Micro flipping involves quick buying and selling of properties to capture short-term profits, capitalizing on market inefficiencies, while REITs (Real Estate Investment Trusts) offer a more passive approach by allowing investors to buy shares in income-generating real estate portfolios. Micro flipping demands hands-on involvement and market knowledge, contrasting with REITs' diversification and liquidity benefits, ideal for those seeking lower-risk investments. Explore the differences in risk, return, and management styles to determine which real estate strategy suits your financial goals.

Why it is important

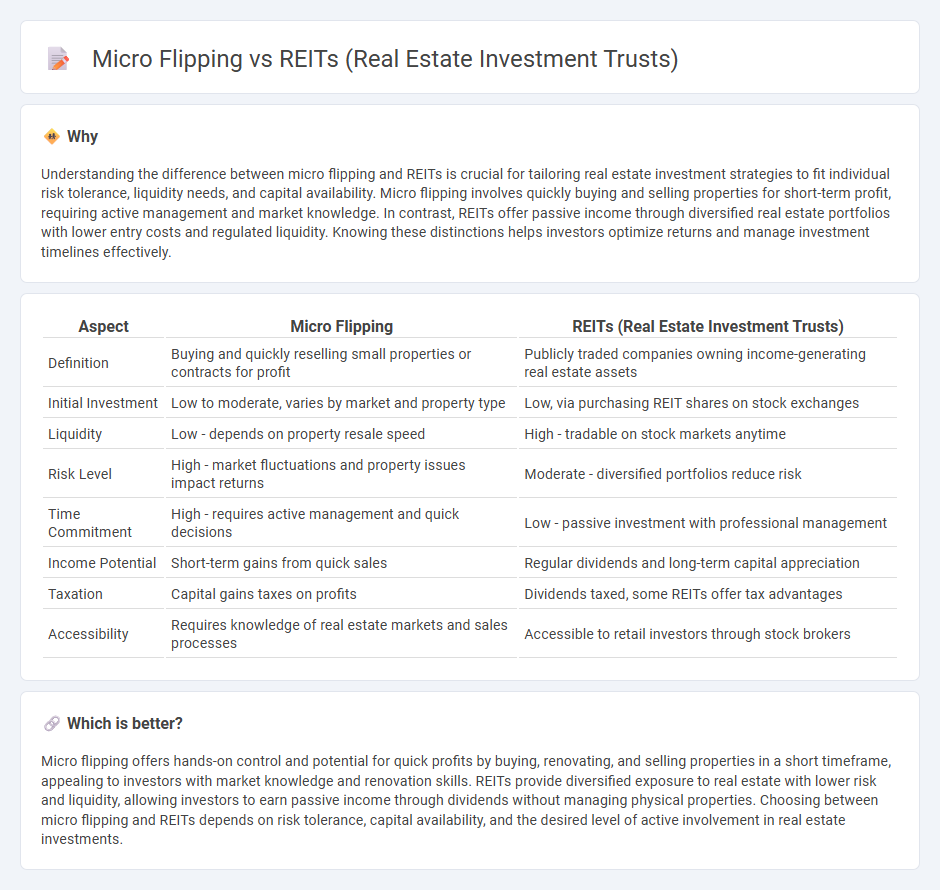

Understanding the difference between micro flipping and REITs is crucial for tailoring real estate investment strategies to fit individual risk tolerance, liquidity needs, and capital availability. Micro flipping involves quickly buying and selling properties for short-term profit, requiring active management and market knowledge. In contrast, REITs offer passive income through diversified real estate portfolios with lower entry costs and regulated liquidity. Knowing these distinctions helps investors optimize returns and manage investment timelines effectively.

Comparison Table

| Aspect | Micro Flipping | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Definition | Buying and quickly reselling small properties or contracts for profit | Publicly traded companies owning income-generating real estate assets |

| Initial Investment | Low to moderate, varies by market and property type | Low, via purchasing REIT shares on stock exchanges |

| Liquidity | Low - depends on property resale speed | High - tradable on stock markets anytime |

| Risk Level | High - market fluctuations and property issues impact returns | Moderate - diversified portfolios reduce risk |

| Time Commitment | High - requires active management and quick decisions | Low - passive investment with professional management |

| Income Potential | Short-term gains from quick sales | Regular dividends and long-term capital appreciation |

| Taxation | Capital gains taxes on profits | Dividends taxed, some REITs offer tax advantages |

| Accessibility | Requires knowledge of real estate markets and sales processes | Accessible to retail investors through stock brokers |

Which is better?

Micro flipping offers hands-on control and potential for quick profits by buying, renovating, and selling properties in a short timeframe, appealing to investors with market knowledge and renovation skills. REITs provide diversified exposure to real estate with lower risk and liquidity, allowing investors to earn passive income through dividends without managing physical properties. Choosing between micro flipping and REITs depends on risk tolerance, capital availability, and the desired level of active involvement in real estate investments.

Connection

Micro flipping involves quickly buying, renovating, and reselling properties on a small scale, often focusing on single-family homes or condos. REITs (Real Estate Investment Trusts) pool investor capital to acquire and manage diverse real estate portfolios, including residential, commercial, and industrial properties. Both micro flipping and REITs capitalize on real estate market dynamics, offering distinct investment approaches--micro flipping targets short-term profit from property improvements, while REITs provide long-term income and portfolio diversification through collective ownership.

Key Terms

Liquidity

REITs offer high liquidity by allowing investors to buy and sell shares on major stock exchanges with ease, providing access to real estate markets without the complexities of property management. Micro flipping involves faster turnover of small, low-cost properties, but liquidity depends on the local real estate market's demand and can vary significantly. Explore deeper insights on liquidity dynamics and investment strategies between REITs and micro flipping to optimize your portfolio.

Ownership Structure

REITs (Real Estate Investment Trusts) offer investors an opportunity to own shares in large-scale, income-generating real estate properties through a pooled ownership structure, which provides liquidity and diversification. Micro flipping involves direct ownership of individual properties with short-term resale strategies, resulting in hands-on management but higher risk and less liquidity compared to REITs. Explore the nuances of ownership structure to determine which real estate investment aligns with your financial goals and risk tolerance.

Investment Horizon

REITs offer long-term investment horizons with steady income streams and portfolio diversification, ideal for investors seeking passive real estate exposure. Micro flipping involves short-term property transactions aiming for quick profits, suitable for active investors prepared for higher risk and market volatility. Explore the detailed comparison to determine which investment horizon aligns best with your financial goals.

Source and External Links

Real Estate Investment Trust - Wikipedia - A real estate investment trust (REIT) is a company that owns and operates income-producing real estate, offering tax benefits and diversified investment opportunities.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies that own or finance income-producing real estate, providing investors with regular income and diversification benefits.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale, income-producing real estate without directly owning properties.

dowidth.com

dowidth.com