Single family rental portfolios consist of individually owned homes leased separately, offering diversified investment across varied locations. Build-to-rent communities, by contrast, are designed and developed specifically for rental purposes, with uniform homes focused on scale and operational efficiency. Explore the benefits and challenges of each model to determine the ideal real estate investment strategy.

Why it is important

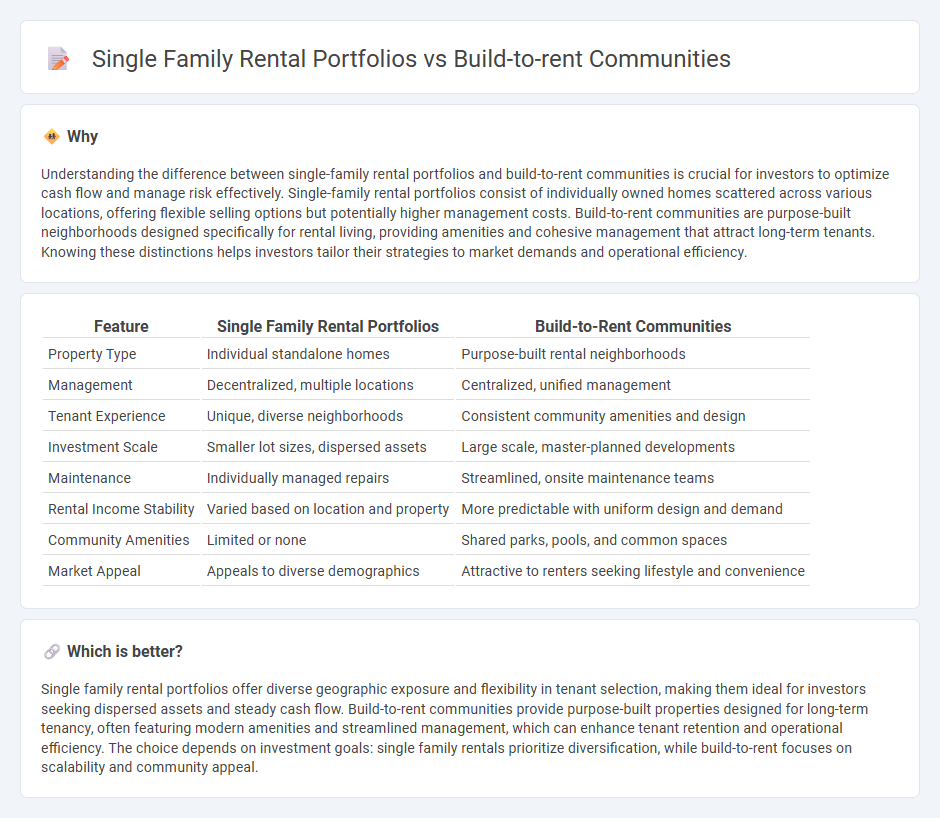

Understanding the difference between single-family rental portfolios and build-to-rent communities is crucial for investors to optimize cash flow and manage risk effectively. Single-family rental portfolios consist of individually owned homes scattered across various locations, offering flexible selling options but potentially higher management costs. Build-to-rent communities are purpose-built neighborhoods designed specifically for rental living, providing amenities and cohesive management that attract long-term tenants. Knowing these distinctions helps investors tailor their strategies to market demands and operational efficiency.

Comparison Table

| Feature | Single Family Rental Portfolios | Build-to-Rent Communities |

|---|---|---|

| Property Type | Individual standalone homes | Purpose-built rental neighborhoods |

| Management | Decentralized, multiple locations | Centralized, unified management |

| Tenant Experience | Unique, diverse neighborhoods | Consistent community amenities and design |

| Investment Scale | Smaller lot sizes, dispersed assets | Large scale, master-planned developments |

| Maintenance | Individually managed repairs | Streamlined, onsite maintenance teams |

| Rental Income Stability | Varied based on location and property | More predictable with uniform design and demand |

| Community Amenities | Limited or none | Shared parks, pools, and common spaces |

| Market Appeal | Appeals to diverse demographics | Attractive to renters seeking lifestyle and convenience |

Which is better?

Single family rental portfolios offer diverse geographic exposure and flexibility in tenant selection, making them ideal for investors seeking dispersed assets and steady cash flow. Build-to-rent communities provide purpose-built properties designed for long-term tenancy, often featuring modern amenities and streamlined management, which can enhance tenant retention and operational efficiency. The choice depends on investment goals: single family rentals prioritize diversification, while build-to-rent focuses on scalability and community appeal.

Connection

Single family rental portfolios and Build-to-Rent (BTR) communities are connected through their shared focus on providing long-term residential rental housing within suburban and urban markets. Both investment models capitalize on steady rental income generated from detached homes designed for tenant occupancy, with BTR communities often representing large-scale, professionally managed developments within these portfolios. The integration of single family rental assets into BTR strategies enhances operational efficiency, tenant retention, and scalability in the evolving real estate rental sector.

Key Terms

Ownership Structure

Build-to-rent communities often feature centralized ownership by institutional investors, enabling streamlined management and consistent property standards, whereas single-family rental portfolios typically consist of dispersed individual landlords with varied management approaches. Centralized ownership in build-to-rent developments supports scalability and operational efficiency, attracting long-term investment and fostering community engagement. Explore detailed insights on how ownership structures impact investment performance and tenant experience in both property types.

Property Management

Build-to-rent communities offer streamlined property management with centralized amenities and uniform maintenance protocols, enhancing operational efficiency and tenant satisfaction. Single family rental portfolios require individualized management approaches, often leading to varied maintenance schedules and higher administrative complexities. Discover more about optimizing property management strategies tailored to both investment models.

Investment Scale

Build-to-rent communities offer significant investment scale advantages with large, purpose-built developments often exceeding hundreds of units, providing economies of scale in management and maintenance compared to dispersed single-family rental portfolios. Single-family rental portfolios typically consist of individual homes scattered across multiple locations, which can limit operational efficiencies but allow diversification across various markets. Explore how investment scale impacts returns by diving deeper into these two rental housing models.

dowidth.com

dowidth.com