Proptech startups revolutionize real estate by integrating advanced technologies such as AI, blockchain, and IoT to streamline property management, enhance transaction transparency, and improve user experience. Crowdfunding platforms democratize real estate investment, enabling individual investors to pool resources and access diverse property portfolios with lower capital requirements. Discover how these innovative models are reshaping property markets and investment strategies today.

Why it is important

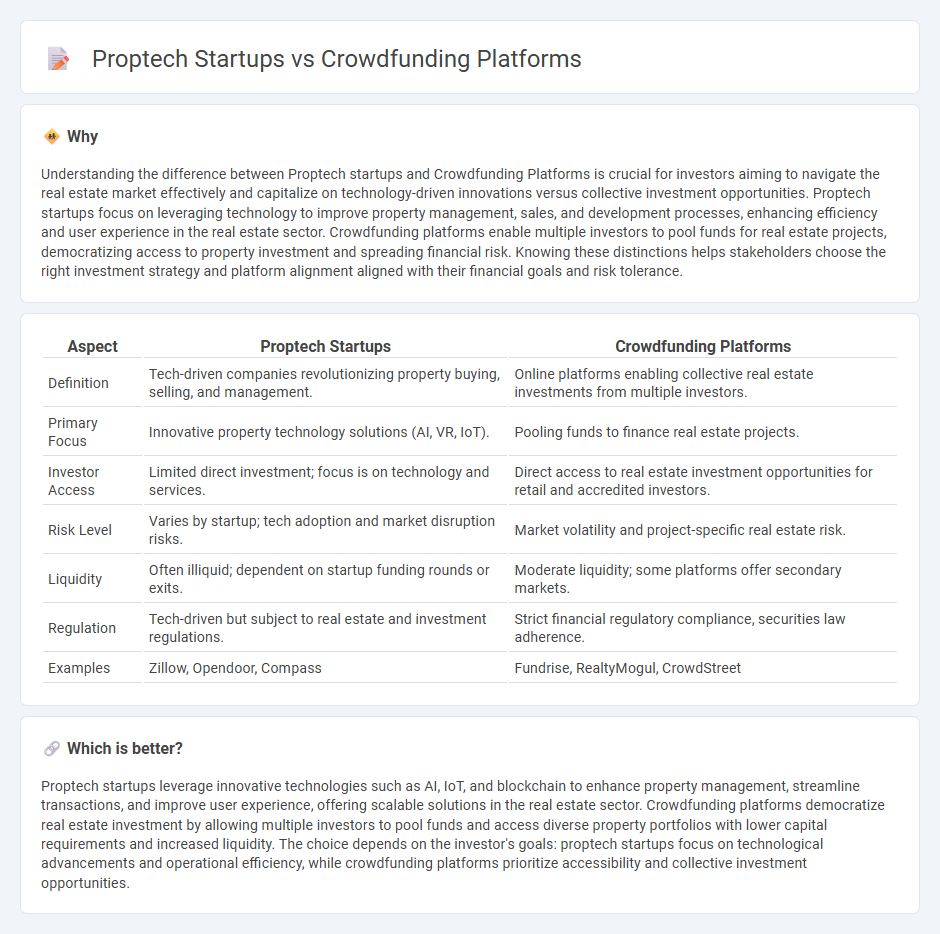

Understanding the difference between Proptech startups and Crowdfunding Platforms is crucial for investors aiming to navigate the real estate market effectively and capitalize on technology-driven innovations versus collective investment opportunities. Proptech startups focus on leveraging technology to improve property management, sales, and development processes, enhancing efficiency and user experience in the real estate sector. Crowdfunding platforms enable multiple investors to pool funds for real estate projects, democratizing access to property investment and spreading financial risk. Knowing these distinctions helps stakeholders choose the right investment strategy and platform alignment aligned with their financial goals and risk tolerance.

Comparison Table

| Aspect | Proptech Startups | Crowdfunding Platforms |

|---|---|---|

| Definition | Tech-driven companies revolutionizing property buying, selling, and management. | Online platforms enabling collective real estate investments from multiple investors. |

| Primary Focus | Innovative property technology solutions (AI, VR, IoT). | Pooling funds to finance real estate projects. |

| Investor Access | Limited direct investment; focus is on technology and services. | Direct access to real estate investment opportunities for retail and accredited investors. |

| Risk Level | Varies by startup; tech adoption and market disruption risks. | Market volatility and project-specific real estate risk. |

| Liquidity | Often illiquid; dependent on startup funding rounds or exits. | Moderate liquidity; some platforms offer secondary markets. |

| Regulation | Tech-driven but subject to real estate and investment regulations. | Strict financial regulatory compliance, securities law adherence. |

| Examples | Zillow, Opendoor, Compass | Fundrise, RealtyMogul, CrowdStreet |

Which is better?

Proptech startups leverage innovative technologies such as AI, IoT, and blockchain to enhance property management, streamline transactions, and improve user experience, offering scalable solutions in the real estate sector. Crowdfunding platforms democratize real estate investment by allowing multiple investors to pool funds and access diverse property portfolios with lower capital requirements and increased liquidity. The choice depends on the investor's goals: proptech startups focus on technological advancements and operational efficiency, while crowdfunding platforms prioritize accessibility and collective investment opportunities.

Connection

Proptech startups leverage technology to innovate real estate transactions, property management, and investment processes, creating more accessible and efficient solutions. Crowdfunding platforms enable individual investors to participate in real estate projects by pooling smaller investments, democratizing access to real estate markets. The synergy between Proptech and crowdfunding accelerates property development funding, enhances transparency, and expands investment opportunities globally.

Key Terms

Investment Model

Crowdfunding platforms enable investors to pool resources collectively into real estate projects, offering fractional ownership and lower entry barriers compared to traditional financing methods. Proptech startups leverage technological innovations such as AI-driven analytics and blockchain to create more efficient, transparent investment models that enhance property valuation accuracy and transactional security. Explore how these evolving investment models are transforming real estate financing by diving deeper into their comparative advantages.

Technology Integration

Crowdfunding platforms leverage advanced digital payment systems, AI-driven marketing tools, and blockchain for transparent transactions, enhancing user trust and scalability. Proptech startups integrate IoT devices, big data analytics, and virtual reality to revolutionize property management, client engagement, and real estate investment insights. Explore our detailed comparison to understand how technology reshapes investment and property landscapes in these sectors.

Ownership Structure

Crowdfunding platforms typically operate with a decentralized ownership structure, allowing numerous individual investors to collectively fund real estate projects, while proptech startups often maintain centralized ownership controlled by founders and venture capital investors. This difference influences decision-making processes, equity distribution, and investor engagement, with crowdfunding platforms promoting broader participation and proptech startups focusing on innovation and scalability under concentrated leadership. Explore the nuances of ownership models in these sectors for deeper insights.

Source and External Links

GoFundMe - A trusted crowdfunding platform ideal for personal fundraising, charities, and community projects, with no platform fee and a 2.9% + $0.30 transaction fee per donation.

Kickstarter - The world's largest reward-based crowdfunding platform, known for its "all or nothing" funding model, where projects must meet their target to receive funds.

Patreon - A platform designed for artists and creators to receive recurring funding from patrons, offering various service levels with fees ranging from 5% to 12%.

dowidth.com

dowidth.com