House hacking maximizes property utilization by living in one portion while renting out other units, generating steady rental income and reducing living expenses. Flipping involves purchasing undervalued properties, renovating them swiftly, and selling for profit, requiring market expertise and renovation skills. Discover more strategies to enhance your real estate investment portfolio.

Why it is important

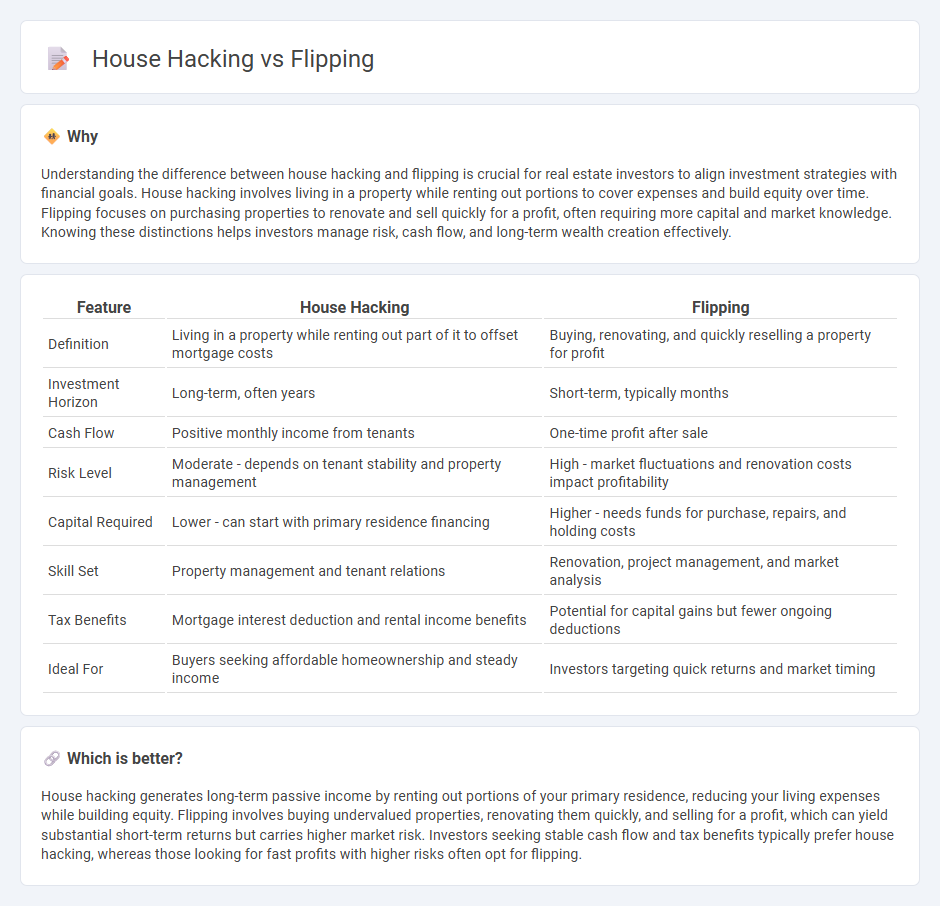

Understanding the difference between house hacking and flipping is crucial for real estate investors to align investment strategies with financial goals. House hacking involves living in a property while renting out portions to cover expenses and build equity over time. Flipping focuses on purchasing properties to renovate and sell quickly for a profit, often requiring more capital and market knowledge. Knowing these distinctions helps investors manage risk, cash flow, and long-term wealth creation effectively.

Comparison Table

| Feature | House Hacking | Flipping |

|---|---|---|

| Definition | Living in a property while renting out part of it to offset mortgage costs | Buying, renovating, and quickly reselling a property for profit |

| Investment Horizon | Long-term, often years | Short-term, typically months |

| Cash Flow | Positive monthly income from tenants | One-time profit after sale |

| Risk Level | Moderate - depends on tenant stability and property management | High - market fluctuations and renovation costs impact profitability |

| Capital Required | Lower - can start with primary residence financing | Higher - needs funds for purchase, repairs, and holding costs |

| Skill Set | Property management and tenant relations | Renovation, project management, and market analysis |

| Tax Benefits | Mortgage interest deduction and rental income benefits | Potential for capital gains but fewer ongoing deductions |

| Ideal For | Buyers seeking affordable homeownership and steady income | Investors targeting quick returns and market timing |

Which is better?

House hacking generates long-term passive income by renting out portions of your primary residence, reducing your living expenses while building equity. Flipping involves buying undervalued properties, renovating them quickly, and selling for a profit, which can yield substantial short-term returns but carries higher market risk. Investors seeking stable cash flow and tax benefits typically prefer house hacking, whereas those looking for fast profits with higher risks often opt for flipping.

Connection

House hacking and flipping both maximize real estate investment returns by leveraging property value growth and rental income strategies. House hacking involves living in a property while renting out portions to offset mortgage costs, creating steady cash flow and equity buildup. Flipping capitalizes on purchasing undervalued properties, renovating, and selling them quickly for profit, often benefiting from market knowledge gained through house hacking experiences.

Key Terms

Renovation

Flipping involves purchasing a property, renovating it extensively to increase its market value, and selling it quickly for a profit, often requiring significant capital and detailed renovation planning. House hacking typically consists of buying a multi-unit property, renovating individual units to attract tenants, and living in one while generating rental income to offset mortgage costs. Explore the detailed strategies and financial benefits of both approaches to optimize your renovation investment.

Rental Income

Flipping properties involves buying, renovating, and quickly selling homes to generate short-term profits, whereas house hacking centers on purchasing multi-unit properties or homes with extra space to live in one unit while renting out the others for consistent rental income. House hacking offers long-term financial benefits through passive income and property appreciation, making it a sustainable wealth-building strategy compared to the higher risk and effort required in flipping. Discover how choosing between flipping and house hacking can maximize your rental income potential.

Financing

Flipping properties requires substantial upfront capital and often involves short-term financing such as hard money loans or private lenders to cover renovation costs quickly. House hacking leverages traditional mortgages with lower down payments while generating rental income that can offset monthly mortgage payments, making it more accessible for first-time investors. Explore detailed financing strategies for both to determine the best approach for your real estate investment goals.

Source and External Links

Flipping - Wikipedia - Flipping is the process of buying, rehabilitating, and quickly reselling properties or assets for profit, commonly used in real estate investing and sometimes resulting in economic bubbles.

Flipping Houses: A How-To Guide For Beginners - Bankrate - Flipping houses involves purchasing properties, renovating them, then selling at a higher price, offering potential large profits and neighborhood improvement but also involving risks.

FlippingBook | Flipbook Maker for Digital Publishing - FlippingBook is a digital publishing tool that converts PDFs into interactive online flipbooks to engage audiences and boost marketing efforts.

dowidth.com

dowidth.com