Tokenized real estate offers fractional ownership through blockchain technology, providing enhanced liquidity and transparency in property investments compared to traditional Real Estate Investment Trusts (REITs), which pool investor capital to buy and manage a diversified portfolio of income-generating properties. Unlike REITs, tokenized real estate enables direct buying, selling, and trading of individual real estate assets on digital platforms, reducing barriers to entry and increasing market accessibility. Discover how tokenized real estate is transforming property investment landscapes beyond conventional REIT structures.

Why it is important

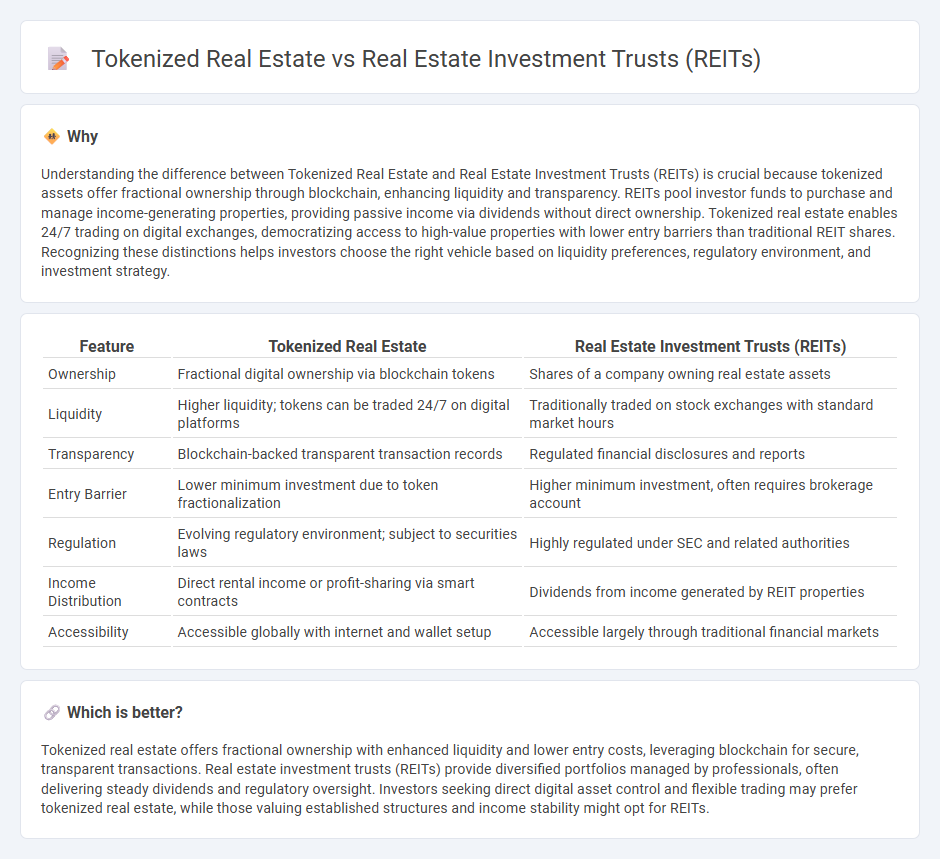

Understanding the difference between Tokenized Real Estate and Real Estate Investment Trusts (REITs) is crucial because tokenized assets offer fractional ownership through blockchain, enhancing liquidity and transparency. REITs pool investor funds to purchase and manage income-generating properties, providing passive income via dividends without direct ownership. Tokenized real estate enables 24/7 trading on digital exchanges, democratizing access to high-value properties with lower entry barriers than traditional REIT shares. Recognizing these distinctions helps investors choose the right vehicle based on liquidity preferences, regulatory environment, and investment strategy.

Comparison Table

| Feature | Tokenized Real Estate | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Ownership | Fractional digital ownership via blockchain tokens | Shares of a company owning real estate assets |

| Liquidity | Higher liquidity; tokens can be traded 24/7 on digital platforms | Traditionally traded on stock exchanges with standard market hours |

| Transparency | Blockchain-backed transparent transaction records | Regulated financial disclosures and reports |

| Entry Barrier | Lower minimum investment due to token fractionalization | Higher minimum investment, often requires brokerage account |

| Regulation | Evolving regulatory environment; subject to securities laws | Highly regulated under SEC and related authorities |

| Income Distribution | Direct rental income or profit-sharing via smart contracts | Dividends from income generated by REIT properties |

| Accessibility | Accessible globally with internet and wallet setup | Accessible largely through traditional financial markets |

Which is better?

Tokenized real estate offers fractional ownership with enhanced liquidity and lower entry costs, leveraging blockchain for secure, transparent transactions. Real estate investment trusts (REITs) provide diversified portfolios managed by professionals, often delivering steady dividends and regulatory oversight. Investors seeking direct digital asset control and flexible trading may prefer tokenized real estate, while those valuing established structures and income stability might opt for REITs.

Connection

Tokenized real estate and Real Estate Investment Trusts (REITs) both enable fractional ownership in real estate assets, enhancing accessibility and liquidity for investors. Tokenized real estate leverages blockchain technology to digitize property shares, allowing for seamless trading and reduced transaction costs, while REITs pool investor capital to invest in diversified real estate portfolios that generate income through rent and capital appreciation. The integration of tokenization with REIT structures can streamline property management, improve transparency, and expand investor participation globally.

Key Terms

Liquidity

Real estate investment trusts (REITs) offer investors liquidity through publicly traded shares on major stock exchanges, enabling easy buying and selling. Tokenized real estate leverages blockchain technology to provide fractional ownership with enhanced liquidity by facilitating peer-to-peer transactions on decentralized platforms. Explore how advances in tokenization are transforming liquidity dynamics in real estate investing.

Fractional Ownership

Real estate investment trusts (REITs) provide investors with fractional ownership in diversified property portfolios through publicly traded shares, offering liquidity and regulatory oversight. Tokenized real estate enables fractional ownership by digitizing property assets on blockchain platforms, enhancing transparency, reducing entry barriers, and facilitating peer-to-peer trading. Explore the advantages and challenges of both models to determine which aligns best with your investment goals.

Regulation

Real estate investment trusts (REITs) are governed by established securities regulations such as the SEC's regulatory framework in the United States, ensuring investor protection through stringent disclosure and compliance requirements. Tokenized real estate operates within a rapidly evolving legal landscape, often navigating both securities laws and emerging digital asset regulations, which vary significantly by jurisdiction. Explore further to understand the regulatory nuances and compliance challenges in real estate investment modalities.

Source and External Links

Real Estate Investment Trust - Wikipedia - A real estate investment trust (REIT) is a company that owns or operates income-producing real estate, often offering benefits like tax advantages and high dividends.

What's a REIT (Real Estate Investment Trust)? - Nareit - A REIT is a company that owns, operates, or finances income-producing real estate, providing investors with income streams and capital appreciation.

Real Estate Investment Trusts (REITs) - Charles Schwab - REITs are corporations that own and operate income-producing real estate, allowing investors to participate via stock exchanges and offering special tax benefits.

dowidth.com

dowidth.com