Opportunity zone investing offers tax incentives for investors targeting designated economically distressed areas, enhancing long-term returns through capital gains deferral and potential exclusion. Distressed property acquisition focuses on purchasing undervalued real estate due to financial or physical distress, allowing for significant profit through rehabilitation and resale. Explore the benefits and risks of each strategy to determine the best fit for your real estate investment goals.

Why it is important

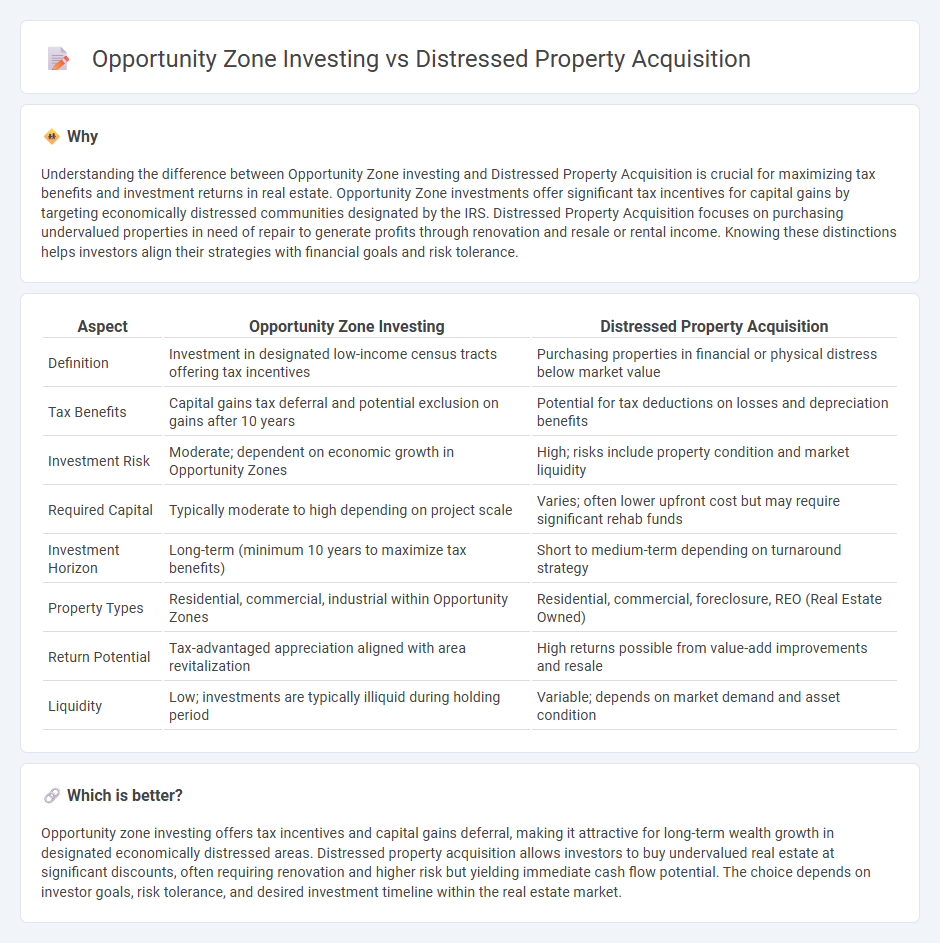

Understanding the difference between Opportunity Zone investing and Distressed Property Acquisition is crucial for maximizing tax benefits and investment returns in real estate. Opportunity Zone investments offer significant tax incentives for capital gains by targeting economically distressed communities designated by the IRS. Distressed Property Acquisition focuses on purchasing undervalued properties in need of repair to generate profits through renovation and resale or rental income. Knowing these distinctions helps investors align their strategies with financial goals and risk tolerance.

