Ghost listings represent properties marketed quietly to select buyers to gauge interest without public exposure, often used for luxury or high-profile real estate. Distressed listings, on the other hand, involve properties facing financial or physical challenges, such as foreclosures or urgent sales, typically priced below market value to attract quick offers. Explore more to understand how these listing types impact market strategies and investment opportunities.

Why it is important

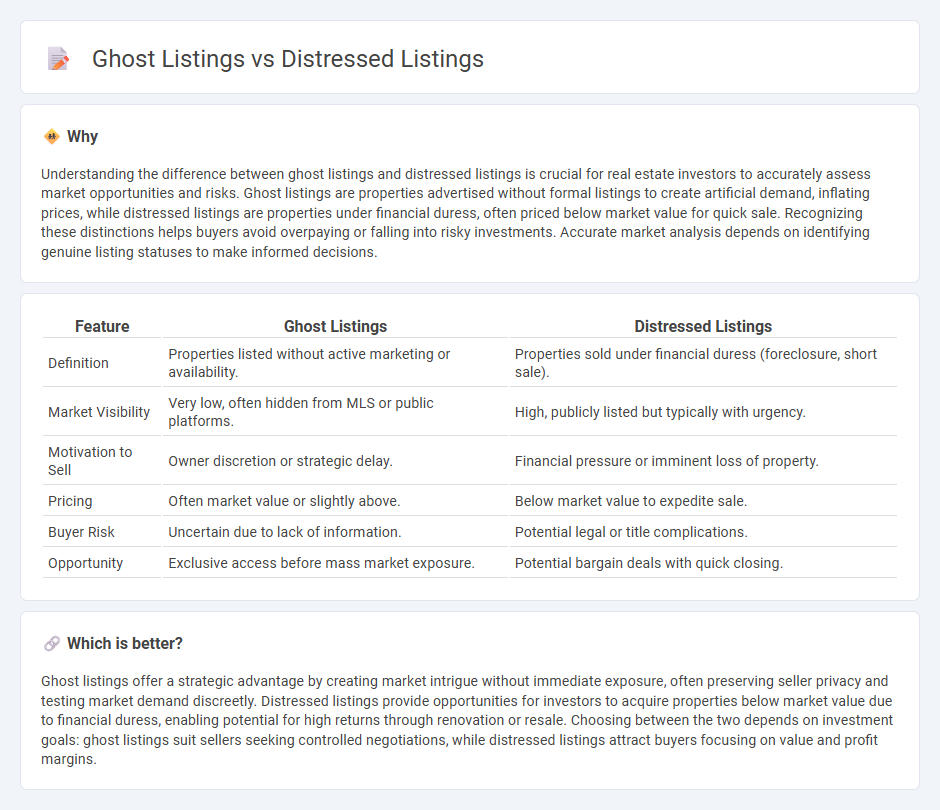

Understanding the difference between ghost listings and distressed listings is crucial for real estate investors to accurately assess market opportunities and risks. Ghost listings are properties advertised without formal listings to create artificial demand, inflating prices, while distressed listings are properties under financial duress, often priced below market value for quick sale. Recognizing these distinctions helps buyers avoid overpaying or falling into risky investments. Accurate market analysis depends on identifying genuine listing statuses to make informed decisions.

Comparison Table

| Feature | Ghost Listings | Distressed Listings |

|---|---|---|

| Definition | Properties listed without active marketing or availability. | Properties sold under financial duress (foreclosure, short sale). |

| Market Visibility | Very low, often hidden from MLS or public platforms. | High, publicly listed but typically with urgency. |

| Motivation to Sell | Owner discretion or strategic delay. | Financial pressure or imminent loss of property. |

| Pricing | Often market value or slightly above. | Below market value to expedite sale. |

| Buyer Risk | Uncertain due to lack of information. | Potential legal or title complications. |

| Opportunity | Exclusive access before mass market exposure. | Potential bargain deals with quick closing. |

Which is better?

Ghost listings offer a strategic advantage by creating market intrigue without immediate exposure, often preserving seller privacy and testing market demand discreetly. Distressed listings provide opportunities for investors to acquire properties below market value due to financial duress, enabling potential for high returns through renovation or resale. Choosing between the two depends on investment goals: ghost listings suit sellers seeking controlled negotiations, while distressed listings attract buyers focusing on value and profit margins.

Connection

Ghost listings and distressed listings are interrelated in real estate, as both involve properties that often fail to generate conventional buyer interest due to pricing or condition issues. Ghost listings are properties marketed in elusive or misleading ways to test market response without full public exposure, frequently seen with distressed listings needing urgent sales. Distressed listings, such as foreclosures or short sales, often become ghost listings to avoid stigmatization and facilitate negotiation with motivated buyers.

Key Terms

Foreclosure

Distressed listings refer to properties facing financial hardship, often in foreclosure or short sale situations, where owners are motivated to sell quickly to avoid further penalties. Ghost listings are properties marketed covertly, frequently used by sellers in foreclosure to test the market without public exposure, minimizing stigma and allowing price flexibility. Discover how understanding the nuances of foreclosure-related distressed and ghost listings can optimize your real estate strategy.

Off-market

Distressed listings refer to properties that are available for sale due to financial hardship or urgent need, often listed off-market to avoid public exposure and attract serious buyers. Ghost listings, on the other hand, are properties marketed as if they were for sale but either have no intention of a sale or are exclusively available off-market to a select group, aiming to create artificial demand or test market interest. Explore the nuances of off-market real estate strategies and how these listings impact investment opportunities.

Shadow Inventory

Shadow inventory consists of distressed listings that remain off the market, including properties not actively listed but available for sale, as well as ghost listings--properties advertised but not officially on the market. Distressed listings typically involve foreclosures, short sales, or properties in financial distress, while ghost listings complicate market transparency by obscuring true supply levels. Explore the dynamics of shadow inventory to understand hidden market pressures and investment opportunities.

Source and External Links

How to Find Distressed Properties in Your Market - This guide provides tips on finding distressed properties, including using the MLS, absentee/vacant lists, and direct mail campaigns.

Unearth Hidden Gems: How to Find Distressed Properties - This resource outlines methods such as using MLS listings, driving for dollars, and networking to locate distressed properties.

The Complete Guide to Distressed Properties - This comprehensive guide covers various types of distressed properties and offers strategies for identifying and marketing them.

dowidth.com

dowidth.com