Blockchain technology revolutionizes real estate by enabling transparent, secure property transactions through decentralized ledgers, reducing fraud and expediting deals. Crowdfunding platforms democratize real estate investment by allowing multiple investors to pool funds and access diverse property portfolios with lower capital requirements. Explore how these innovative platforms transform property investment and funding opportunities.

Why it is important

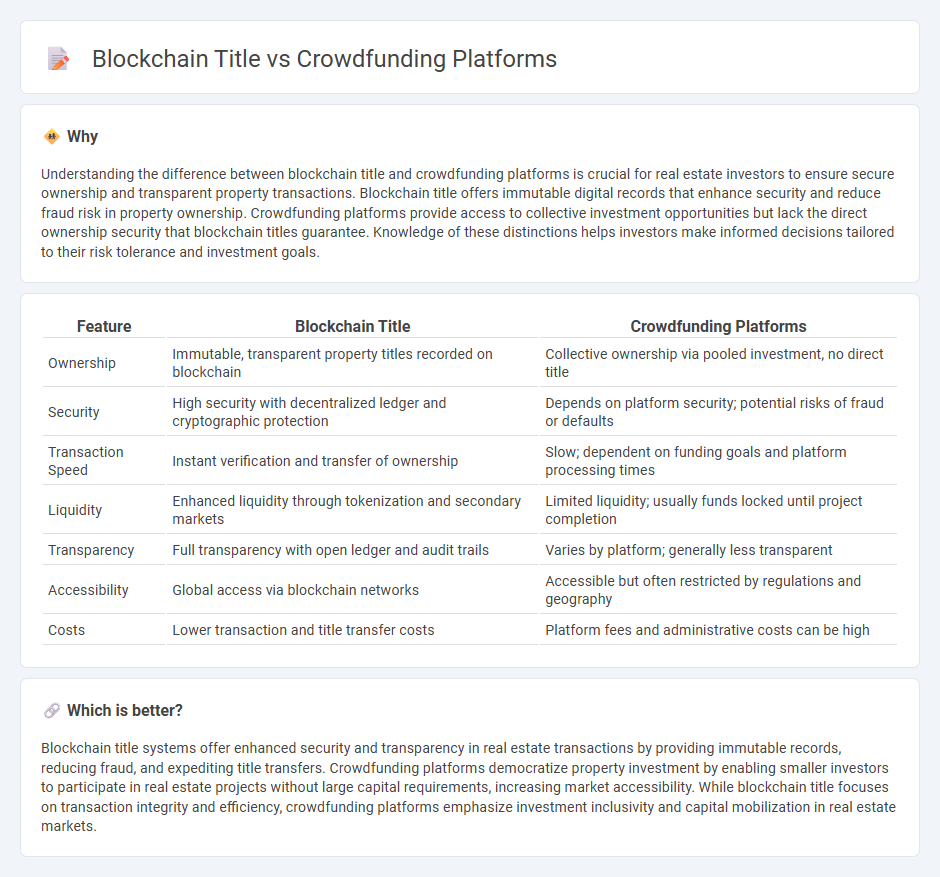

Understanding the difference between blockchain title and crowdfunding platforms is crucial for real estate investors to ensure secure ownership and transparent property transactions. Blockchain title offers immutable digital records that enhance security and reduce fraud risk in property ownership. Crowdfunding platforms provide access to collective investment opportunities but lack the direct ownership security that blockchain titles guarantee. Knowledge of these distinctions helps investors make informed decisions tailored to their risk tolerance and investment goals.

Comparison Table

| Feature | Blockchain Title | Crowdfunding Platforms |

|---|---|---|

| Ownership | Immutable, transparent property titles recorded on blockchain | Collective ownership via pooled investment, no direct title |

| Security | High security with decentralized ledger and cryptographic protection | Depends on platform security; potential risks of fraud or defaults |

| Transaction Speed | Instant verification and transfer of ownership | Slow; dependent on funding goals and platform processing times |

| Liquidity | Enhanced liquidity through tokenization and secondary markets | Limited liquidity; usually funds locked until project completion |

| Transparency | Full transparency with open ledger and audit trails | Varies by platform; generally less transparent |

| Accessibility | Global access via blockchain networks | Accessible but often restricted by regulations and geography |

| Costs | Lower transaction and title transfer costs | Platform fees and administrative costs can be high |

Which is better?

Blockchain title systems offer enhanced security and transparency in real estate transactions by providing immutable records, reducing fraud, and expediting title transfers. Crowdfunding platforms democratize property investment by enabling smaller investors to participate in real estate projects without large capital requirements, increasing market accessibility. While blockchain title focuses on transaction integrity and efficiency, crowdfunding platforms emphasize investment inclusivity and capital mobilization in real estate markets.

Connection

Blockchain technology enhances real estate title management by providing a secure, transparent, and immutable ledger that reduces fraud and streamlines property transactions. Crowdfunding platforms leverage blockchain to offer decentralized investment opportunities, enabling fractional ownership and increased access to real estate markets. This integration improves trust, liquidity, and efficiency in real estate financing and title verification processes.

Key Terms

Decentralization

Decentralization in crowdfunding platforms enhances transparency and reduces reliance on intermediary control, enabling direct peer-to-peer funding through blockchain technology. Blockchain-based crowdfunding ensures immutable transaction records, faster fund transfers, and increased security compared to traditional centralized platforms. Explore how decentralized crowdfunding can reshape investment landscapes by embracing blockchain innovations.

Smart Contracts

Smart contracts automate and secure transactions on blockchain-based crowdfunding platforms, reducing the need for intermediaries and enhancing transparency. Unlike traditional crowdfunding platforms, blockchain leverages decentralized networks to enforce contract terms automatically, minimizing fraud and delays in fund distribution. Explore how smart contracts revolutionize fundraising efficiency and trust-building in modern crowdfunding.

Tokenization

Tokenization on blockchain transforms crowdfunding platforms by enabling fractional ownership and secure, transparent transactions through digital tokens. Unlike traditional crowdfunding, blockchain ensures immutable records and seamless peer-to-peer exchanges, enhancing investor confidence and liquidity. Discover how tokenization reshapes fundraising dynamics and investment accessibility in this evolving domain.

Source and External Links

GoFundMe - Trusted global leader in crowdfunding for personal and charitable causes, offering free setup and a 2.9% + $0.30 transaction fee per donation.

Kickstarter - World's largest reward-based platform with an "all or nothing" policy, primarily for creative and product projects, charging a 5% fee plus payment processing on successful campaigns.

Patreon - Leading crowdfunding site for creators, allowing fans to financially support artists through recurring or per-work payments, with tiered service fees of 5%, 8%, or 12% plus processing charges.

dowidth.com

dowidth.com