Comparison Table

| Aspect | Opportunity Zone Investing | Distressed Property Acquisition |

|---|---|---|

| Definition | Investment in designated low-income census tracts offering tax incentives | Purchasing properties in financial or physical distress below market value |

| Tax Benefits | Capital gains tax deferral and potential exclusion on gains after 10 years | Potential for tax deductions on losses and depreciation benefits |

| Investment Risk | Moderate; dependent on economic growth in Opportunity Zones | High; risks include property condition and market liquidity |

| Required Capital | Typically moderate to high depending on project scale | Varies; often lower upfront cost but may require significant rehab funds |

| Investment Horizon | Long-term (minimum 10 years to maximize tax benefits) | Short to medium-term depending on turnaround strategy |

| Property Types | Residential, commercial, industrial within Opportunity Zones | Residential, commercial, foreclosure, REO (Real Estate Owned) |

| Return Potential | Tax-advantaged appreciation aligned with area revitalization | High returns possible from value-add improvements and resale |

| Liquidity | Low; investments are typically illiquid during holding period | Variable; depends on market demand and asset condition |

Which is better?

Opportunity zone investing offers tax incentives and capital gains deferral, making it attractive for long-term wealth growth in designated economically distressed areas. Distressed property acquisition allows investors to buy undervalued real estate at significant discounts, often requiring renovation and higher risk but yielding immediate cash flow potential. The choice depends on investor goals, risk tolerance, and desired investment timeline within the real estate market.

Connection

Opportunity zone investing encourages capital deployment into designated low-income communities, enhancing real estate values and economic growth. Distressed property acquisition within these zones allows investors to purchase undervalued assets at lower costs, maximizing potential returns. Combining these strategies leverages tax incentives and property appreciation for substantial financial benefits in real estate portfolios.

Key Terms

Foreclosure

Foreclosure properties often present distressed property acquisition opportunities with discounted pricing, requiring investors to navigate legal processes and potential repairs. Opportunity zone investing focuses on long-term capital gains tax incentives when investing in designated economically-distressed areas, with less immediate risk compared to foreclosures. Explore detailed comparisons to optimize your real estate investment strategy.

Tax Incentives

Distressed property acquisition offers significant tax benefits such as depreciation deductions and potential capital gains tax deferral, while opportunity zone investing provides substantial capital gains tax deferrals and exclusions for long-term investments within designated economically distressed areas. Opportunity zones encourage reinvestment in underserved communities by allowing investors to defer taxes on prior gains and exclude gains on new investments held for at least ten years, creating a unique tax strategy compared to traditional distressed property purchases. Explore the distinct tax incentives of both strategies to determine the optimal investment approach for maximizing financial and community impact.

Capital Gains

Distressed property acquisition often results in shorter holding periods and potential capital gains taxed as ordinary income or short-term gains, whereas opportunity zone investing offers deferral and potential exclusion of capital gains if held for at least 10 years under IRS Section 1400Z-2. Opportunity zones, designated by the U.S. Treasury Department, provide tax incentives aimed at encouraging long-term investment in economically distressed communities. Explore detailed tax strategies for maximizing capital gains benefits in both distressed property and opportunity zone investments.

Source and External Links

The risks and rewards of distressed real estate investment - Distressed property acquisition involves buying properties below market value usually at foreclosure auctions, tax lien sales, or through HUD; essential steps include conducting thorough due diligence like inspections, title searches, and market analysis to assess risks and value before purchase.

How To Sell A Distressed Commercial Property With Ease - Selling distressed commercial properties typically means accepting lower offers and preparing for expedited due diligence and quick closings, with some buyers like Point Acquisitions offering as-is purchases that speed up the sale without requiring repairs or resolving legal issues.

The Ultimate Guide to Buying Distressed Properties - Key strategies for acquiring distressed properties include setting a clear budget including renovations, securing financing early (often favoring cash offers), conducting thorough inspections to estimate repair costs, negotiating based on property condition, and building a reliable team of experts to manage the process effectively.

dowidth.com

dowidth.com