Green leases promote sustainability by integrating energy efficiency and environmental responsibility into tenant agreements, reducing operational costs and carbon footprints. Modified gross leases balance fixed rent with shared expenses, offering flexibility in utility and maintenance cost allocation between landlords and tenants. Explore deeper insights into how these lease types impact property management and tenant relations.

Why it is important

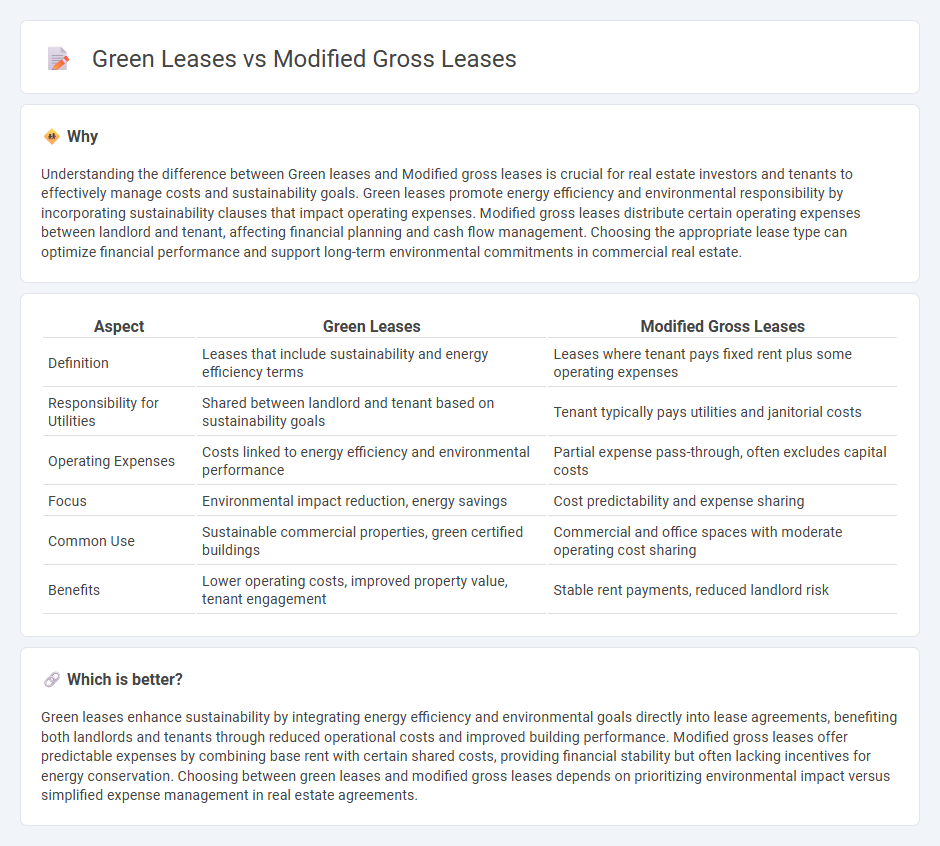

Understanding the difference between Green leases and Modified gross leases is crucial for real estate investors and tenants to effectively manage costs and sustainability goals. Green leases promote energy efficiency and environmental responsibility by incorporating sustainability clauses that impact operating expenses. Modified gross leases distribute certain operating expenses between landlord and tenant, affecting financial planning and cash flow management. Choosing the appropriate lease type can optimize financial performance and support long-term environmental commitments in commercial real estate.

Comparison Table

| Aspect | Green Leases | Modified Gross Leases |

|---|---|---|

| Definition | Leases that include sustainability and energy efficiency terms | Leases where tenant pays fixed rent plus some operating expenses |

| Responsibility for Utilities | Shared between landlord and tenant based on sustainability goals | Tenant typically pays utilities and janitorial costs |

| Operating Expenses | Costs linked to energy efficiency and environmental performance | Partial expense pass-through, often excludes capital costs |

| Focus | Environmental impact reduction, energy savings | Cost predictability and expense sharing |

| Common Use | Sustainable commercial properties, green certified buildings | Commercial and office spaces with moderate operating cost sharing |

| Benefits | Lower operating costs, improved property value, tenant engagement | Stable rent payments, reduced landlord risk |

Which is better?

Green leases enhance sustainability by integrating energy efficiency and environmental goals directly into lease agreements, benefiting both landlords and tenants through reduced operational costs and improved building performance. Modified gross leases offer predictable expenses by combining base rent with certain shared costs, providing financial stability but often lacking incentives for energy conservation. Choosing between green leases and modified gross leases depends on prioritizing environmental impact versus simplified expense management in real estate agreements.

Connection

Green leases and modified gross leases intersect by integrating sustainability commitments within flexible rent structures, enabling tenants to share operating expenses while promoting energy efficiency and environmental responsibility. Modified gross leases often incorporate green lease clauses that allocate costs for sustainable upgrades and maintenance, aligning financial incentives with ecological goals. This hybrid approach fosters collaborative efforts between landlords and tenants to reduce carbon footprints and optimize building performance in commercial real estate.

Key Terms

Operating Expenses

Modified gross leases typically allocate operating expenses such as maintenance, utilities, and property taxes partially to tenants, often through a fixed expense cap or predefined cost-sharing formula. Green leases emphasize operating expenses related to sustainability, including energy efficiency upgrades, waste management, and water conservation, promoting shared responsibility for reducing environmental impact. Explore how integrating green lease provisions can optimize operating expense management and enhance tenant-landlord collaboration.

Sustainability Clauses

Modified gross leases allocate operating expenses between landlord and tenant, typically covering property taxes, insurance, and maintenance, but may lack explicit sustainability clauses. Green leases incorporate specific sustainability obligations, such as energy efficiency targets, waste reduction, and water conservation measures, aligning tenant and landlord efforts toward environmental goals. Explore the distinct benefits and implementation strategies of sustainability clauses in these lease types to optimize eco-friendly property management.

Utility Responsibility

Modified gross leases require tenants to pay a base rent covering most expenses, with utility costs often included or shared, limiting direct tenant responsibility. Green leases specifically assign utility expenses to tenants, encouraging energy-efficient practices and aligning with sustainability goals. Explore how these lease types impact utility management and tenant incentives for energy conservation.

Source and External Links

What Is a Modified Gross Lease, and How Does It Work? - A modified gross lease is a real estate rental agreement where both landlords and tenants share property operating expenses, providing a balance between control and predictability.

What is a Modified Gross Lease & How Does It Work? - This lease structure involves both landlords and tenants paying a portion of a property's operating expenses, with responsibilities varying based on market conditions and negotiations.

AI Review for Modified Gross Office Lease Agreements - The modified gross lease is a flexible, hybrid lease type that combines elements of gross and triple net leases, offering customization in cost responsibilities.

dowidth.com

dowidth.com