Build to rent properties offer purpose-built homes designed specifically for long-term rental, often managed by professional landlords ensuring consistent maintenance and tenant support. Leasehold housing involves owning the property for a fixed term while paying ground rent and service charges to the freeholder, with ownership reverting back at lease expiry. Explore the key differences, benefits, and investment potential between build to rent and leasehold housing models.

Why it is important

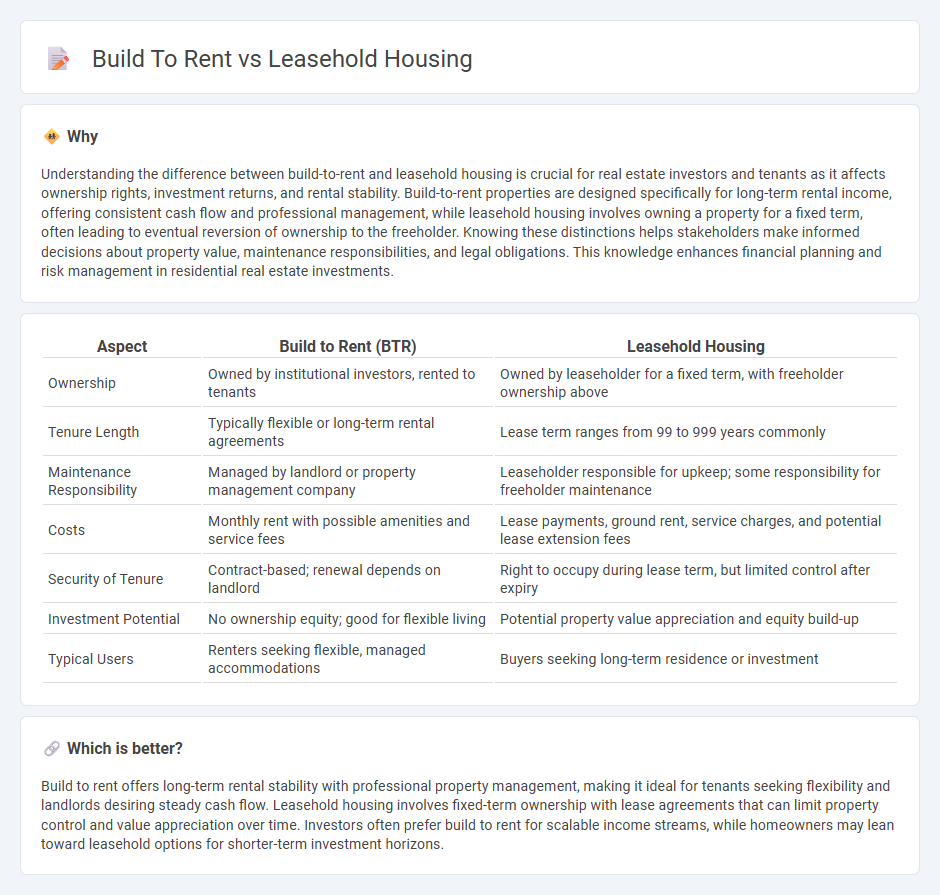

Understanding the difference between build-to-rent and leasehold housing is crucial for real estate investors and tenants as it affects ownership rights, investment returns, and rental stability. Build-to-rent properties are designed specifically for long-term rental income, offering consistent cash flow and professional management, while leasehold housing involves owning a property for a fixed term, often leading to eventual reversion of ownership to the freeholder. Knowing these distinctions helps stakeholders make informed decisions about property value, maintenance responsibilities, and legal obligations. This knowledge enhances financial planning and risk management in residential real estate investments.

Comparison Table

| Aspect | Build to Rent (BTR) | Leasehold Housing |

|---|---|---|

| Ownership | Owned by institutional investors, rented to tenants | Owned by leaseholder for a fixed term, with freeholder ownership above |

| Tenure Length | Typically flexible or long-term rental agreements | Lease term ranges from 99 to 999 years commonly |

| Maintenance Responsibility | Managed by landlord or property management company | Leaseholder responsible for upkeep; some responsibility for freeholder maintenance |

| Costs | Monthly rent with possible amenities and service fees | Lease payments, ground rent, service charges, and potential lease extension fees |

| Security of Tenure | Contract-based; renewal depends on landlord | Right to occupy during lease term, but limited control after expiry |

| Investment Potential | No ownership equity; good for flexible living | Potential property value appreciation and equity build-up |

| Typical Users | Renters seeking flexible, managed accommodations | Buyers seeking long-term residence or investment |

Which is better?

Build to rent offers long-term rental stability with professional property management, making it ideal for tenants seeking flexibility and landlords desiring steady cash flow. Leasehold housing involves fixed-term ownership with lease agreements that can limit property control and value appreciation over time. Investors often prefer build to rent for scalable income streams, while homeowners may lean toward leasehold options for shorter-term investment horizons.

Connection

Build-to-rent developments are often structured under leasehold arrangements, allowing investors to maintain long-term ownership while offering tenants secure, professionally managed housing. Leasehold housing provides a stable legal framework that supports the build-to-rent model by defining property rights and rental terms over extended periods. This synergy enhances the appeal of rental properties, attracting both tenants seeking flexibility and investors prioritizing steady income streams.

Key Terms

Tenure

Leasehold housing involves purchasing a property with ownership limited to a fixed term, typically 99 to 999 years, placing responsibility for maintenance and ground rent on the leaseholder. Build to rent (BTR) properties remain under single ownership, often by institutional investors, offering long-term rental contracts with professional management and additional tenant amenities. Explore in-depth comparisons of leasehold and BTR tenures to understand financial implications, rights, and tenant protections.

Landlord

Leasehold housing grants landlords ownership of the property for a fixed term, often leading to responsibilities such as ground rent and maintenance fees that can impact long-term returns. Build to rent (BTR) offers landlords a steady income stream from purpose-built rental properties designed for multi-tenancy, with professional management enhancing tenant retention and reducing void periods. Explore more about how these models affect landlord profitability and portfolio management strategies.

Rent

Leasehold housing typically involves tenants paying rent to a landlord for a fixed term, often with lease agreements spanning several decades, impacting long-term affordability and control. Build-to-rent properties are designed specifically for rental purposes, offering flexible lease terms and management services tailored to renters' needs, often resulting in more predictable rent payments and maintenance. Explore deeper comparisons to understand how each model influences rental market dynamics and tenant rights.

Source and External Links

Buying a Leasehold Property - This guide provides information on buying a leasehold house, including the implications of owning a property for a set period while paying ground rent to the freeholder.

What Is a Leasehold Property? - This article explains the concept of leasehold property, focusing on the rights and responsibilities of owning a property for a specified period without owning the land it sits on.

What Is a Leasehold Property & Is It Right For You? - This blog post delves into how leasehold properties work, including the implications of owning a structure but not the land, and the associated costs like ground rent and maintenance fees.

dowidth.com

dowidth.com