Build-to-rent homes offer single-family properties designed specifically for long-term leasing, providing tenants with spacious layouts and private outdoor areas, contrasting sharply with condominiums that are individually owned units within multi-family buildings. These rental homes often appeal to tenants seeking community amenities and suburban comfort without the commitment of ownership, while condominiums attract buyers interested in equity building and urban living convenience. Explore the distinct advantages and lifestyle impacts of build-to-rent homes versus condominiums to make an informed real estate decision.

Why it is important

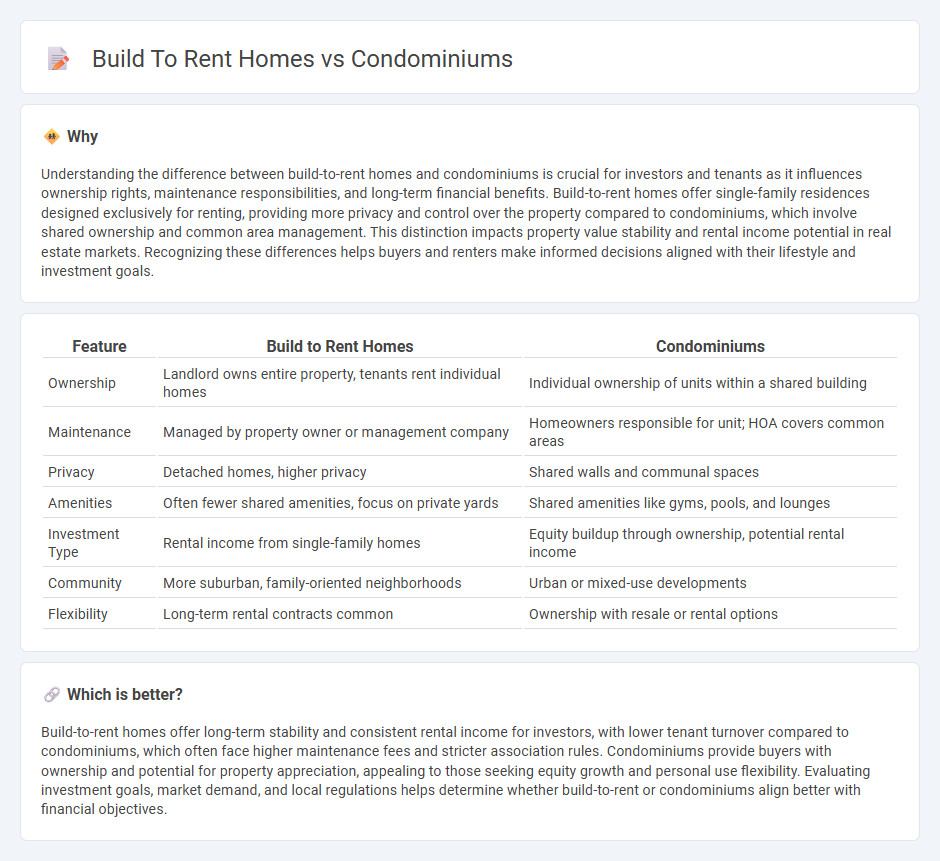

Understanding the difference between build-to-rent homes and condominiums is crucial for investors and tenants as it influences ownership rights, maintenance responsibilities, and long-term financial benefits. Build-to-rent homes offer single-family residences designed exclusively for renting, providing more privacy and control over the property compared to condominiums, which involve shared ownership and common area management. This distinction impacts property value stability and rental income potential in real estate markets. Recognizing these differences helps buyers and renters make informed decisions aligned with their lifestyle and investment goals.

Comparison Table

| Feature | Build to Rent Homes | Condominiums |

|---|---|---|

| Ownership | Landlord owns entire property, tenants rent individual homes | Individual ownership of units within a shared building |

| Maintenance | Managed by property owner or management company | Homeowners responsible for unit; HOA covers common areas |

| Privacy | Detached homes, higher privacy | Shared walls and communal spaces |

| Amenities | Often fewer shared amenities, focus on private yards | Shared amenities like gyms, pools, and lounges |

| Investment Type | Rental income from single-family homes | Equity buildup through ownership, potential rental income |

| Community | More suburban, family-oriented neighborhoods | Urban or mixed-use developments |

| Flexibility | Long-term rental contracts common | Ownership with resale or rental options |

Which is better?

Build-to-rent homes offer long-term stability and consistent rental income for investors, with lower tenant turnover compared to condominiums, which often face higher maintenance fees and stricter association rules. Condominiums provide buyers with ownership and potential for property appreciation, appealing to those seeking equity growth and personal use flexibility. Evaluating investment goals, market demand, and local regulations helps determine whether build-to-rent or condominiums align better with financial objectives.

Connection

Build-to-rent homes and condominiums share a strategic connection in urban real estate development by addressing the growing demand for rental housing in high-density areas. Both property types focus on long-term rental viability, leveraging modern design and amenities to attract stable tenant populations. Investors benefit from predictable cash flow and reduced vacancy risks by integrating build-to-rent principles into condominium projects.

Key Terms

Ownership Structure

Condominiums offer individual ownership of units within a shared property, often including access to communal amenities and a homeowners' association managing maintenance and regulations. Build-to-rent homes feature single-family residences owned by a single entity, typically a company or investment group, providing tenants with rental agreements rather than ownership rights. Explore the distinct ownership dynamics and financial implications of these housing models to make informed decisions.

Maintenance Responsibility

Condominiums often shift maintenance responsibility to the homeowners' association, covering common areas and exterior repairs, while individual unit owners handle interior upkeep. Build-to-rent homes place all maintenance obligations squarely on the property management or landlord, streamlining tenant experience but potentially increasing rents. Explore detailed comparisons to understand how these maintenance frameworks impact long-term living costs and convenience.

Investment Model

Condominiums typically involve individual ownership of units within a shared property, generating income through resale value and potential rental when permitted, while Build-to-Rent (BTR) homes are professionally managed rental properties designed to provide consistent rental income and long-term asset appreciation. The condominium investment model often depends on market demand fluctuations and maintenance fees, whereas Build-to-Rent offers scalability, centralized management, and predictable cash flow driven by institutional investors. Explore the nuances of these investment models to determine which aligns best with your financial goals.

Source and External Links

Condominiums Defined - This webpage defines a condominium as an estate in real property with shared interests in common areas and separate units owned individually.

What is a condo? - This article explains that condominiums are residential complexes where each unit is owned by an individual, with shared common areas managed by a homeowners association.

What Is A Condo? - This resource describes condominiums as individual residential units within a community, where owners jointly own shared common areas and generally enjoy lower maintenance costs compared to single-family homes.

dowidth.com

dowidth.com