Automated valuation models (AVMs) utilize advanced algorithms and vast data sets to produce rapid property value estimates, enhancing real estate market efficiency. The Cost Approach calculates property value based on land price plus the cost of improvements, reflecting replacement or reproduction expenses. Explore these methods to understand which valuation strategy best suits your real estate investment needs.

Why it is important

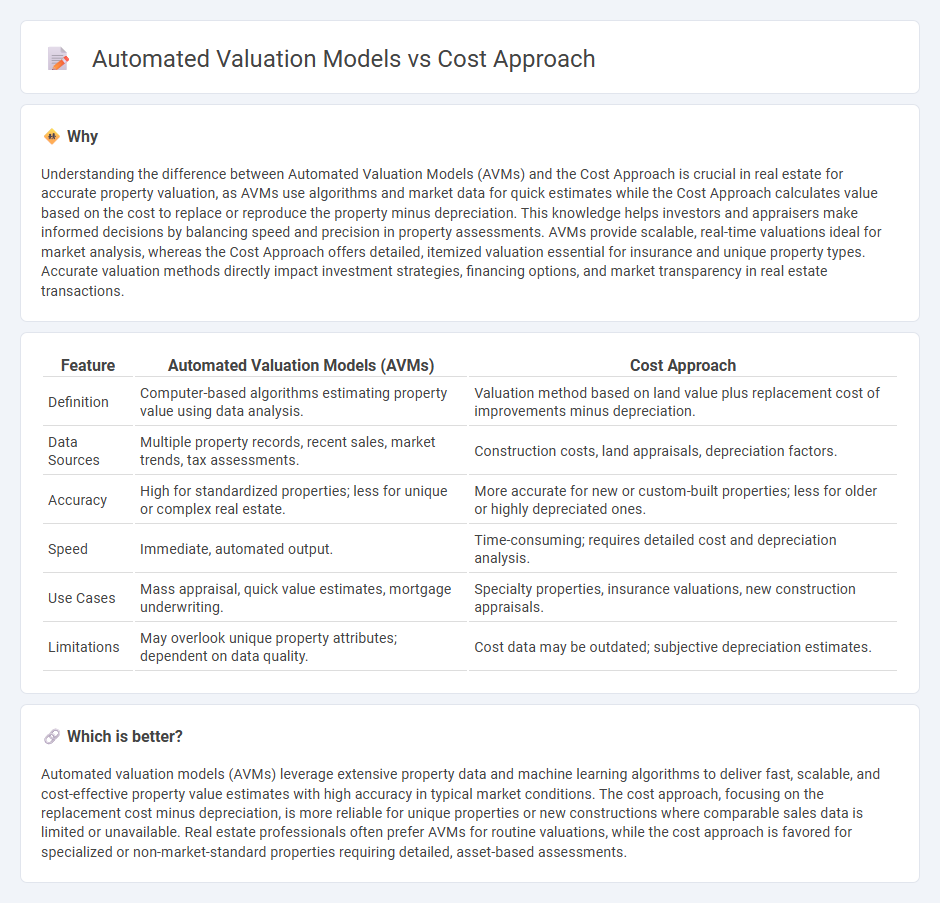

Understanding the difference between Automated Valuation Models (AVMs) and the Cost Approach is crucial in real estate for accurate property valuation, as AVMs use algorithms and market data for quick estimates while the Cost Approach calculates value based on the cost to replace or reproduce the property minus depreciation. This knowledge helps investors and appraisers make informed decisions by balancing speed and precision in property assessments. AVMs provide scalable, real-time valuations ideal for market analysis, whereas the Cost Approach offers detailed, itemized valuation essential for insurance and unique property types. Accurate valuation methods directly impact investment strategies, financing options, and market transparency in real estate transactions.

Comparison Table

| Feature | Automated Valuation Models (AVMs) | Cost Approach |

|---|---|---|

| Definition | Computer-based algorithms estimating property value using data analysis. | Valuation method based on land value plus replacement cost of improvements minus depreciation. |

| Data Sources | Multiple property records, recent sales, market trends, tax assessments. | Construction costs, land appraisals, depreciation factors. |

| Accuracy | High for standardized properties; less for unique or complex real estate. | More accurate for new or custom-built properties; less for older or highly depreciated ones. |

| Speed | Immediate, automated output. | Time-consuming; requires detailed cost and depreciation analysis. |

| Use Cases | Mass appraisal, quick value estimates, mortgage underwriting. | Specialty properties, insurance valuations, new construction appraisals. |

| Limitations | May overlook unique property attributes; dependent on data quality. | Cost data may be outdated; subjective depreciation estimates. |

Which is better?

Automated valuation models (AVMs) leverage extensive property data and machine learning algorithms to deliver fast, scalable, and cost-effective property value estimates with high accuracy in typical market conditions. The cost approach, focusing on the replacement cost minus depreciation, is more reliable for unique properties or new constructions where comparable sales data is limited or unavailable. Real estate professionals often prefer AVMs for routine valuations, while the cost approach is favored for specialized or non-market-standard properties requiring detailed, asset-based assessments.

Connection

Automated Valuation Models (AVMs) often incorporate the Cost Approach by estimating a property's value based on the land value plus the current replacement cost of improvements minus depreciation. This integration enhances AVM accuracy, especially for unique or newly constructed properties where comparable sales data may be limited. Leveraging cost data alongside market trends allows AVMs to provide more reliable real estate valuations.

Key Terms

Replacement Cost

The Cost Approach estimates property value by calculating the replacement cost of the building, subtracting depreciation, and adding land value, providing a tangible basis for appraisal. Automated Valuation Models (AVMs) use algorithms and data sets to rapidly estimate property values but often lack detailed cost breakdowns like replacement cost, potentially limiting accuracy in unique properties. Explore more to understand how replacement cost impacts valuation accuracy in different appraisal methods.

Depreciation

The Cost Approach values properties by calculating the replacement cost minus depreciation, emphasizing physical wear, functional obsolescence, and economic factors affecting property value. Automated Valuation Models (AVMs) estimate property values using algorithms that analyze market data but often lack detailed consideration of depreciation nuances. Explore how depreciation impacts valuation accuracy and decision-making in real estate assessments.

Algorithmic Valuation

The cost approach calculates property value based on replacement costs minus depreciation, providing a tangible asset-based assessment, while automated valuation models (AVMs) leverage algorithmic valuation using extensive real estate data, machine learning, and predictive analytics to estimate market prices rapidly and at scale. Algorithmic valuation in AVMs enhances accuracy by analyzing historical sales, property features, and market trends to generate dynamic valuations adaptable to changing conditions. Explore further insights into how algorithmic valuation is transforming property appraisal efficiency and accuracy.

Source and External Links

Cost Approach Appraisal | Formula + Calculator - The cost approach estimates a property's value based on the cost to rebuild from scratch, considering land value, replacement cost, and depreciation, useful especially when market comparables are limited.

What is the Cost Approach to Real Estate Appraisal? - This method calculates property value as replacement cost minus depreciation plus land value and is primarily used for unique properties, new construction, or situations without comparable sales.

Cost Approach (Real Estate) - Overview, How To Calculate ... - The cost approach assumes buyers won't pay more than the cost to construct an equivalent property and is suited for appraising unique or newly built properties by adding land value and subtracting depreciation.

dowidth.com

dowidth.com