Escrow crowdfunding and lease-to-own agreements represent innovative real estate investment and ownership models catering to diverse financial strategies. Escrow crowdfunding pools resources from multiple investors to purchase properties via a secured escrow account, ensuring transparent, collective ownership. Explore the advantages, risks, and mechanisms of these models to identify the best fit for your real estate goals.

Why it is important

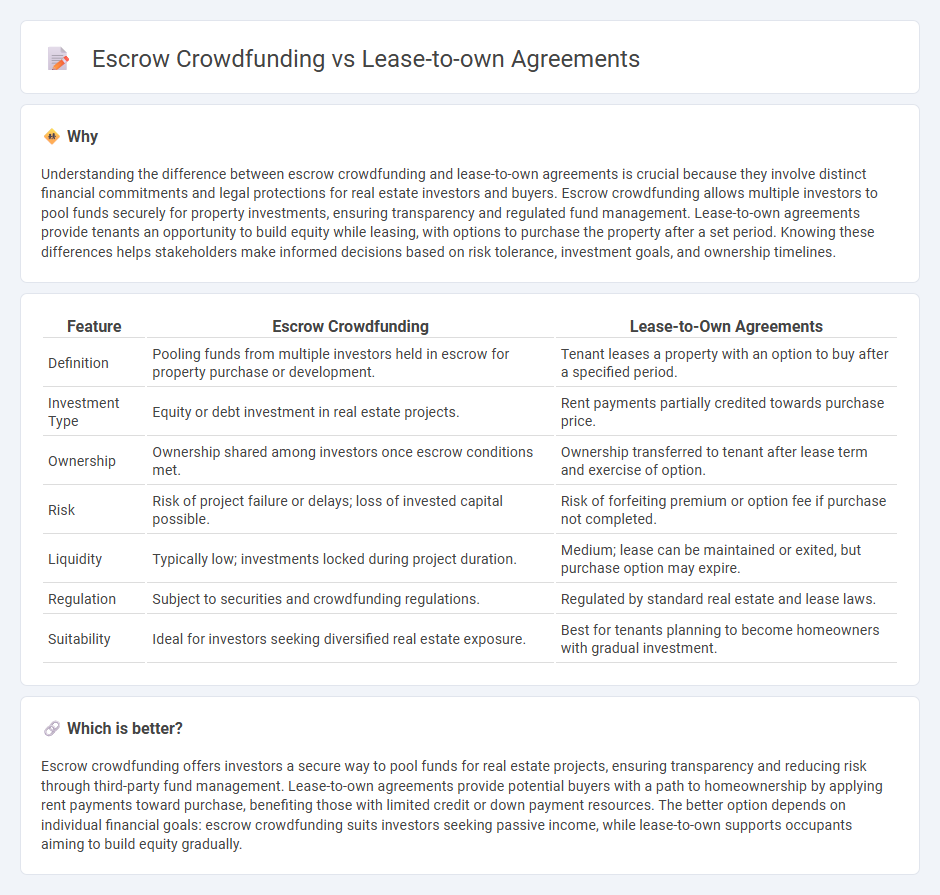

Understanding the difference between escrow crowdfunding and lease-to-own agreements is crucial because they involve distinct financial commitments and legal protections for real estate investors and buyers. Escrow crowdfunding allows multiple investors to pool funds securely for property investments, ensuring transparency and regulated fund management. Lease-to-own agreements provide tenants an opportunity to build equity while leasing, with options to purchase the property after a set period. Knowing these differences helps stakeholders make informed decisions based on risk tolerance, investment goals, and ownership timelines.

Comparison Table

| Feature | Escrow Crowdfunding | Lease-to-Own Agreements |

|---|---|---|

| Definition | Pooling funds from multiple investors held in escrow for property purchase or development. | Tenant leases a property with an option to buy after a specified period. |

| Investment Type | Equity or debt investment in real estate projects. | Rent payments partially credited towards purchase price. |

| Ownership | Ownership shared among investors once escrow conditions met. | Ownership transferred to tenant after lease term and exercise of option. |

| Risk | Risk of project failure or delays; loss of invested capital possible. | Risk of forfeiting premium or option fee if purchase not completed. |

| Liquidity | Typically low; investments locked during project duration. | Medium; lease can be maintained or exited, but purchase option may expire. |

| Regulation | Subject to securities and crowdfunding regulations. | Regulated by standard real estate and lease laws. |

| Suitability | Ideal for investors seeking diversified real estate exposure. | Best for tenants planning to become homeowners with gradual investment. |

Which is better?

Escrow crowdfunding offers investors a secure way to pool funds for real estate projects, ensuring transparency and reducing risk through third-party fund management. Lease-to-own agreements provide potential buyers with a path to homeownership by applying rent payments toward purchase, benefiting those with limited credit or down payment resources. The better option depends on individual financial goals: escrow crowdfunding suits investors seeking passive income, while lease-to-own supports occupants aiming to build equity gradually.

Connection

Escrow crowdfunding in real estate secures funds from multiple investors into a trusted third-party account, ensuring transparent financial transactions during property investments. Lease-to-own agreements allow tenants to rent properties with an option to purchase, often relying on escrow accounts to hold option fees securely. Combining escrow crowdfunding with lease-to-own agreements enhances investor confidence and protects buyers by safeguarding payments until contractual conditions are met.

Key Terms

Lease-to-Own Agreements:

Lease-to-own agreements provide a flexible path to homeownership by allowing tenants to apply rent payments toward future purchase prices, often benefiting those with limited credit access. These agreements typically include detailed terms on rent credits and purchase options, offering clarity and security for both tenants and landlords. Explore the advantages and legal considerations of lease-to-own agreements to better understand this alternative home financing option.

Option Fee

Lease-to-own agreements require an initial option fee, typically 1-5% of the purchase price, which secures the buyer's right to purchase the property within a specified period. Escrow crowdfunding platforms pool investments and hold funds in escrow until project milestones are met, with investors usually not paying an upfront option fee but contributing capital toward the project's completion. Explore the differences in financial commitments and risk management between these approaches to understand which option aligns best with your investment strategy.

Rent Credit

Lease-to-own agreements allow tenants to accumulate rent credits that apply toward the future purchase of the property, effectively combining housing and investment. Escrow crowdfunding pools funds from multiple investors to finance real estate projects, but typically does not offer rent credits to participants. Explore the nuances of rent credit applications in lease-to-own agreements compared to escrow crowdfunding to understand your best path to homeownership.

Source and External Links

Lease to Own vs Lease Purchase - This webpage explains the key differences between lease-to-own and lease purchase agreements, highlighting their structures and obligations.

Lease Purchase Contract - This page describes lease purchase contracts as rent-to-own agreements, detailing elements such as property value, duration, and monthly payments.

Lease Purchase Agreement - This article provides an in-depth look at lease purchase agreements, discussing their benefits and legal implications for prospective homebuyers.

dowidth.com

dowidth.com