Value-add investment in real estate involves acquiring existing properties and enhancing their performance through renovations, operational improvements, or repositioning to increase income and property value. Ground-up development focuses on constructing new buildings from vacant land or demolishing old structures to create entirely new assets, often requiring longer timelines and higher initial capital. Explore more to determine which strategy aligns best with your investment goals and risk appetite.

Why it is important

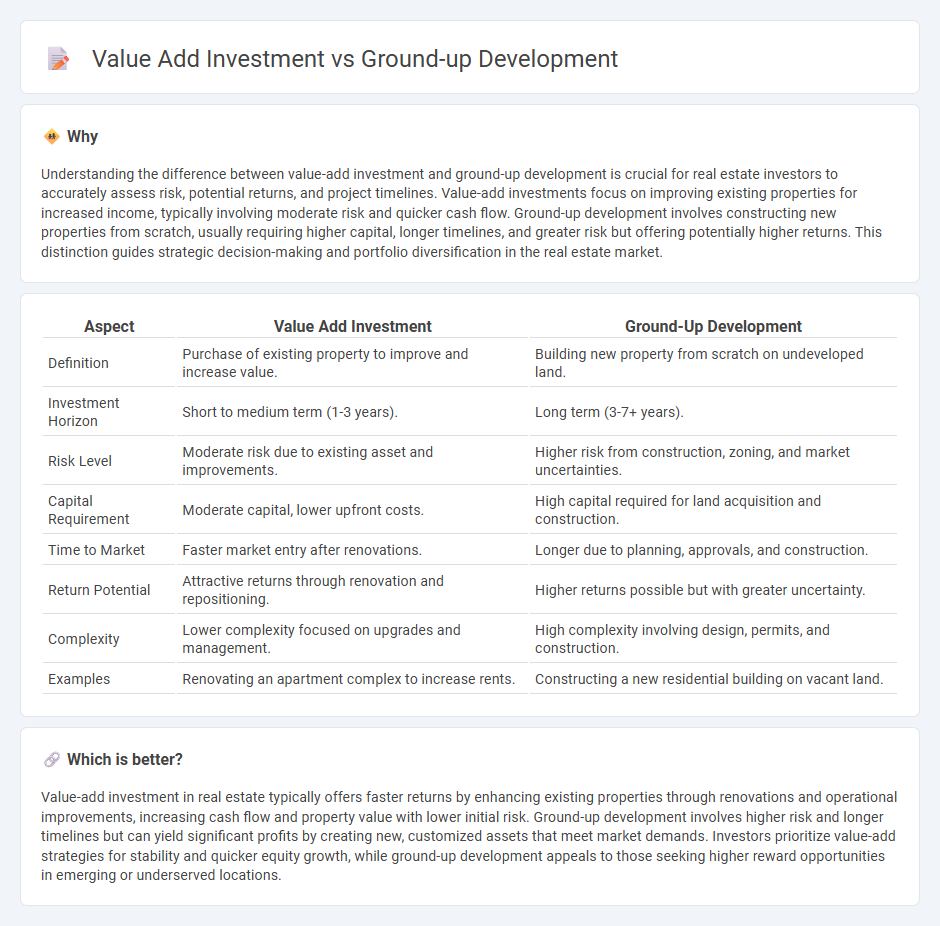

Understanding the difference between value-add investment and ground-up development is crucial for real estate investors to accurately assess risk, potential returns, and project timelines. Value-add investments focus on improving existing properties for increased income, typically involving moderate risk and quicker cash flow. Ground-up development involves constructing new properties from scratch, usually requiring higher capital, longer timelines, and greater risk but offering potentially higher returns. This distinction guides strategic decision-making and portfolio diversification in the real estate market.

Comparison Table

| Aspect | Value Add Investment | Ground-Up Development |

|---|---|---|

| Definition | Purchase of existing property to improve and increase value. | Building new property from scratch on undeveloped land. |

| Investment Horizon | Short to medium term (1-3 years). | Long term (3-7+ years). |

| Risk Level | Moderate risk due to existing asset and improvements. | Higher risk from construction, zoning, and market uncertainties. |

| Capital Requirement | Moderate capital, lower upfront costs. | High capital required for land acquisition and construction. |

| Time to Market | Faster market entry after renovations. | Longer due to planning, approvals, and construction. |

| Return Potential | Attractive returns through renovation and repositioning. | Higher returns possible but with greater uncertainty. |

| Complexity | Lower complexity focused on upgrades and management. | High complexity involving design, permits, and construction. |

| Examples | Renovating an apartment complex to increase rents. | Constructing a new residential building on vacant land. |

Which is better?

Value-add investment in real estate typically offers faster returns by enhancing existing properties through renovations and operational improvements, increasing cash flow and property value with lower initial risk. Ground-up development involves higher risk and longer timelines but can yield significant profits by creating new, customized assets that meet market demands. Investors prioritize value-add strategies for stability and quicker equity growth, while ground-up development appeals to those seeking higher reward opportunities in emerging or underserved locations.

Connection

Value add investment and ground-up development are connected through their focus on enhancing real estate assets to maximize returns. Value add investments involve acquiring properties with potential for improvement through renovations or operational efficiencies, while ground-up development entails building new properties from scratch to meet market demand. Both strategies leverage capital deployment, market analysis, and property transformation to increase asset value and generate higher long-term investment gains.

Key Terms

Construction Costs

Ground-up development often requires higher construction costs due to the need for complete site preparation, foundation work, and building from scratch, which can lead to increased labor and material expenses. In contrast, value-add investments typically involve lower construction costs since they focus on renovating or upgrading existing properties rather than new builds. Explore our detailed analysis to better understand construction cost implications in real estate investment strategies.

Renovation Scope

Ground-up development involves constructing new buildings from scratch, requiring extensive planning, permitting, and long-term capital allocation, often capturing value through brand-new, customized assets. Value-add investments concentrate on renovating or repositioning existing properties, targeting improvements such as structural upgrades, aesthetic enhancements, or operational efficiencies to boost occupancy and rental income. Discover how selecting the right renovation scope can maximize returns and align with your investment strategy.

Stabilization Period

Ground-up development projects require a significant stabilization period as properties are newly constructed and must achieve lease-up targets before generating stable cash flow. Value-add investments often face shorter stabilization periods due to existing occupancy, focusing on renovations to enhance property performance and increase income. Explore detailed strategies and timelines to optimize investment outcomes for each approach.

Source and External Links

What is Ground Up Development? - High Peaks Capital - Ground-up developers focus on transforming unimproved land into functional real estate by creating new property improvements from scratch.

Understanding the Ground Up Development Process - Ground-up real estate development involves constructing new buildings or developments on vacant or undeveloped land, starting with site selection and acquisition.

Ground-up Development - Ground-up development is the construction of a real estate asset from scratch, starting with raw, undeveloped land or complete demolition of existing structures.

dowidth.com

dowidth.com