Green leases promote sustainable property management by incorporating energy efficiency and environmental standards into rental agreements, reducing carbon footprints and operational costs. Index leases adjust rent based on inflation or market indexes, ensuring that rental income stays aligned with economic changes over time. Discover how these leasing strategies impact real estate investment returns and tenant relationships.

Why it is important

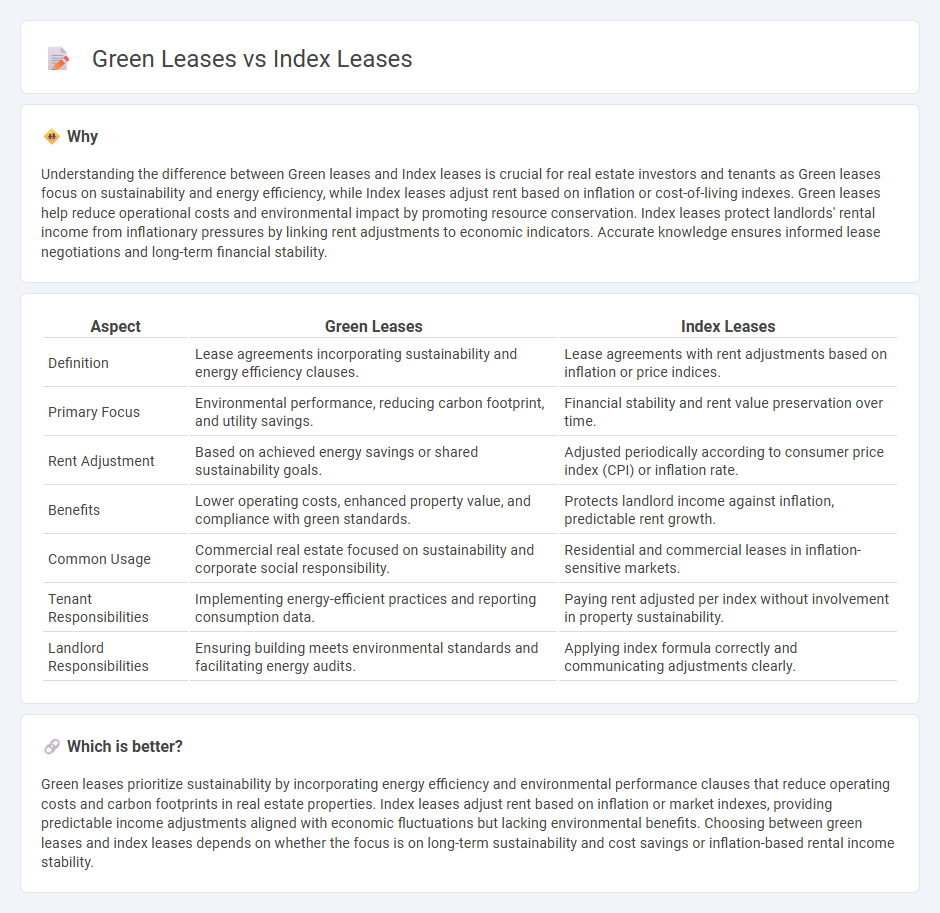

Understanding the difference between Green leases and Index leases is crucial for real estate investors and tenants as Green leases focus on sustainability and energy efficiency, while Index leases adjust rent based on inflation or cost-of-living indexes. Green leases help reduce operational costs and environmental impact by promoting resource conservation. Index leases protect landlords' rental income from inflationary pressures by linking rent adjustments to economic indicators. Accurate knowledge ensures informed lease negotiations and long-term financial stability.

Comparison Table

| Aspect | Green Leases | Index Leases |

|---|---|---|

| Definition | Lease agreements incorporating sustainability and energy efficiency clauses. | Lease agreements with rent adjustments based on inflation or price indices. |

| Primary Focus | Environmental performance, reducing carbon footprint, and utility savings. | Financial stability and rent value preservation over time. |

| Rent Adjustment | Based on achieved energy savings or shared sustainability goals. | Adjusted periodically according to consumer price index (CPI) or inflation rate. |

| Benefits | Lower operating costs, enhanced property value, and compliance with green standards. | Protects landlord income against inflation, predictable rent growth. |

| Common Usage | Commercial real estate focused on sustainability and corporate social responsibility. | Residential and commercial leases in inflation-sensitive markets. |

| Tenant Responsibilities | Implementing energy-efficient practices and reporting consumption data. | Paying rent adjusted per index without involvement in property sustainability. |

| Landlord Responsibilities | Ensuring building meets environmental standards and facilitating energy audits. | Applying index formula correctly and communicating adjustments clearly. |

Which is better?

Green leases prioritize sustainability by incorporating energy efficiency and environmental performance clauses that reduce operating costs and carbon footprints in real estate properties. Index leases adjust rent based on inflation or market indexes, providing predictable income adjustments aligned with economic fluctuations but lacking environmental benefits. Choosing between green leases and index leases depends on whether the focus is on long-term sustainability and cost savings or inflation-based rental income stability.

Connection

Green leases and index leases both align landlord-tenant interests by incorporating sustainability and inflation metrics into lease agreements. Green leases promote energy efficiency and environmental responsibility by sharing costs and benefits related to green building features, reducing overall operational expenses. Index leases adjust rent based on inflation indices, ensuring the financial sustainability of eco-friendly investments embedded in green leases while maintaining predictable lease economics.

Key Terms

Rent Adjustment

Index leases adjust rent based on a specific economic indicator, such as the Consumer Price Index (CPI), ensuring rental payments reflect inflation or market trends. Green leases incorporate sustainability clauses that promote energy efficiency and environmental responsibility, often linking rent adjustments to the building's performance or shared savings. Explore how both lease types can optimize rent adjustment strategies for better financial and environmental outcomes.

Operating Expenses

Index leases adjust rent based on changes in a specific inflation index, impacting operating expenses through predictable cost escalations tied to market inflation rates. Green leases incorporate sustainability clauses that promote energy efficiency and reduced environmental impact, potentially lowering operating expenses via reduced utility consumption and maintenance costs. Explore how integrating these lease types can optimize operating expense management and drive sustainable financial outcomes.

Sustainability Clauses

Index leases primarily tie rent adjustments to inflation or market indices without explicitly addressing environmental performance, whereas green leases incorporate sustainability clauses that promote energy efficiency, waste reduction, and resource conservation. These sustainability clauses often mandate shared responsibilities between landlords and tenants to meet environmental standards and achieve certification goals such as LEED or BREEAM. Explore the evolving role of green leases in driving sustainable real estate practices and regulatory compliance.

Source and External Links

Index lease - An index lease is a property lease where rent is periodically adjusted based on a specific index, often the Consumer Price Index (CPI), to protect landlords from inflation while giving tenants advance notice of changes.

What is an index lease? - It is a lease agreement with rent adjustments tied to a benchmark index like the CPI, ensuring rent keeps pace with inflation, offering transparency and predictability for tenants.

How To Calculate An Index Lease - raamp - Index lease rent adjustment is calculated using the formula (Current index value - Base index value) / Base index value, often including base rent, rate of increase, and growth caps to control rent rises.

dowidth.com

dowidth.com