Leaseback programs allow property owners to sell their real estate while leasing it back, ensuring continued operational use and immediate capital influx. Modified gross leases require tenants to pay a base rent plus a portion of property expenses such as taxes and maintenance, balancing costs between landlord and tenant. Explore the advantages and applications of both lease structures to determine the best fit for your investment goals.

Why it is important

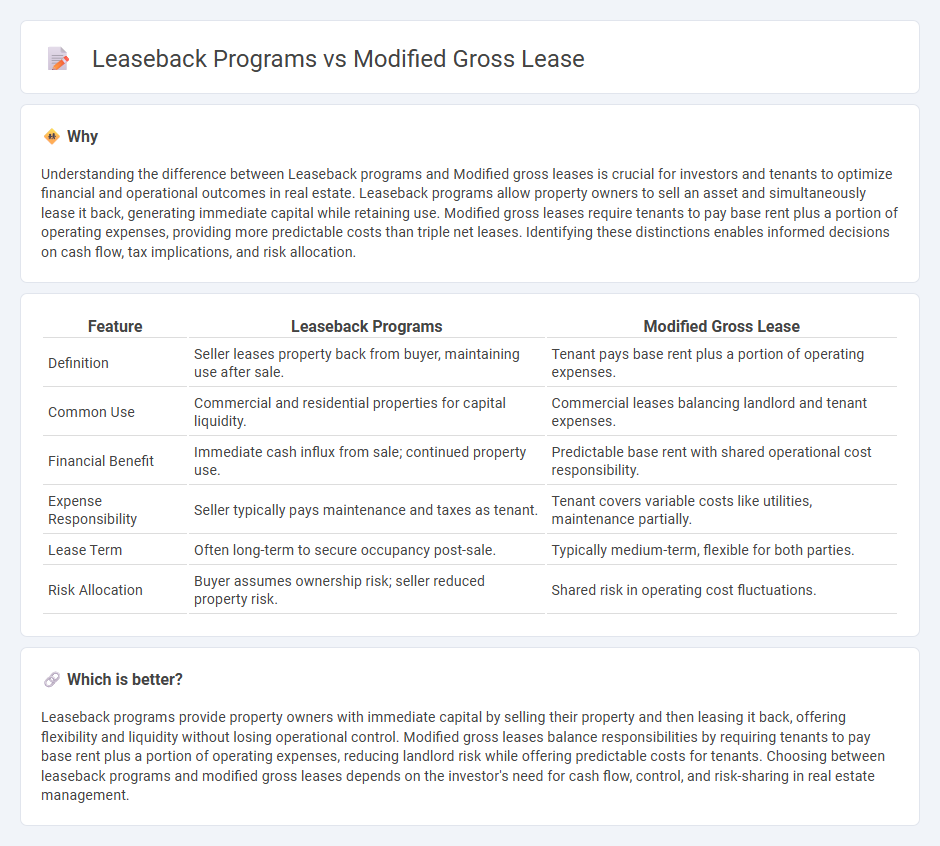

Understanding the difference between Leaseback programs and Modified gross leases is crucial for investors and tenants to optimize financial and operational outcomes in real estate. Leaseback programs allow property owners to sell an asset and simultaneously lease it back, generating immediate capital while retaining use. Modified gross leases require tenants to pay base rent plus a portion of operating expenses, providing more predictable costs than triple net leases. Identifying these distinctions enables informed decisions on cash flow, tax implications, and risk allocation.

Comparison Table

| Feature | Leaseback Programs | Modified Gross Lease |

|---|---|---|

| Definition | Seller leases property back from buyer, maintaining use after sale. | Tenant pays base rent plus a portion of operating expenses. |

| Common Use | Commercial and residential properties for capital liquidity. | Commercial leases balancing landlord and tenant expenses. |

| Financial Benefit | Immediate cash influx from sale; continued property use. | Predictable base rent with shared operational cost responsibility. |

| Expense Responsibility | Seller typically pays maintenance and taxes as tenant. | Tenant covers variable costs like utilities, maintenance partially. |

| Lease Term | Often long-term to secure occupancy post-sale. | Typically medium-term, flexible for both parties. |

| Risk Allocation | Buyer assumes ownership risk; seller reduced property risk. | Shared risk in operating cost fluctuations. |

Which is better?

Leaseback programs provide property owners with immediate capital by selling their property and then leasing it back, offering flexibility and liquidity without losing operational control. Modified gross leases balance responsibilities by requiring tenants to pay base rent plus a portion of operating expenses, reducing landlord risk while offering predictable costs for tenants. Choosing between leaseback programs and modified gross leases depends on the investor's need for cash flow, control, and risk-sharing in real estate management.

Connection

Leaseback programs and modified gross leases intersect by offering flexible financial arrangements where tenants lease property while the original owner retains some ownership or financial interest. Modified gross leases allocate operating expenses between landlord and tenant, often complementing leaseback structures to balance cost responsibilities. This synergy supports investment strategies leveraging property use and income distribution in real estate transactions.

Key Terms

Expense Sharing

Modified gross leases allocate certain operating expenses like property taxes and insurance to tenants while landlords cover structural repairs, optimizing cost predictability. Leaseback programs involve a property owner selling and then leasing back the same asset, concentrating on expense sharing through negotiated terms that often encompass maintenance and utilities. Explore how each structure impacts financial planning and operational control for tenants and landlords.

Ownership Structure

Modified gross leases allocate most operating expenses like property taxes and insurance to the landlord, while tenants cover a portion of utilities and maintenance, maintaining clearer operational cost responsibility boundaries. Leaseback programs involve an owner selling a property and leasing it back, enabling capital infusion while retaining operational control, often used in corporate real estate to optimize balance sheets. Explore the nuances between these leasing structures to understand their impact on ownership and financial strategies.

Rental Payments

Modified gross lease typically includes base rent plus certain operating expenses, providing tenants predictable rental payments with some variability based on expense fluctuations. Leaseback programs involve selling an asset and leasing it back, often resulting in stable, long-term rental payments tied to the property's market value. Explore how these rental payment structures impact financial planning and cash flow management in commercial real estate.

Source and External Links

The Trend Towards Modified Gross Leases and Their Unpredictable Expense Structure - This article discusses the trend towards modified gross leases, where tenants and landlords share property expenses, and the unpredictability of these expenses.

Modified Gross Lease - How is it different from a Triple Net Lease - Explains how a modified gross lease differs from a triple net lease by splitting responsibility for property expenses between the landlord and tenant.

What Is a Modified Gross Lease, and How Does It Work? - Delivers insights into the structure and impact of modified gross leases in commercial real estate, highlighting shared expenses and negotiation flexibility.

dowidth.com

dowidth.com