Smart contract leasing automates rental agreements using blockchain technology, ensuring transparent, tamper-proof transactions without intermediaries. Escrow services provide a trusted third party to hold funds securely until contractual obligations are met, reducing financial risk for both landlords and tenants. Explore how these innovative solutions transform real estate transactions for enhanced security and efficiency.

Why it is important

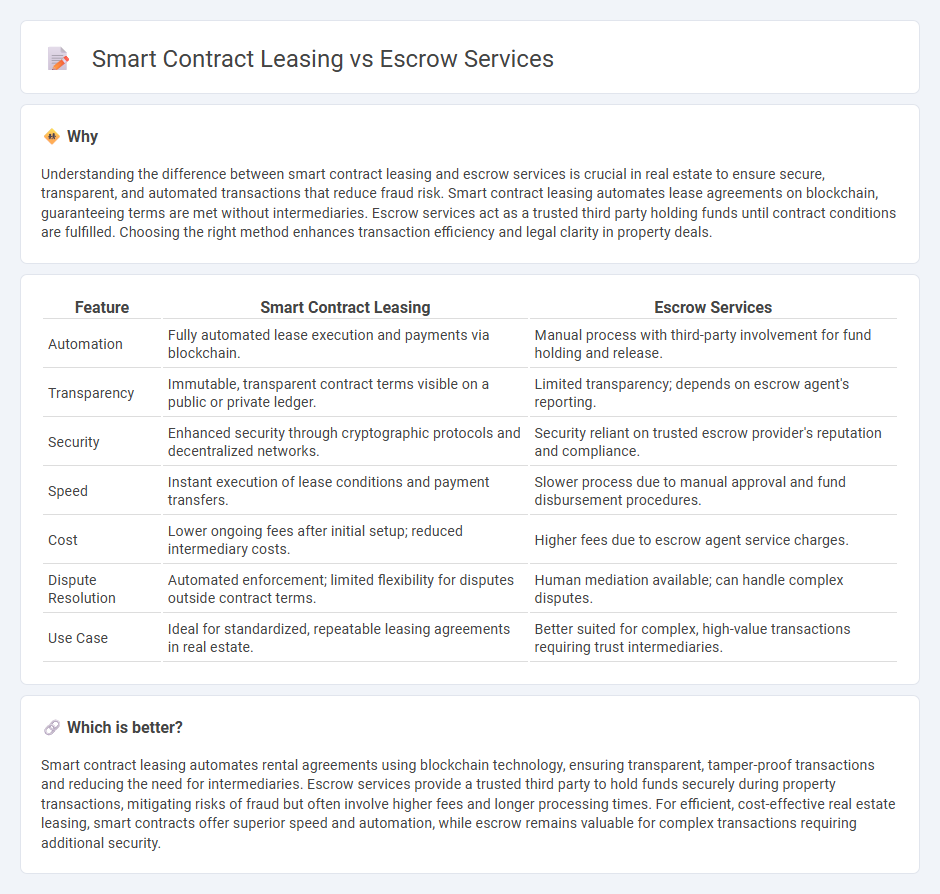

Understanding the difference between smart contract leasing and escrow services is crucial in real estate to ensure secure, transparent, and automated transactions that reduce fraud risk. Smart contract leasing automates lease agreements on blockchain, guaranteeing terms are met without intermediaries. Escrow services act as a trusted third party holding funds until contract conditions are fulfilled. Choosing the right method enhances transaction efficiency and legal clarity in property deals.

Comparison Table

| Feature | Smart Contract Leasing | Escrow Services |

|---|---|---|

| Automation | Fully automated lease execution and payments via blockchain. | Manual process with third-party involvement for fund holding and release. |

| Transparency | Immutable, transparent contract terms visible on a public or private ledger. | Limited transparency; depends on escrow agent's reporting. |

| Security | Enhanced security through cryptographic protocols and decentralized networks. | Security reliant on trusted escrow provider's reputation and compliance. |

| Speed | Instant execution of lease conditions and payment transfers. | Slower process due to manual approval and fund disbursement procedures. |

| Cost | Lower ongoing fees after initial setup; reduced intermediary costs. | Higher fees due to escrow agent service charges. |

| Dispute Resolution | Automated enforcement; limited flexibility for disputes outside contract terms. | Human mediation available; can handle complex disputes. |

| Use Case | Ideal for standardized, repeatable leasing agreements in real estate. | Better suited for complex, high-value transactions requiring trust intermediaries. |

Which is better?

Smart contract leasing automates rental agreements using blockchain technology, ensuring transparent, tamper-proof transactions and reducing the need for intermediaries. Escrow services provide a trusted third party to hold funds securely during property transactions, mitigating risks of fraud but often involve higher fees and longer processing times. For efficient, cost-effective real estate leasing, smart contracts offer superior speed and automation, while escrow remains valuable for complex transactions requiring additional security.

Connection

Smart contract leasing automates rental agreements by embedding terms directly into blockchain code, ensuring transparent and tamper-proof transactions. Escrow services integrate with smart contracts to securely hold and release funds only when leasing conditions are met, reducing the risk of fraud. This synergy enhances trust and efficiency in real estate transactions by providing real-time verification and automated enforcement of lease agreements.

Key Terms

Third-party custody

Escrow services provide third-party custody by securely holding funds or assets until contract conditions are met, ensuring trust between transacting parties. Smart contract leasing automates agreements on blockchain platforms, removing intermediaries but relying on code to enforce terms without direct custodial oversight. Explore the differences in custody mechanisms and risk management between these methods to make informed leasing decisions.

Decentralization

Escrow services act as trusted third parties to hold funds during transactions, often requiring centralized control and third-party oversight. Smart contract leasing operates on decentralized blockchain platforms, eliminating intermediaries by automatically enforcing lease terms through transparent, tamper-proof code. Explore how decentralization transforms trust and security in leasing by learning more about these innovative technologies.

Automation

Escrow services provide a traditional, third-party mediation system to secure transactions, but lack full automation and require manual oversight. Smart contract leasing leverages blockchain technology to automate lease agreements, enforce terms, and execute payments without intermediaries, reducing errors and increasing efficiency. Explore how smart contract leasing revolutionizes automation in property management to streamline transactions seamlessly.

Source and External Links

Escrow Services - Trust Gateway Portal - U.S. Bank - U.S. Bank provides a range of integrated escrow services including document review, payment services, and investment services.

Escrow Services | Corporate Trust Services - Regions offers dedicated escrow services for various transactions with fast turnaround times and experience in handling mergers and acquisitions.

Escrow.com - Escrow.com provides secure online payment processing for buyers and sellers, protecting both parties by holding funds in trust until transactions are completed.

dowidth.com

dowidth.com