Value-add real estate investments involve properties that require improvements, renovations, or repositioning to increase their value and cash flow potential, targeting higher returns with moderate risk. Core investments focus on stable, well-located properties with predictable income, offering lower risk and steady returns for conservative investors. Discover the key differences between value-add and core strategies to choose the best fit for your investment goals.

Why it is important

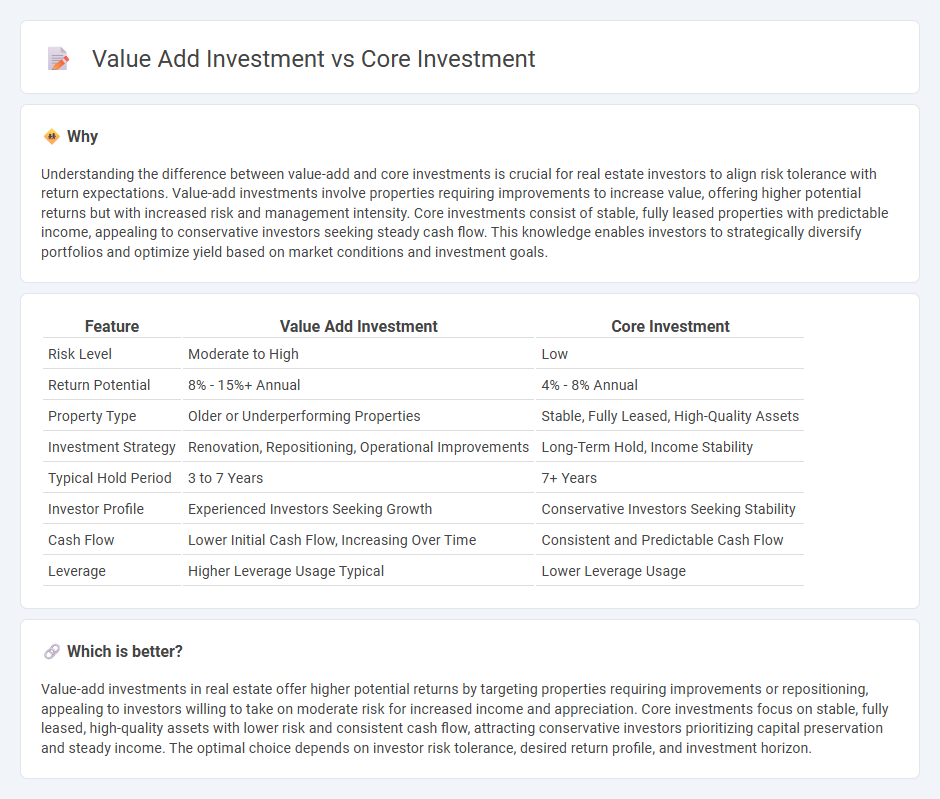

Understanding the difference between value-add and core investments is crucial for real estate investors to align risk tolerance with return expectations. Value-add investments involve properties requiring improvements to increase value, offering higher potential returns but with increased risk and management intensity. Core investments consist of stable, fully leased properties with predictable income, appealing to conservative investors seeking steady cash flow. This knowledge enables investors to strategically diversify portfolios and optimize yield based on market conditions and investment goals.

Comparison Table

| Feature | Value Add Investment | Core Investment |

|---|---|---|

| Risk Level | Moderate to High | Low |

| Return Potential | 8% - 15%+ Annual | 4% - 8% Annual |

| Property Type | Older or Underperforming Properties | Stable, Fully Leased, High-Quality Assets |

| Investment Strategy | Renovation, Repositioning, Operational Improvements | Long-Term Hold, Income Stability |

| Typical Hold Period | 3 to 7 Years | 7+ Years |

| Investor Profile | Experienced Investors Seeking Growth | Conservative Investors Seeking Stability |

| Cash Flow | Lower Initial Cash Flow, Increasing Over Time | Consistent and Predictable Cash Flow |

| Leverage | Higher Leverage Usage Typical | Lower Leverage Usage |

Which is better?

Value-add investments in real estate offer higher potential returns by targeting properties requiring improvements or repositioning, appealing to investors willing to take on moderate risk for increased income and appreciation. Core investments focus on stable, fully leased, high-quality assets with lower risk and consistent cash flow, attracting conservative investors prioritizing capital preservation and steady income. The optimal choice depends on investor risk tolerance, desired return profile, and investment horizon.

Connection

Value-add investment in real estate involves acquiring properties with potential for improvement through renovations or operational enhancements, directly impacting asset performance and increasing market value. Core investment focuses on stable, income-generating properties with lower risk and steady cash flow, often serving as a foundation for diversified portfolios. Combining value-add and core strategies allows investors to balance risk and return, leveraging the growth potential of value-add assets while maintaining portfolio stability through core holdings.

Key Terms

Risk Profile

Core investments are characterized by low risk profiles, offering stable income through well-leased, high-quality assets in prime locations. Value-add investments entail moderate to high risk, involving asset improvements or re-leasing to increase property value and generate higher returns. Explore deeper insights into risk management strategies in real estate investment by learning more about these contrasting approaches.

Stabilized Income

Core investments focus on stabilized income by targeting fully-leased, high-quality properties with predictable cash flows and low risk. Value-add investments seek properties with operational inefficiencies or potential for improvements to increase income and property value over time, introducing moderate risk. Explore core versus value-add strategies to understand which aligns best with your investment goals.

Capital Improvements

Core investments prioritize stable, income-generating assets with minimal capital improvements, targeting low-risk, high-quality properties in prime locations. Value-add investments emphasize strategic capital improvements to enhance property value and generate higher returns through renovations, repositioning, or operational upgrades. Explore key differences in capital improvement strategies to optimize your real estate portfolio effectively.

Source and External Links

Core - (investment strategy) - A real estate investment strategy focusing on low-risk, stable returns through high-quality, stabilized properties with predictable cash flows.

Core Investment Properties Fund - A private investor in retail properties across Florida and the Southeast, focusing on stable cash flow and upside potential through active management.

CORE Investment Management, LLC - A fee-only financial advisory firm offering fiduciary services to enhance client relationships and support long-term financial goals.

dowidth.com

dowidth.com