Leaseback programs enable property owners to sell their real estate to investors while immediately leasing it back, providing continuous occupancy and steady rental income. Ground leases grant tenants long-term rights to use and develop land owned by another party, often spanning several decades with specific terms governing property improvements. Explore the key differences and benefits of leaseback programs versus ground leases to determine the best real estate strategy for your investment goals.

Why it is important

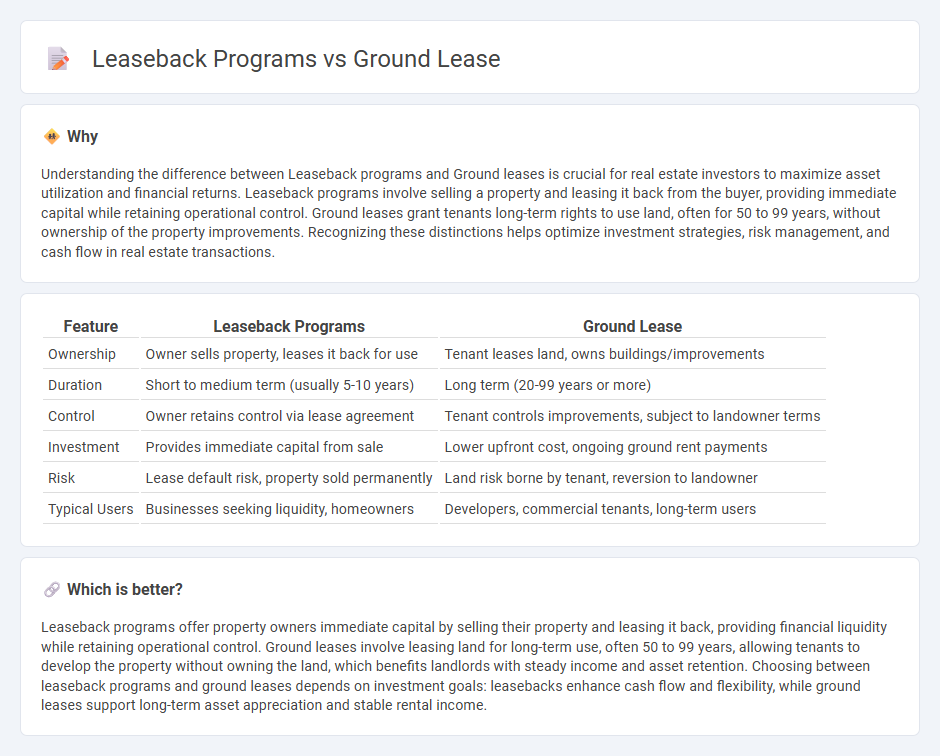

Understanding the difference between Leaseback programs and Ground leases is crucial for real estate investors to maximize asset utilization and financial returns. Leaseback programs involve selling a property and leasing it back from the buyer, providing immediate capital while retaining operational control. Ground leases grant tenants long-term rights to use land, often for 50 to 99 years, without ownership of the property improvements. Recognizing these distinctions helps optimize investment strategies, risk management, and cash flow in real estate transactions.

Comparison Table

| Feature | Leaseback Programs | Ground Lease |

|---|---|---|

| Ownership | Owner sells property, leases it back for use | Tenant leases land, owns buildings/improvements |

| Duration | Short to medium term (usually 5-10 years) | Long term (20-99 years or more) |

| Control | Owner retains control via lease agreement | Tenant controls improvements, subject to landowner terms |

| Investment | Provides immediate capital from sale | Lower upfront cost, ongoing ground rent payments |

| Risk | Lease default risk, property sold permanently | Land risk borne by tenant, reversion to landowner |

| Typical Users | Businesses seeking liquidity, homeowners | Developers, commercial tenants, long-term users |

Which is better?

Leaseback programs offer property owners immediate capital by selling their property and leasing it back, providing financial liquidity while retaining operational control. Ground leases involve leasing land for long-term use, often 50 to 99 years, allowing tenants to develop the property without owning the land, which benefits landlords with steady income and asset retention. Choosing between leaseback programs and ground leases depends on investment goals: leasebacks enhance cash flow and flexibility, while ground leases support long-term asset appreciation and stable rental income.

Connection

Leaseback programs and ground leases are interconnected by providing long-term property control while freeing up capital for investors. In leaseback arrangements, property owners sell assets and lease them back to maintain operational use, often involving ground leases for land where buildings are constructed. This synergy allows investors to optimize cash flow and leverage real estate assets without relinquishing physical occupancy or control over underlying land.

Key Terms

Ownership Structure

Ground leases establish ownership of the land with the lessor while lessees hold long-term rights to use the property, creating a split between land ownership and building occupancy. Leaseback programs involve the sale of an asset with its immediate leaseback to the seller, allowing the original owner to maintain operational control while converting an asset into capital. Explore deeper insights into ownership dynamics and financial benefits in both ground lease and leaseback arrangements.

Rent Payments

Ground lease agreements typically involve long-term rental payments made to a landowner, allowing lessees to develop or use the land while retaining ownership of any improvements. Leaseback programs usually involve a property owner selling an asset and then leasing it back, enabling continuous use of the property with rental payments that may offer tax benefits and improved cash flow. Explore the key differences and financial implications of rent payments in both programs to determine the best option for your real estate strategy.

Property Control

Ground leases grant property owners long-term control over land while allowing tenants to develop and use the property, maintaining ownership rights and future value appreciation. Leaseback programs involve the owner selling the property to an investor and leasing it back, sacrificing ownership but retaining operational control through lease terms. Explore in-depth comparisons of property control benefits in ground leases versus leaseback arrangements.

Source and External Links

Key Considerations in a Ground Lease - This article discusses the key considerations for lawyers when negotiating and preparing a ground lease, highlighting its benefits and complexities.

Ground Lease vs Land Lease - This page explains the differences between ground leases and land leases, focusing on their definitions and basic concepts in real estate.

What Is A Ground Lease - This resource provides a definition and examples of ground leases, explaining how they work and their fundamental inclusions.

dowidth.com

dowidth.com