized enforcement of lease terms. | Centralized control by master lessor. |

| Use Case | Ideal for tech-savvy landlords and tenants seeking automation. | Commonly used by investors managing several rental units. |

Which is better?

Smart lease agreements leverage blockchain technology to enhance transparency, security, and automate rent payments through smart contracts, reducing disputes and administrative costs. Master leases consolidate multiple rental properties under a single lease, providing scalability and consistent cash flow for landlords, but they often lack flexibility for individual tenant terms. For real estate investors seeking efficiency and technological integration, smart leases offer superior control and streamlined management compared to traditional master lease structures.

Connection

Smart lease agreements leverage blockchain technology to automate and secure rental contracts, ensuring transparency and reducing disputes. Master lease agreements function as a legal framework allowing a tenant to sublet or manage multiple properties under a single lease, optimizing property management efficiency. Integrating smart lease agreements with master leases enhances control and accountability in multi-property real estate portfolios.

Key Terms

Control

Master lease agreements grant landlords full control over multiple properties under a single contract, simplifying management and consistent enforcement of terms. Smart lease agreements integrate technology-enabled controls, allowing dynamic adjustments and remote monitoring of lease terms to enhance operational efficiency. Explore how control mechanisms differ in master and smart leases to optimize property management strategies.

Flexibility

Master lease agreements typically offer less flexibility as they involve a single, long-term contract covering multiple properties under one lease, restricting modifications during the lease term. Smart lease agreements enhance flexibility by incorporating dynamic terms and digital management tools that allow tenants and landlords to adjust lease conditions quickly and transparently. Explore the advantages of each leasing model to determine which best supports your property management goals.

Profit-sharing

Master lease agreements typically involve a fixed rental payment structure, where the lessee pays a set amount regardless of the property's income, limiting profit-sharing opportunities. Smart lease agreements incorporate profit-sharing mechanisms, enabling landlords and tenants to share revenues or profits generated from the leased asset, aligning incentives for better performance and property management. Explore further to understand how these lease types impact investment returns and tenant-landlord relationships.

dowidth.com

dowidth.com