House hacking leverages owner-occupied properties to generate rental income, reducing living expenses while building equity, whereas wholesale real estate focuses on contracting properties at below-market prices to assign those contracts to investors for profit without property ownership. Understanding these strategies is crucial for investors aiming to maximize cash flow and minimize risk through distinct methods of property investment. Explore the key differences and benefits of house hacking versus wholesaling to determine the best real estate approach for your financial goals.

Why it is important

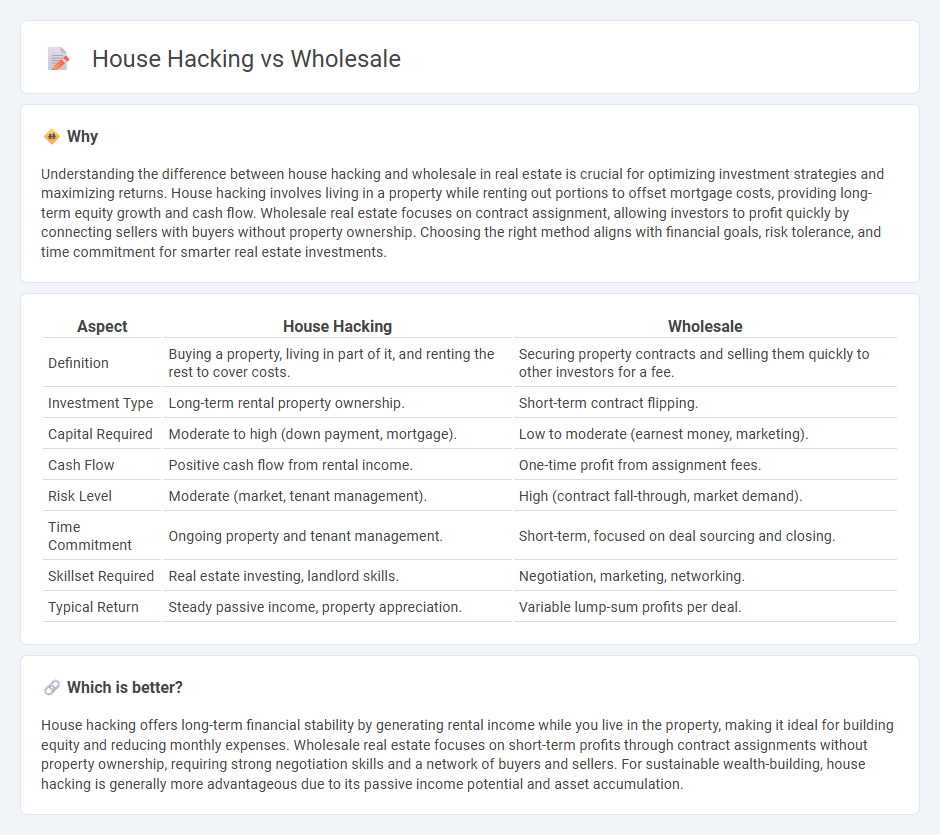

Understanding the difference between house hacking and wholesale in real estate is crucial for optimizing investment strategies and maximizing returns. House hacking involves living in a property while renting out portions to offset mortgage costs, providing long-term equity growth and cash flow. Wholesale real estate focuses on contract assignment, allowing investors to profit quickly by connecting sellers with buyers without property ownership. Choosing the right method aligns with financial goals, risk tolerance, and time commitment for smarter real estate investments.

Comparison Table

| Aspect | House Hacking | Wholesale |

|---|---|---|

| Definition | Buying a property, living in part of it, and renting the rest to cover costs. | Securing property contracts and selling them quickly to other investors for a fee. |

| Investment Type | Long-term rental property ownership. | Short-term contract flipping. |

| Capital Required | Moderate to high (down payment, mortgage). | Low to moderate (earnest money, marketing). |

| Cash Flow | Positive cash flow from rental income. | One-time profit from assignment fees. |

| Risk Level | Moderate (market, tenant management). | High (contract fall-through, market demand). |

| Time Commitment | Ongoing property and tenant management. | Short-term, focused on deal sourcing and closing. |

| Skillset Required | Real estate investing, landlord skills. | Negotiation, marketing, networking. |

| Typical Return | Steady passive income, property appreciation. | Variable lump-sum profits per deal. |

Which is better?

House hacking offers long-term financial stability by generating rental income while you live in the property, making it ideal for building equity and reducing monthly expenses. Wholesale real estate focuses on short-term profits through contract assignments without property ownership, requiring strong negotiation skills and a network of buyers and sellers. For sustainable wealth-building, house hacking is generally more advantageous due to its passive income potential and asset accumulation.

Connection

House hacking generates rental income by living in a property while renting out portions, creating cash flow that can fund additional real estate investments. Wholesale real estate involves securing properties under contract and assigning them to end buyers for a fee, requiring minimal capital compared to traditional purchases. Both strategies optimize cash flow and minimize upfront costs, enabling investors to build a real estate portfolio efficiently through creative financing and property management techniques.

Key Terms

Assignment Contract

Assignment contracts in wholesale real estate involve securing properties under contract and selling those contracts to other investors for a profit, minimizing capital risk and enabling rapid deal turnover. House hacking, by contrast, requires purchasing and living in a multi-unit property while renting out portions to offset mortgage costs, emphasizing long-term wealth building through rental income. Explore the detailed benefits and strategies behind assignment contracts and house hacking to optimize your real estate investments.

Owner-Occupancy

Wholesale real estate involves quickly selling properties without owner-occupancy, targeting investors and minimizing personal residence involvement. House hacking requires owners to live in the property while generating rental income, maximizing financial benefits through owner-occupied housing. Discover the key differences and benefits of each approach to optimize your real estate investment strategy.

Equity

Wholesale real estate generates quick cash flow without building equity, as transactions involve assigning contracts rather than ownership. House hacking creates long-term equity by living in and leveraging rental income from the property, effectively reducing mortgage costs while building wealth. Explore strategies to maximize your equity growth and financial independence through both approaches.

Source and External Links

Wholesaling - Wholesaling involves the sale of goods in bulk to retailers, industrial, commercial, or professional users, purchased at a discounted rate from manufacturers or sources.

How To Find Wholesale Suppliers - This guide provides insights into wholesale buying, sourcing options, and how to find suppliers for various products.

Faire - Faire is an online wholesale marketplace where retailers can buy products from thousands of vendors with flexible payment terms.

dowidth.com

dowidth.com